Court says city of Stockton, California may proceed with bankruptcy

- Creditors including Wells Fargo, BOA, Union Bank NA, IBM, Key Government Finance, Ambac, others object; judge rebukes them

- Retirees still in danger if federal law trumps state law guaranteeing pensions

- Detroit advocates of bankruptcy–beware

(VOD editor: As of April 14, 2013, VOD has corrected the original version of this post as follows: A representative of The Bank of Stockton contacted VOD earlir about the caption to the photo previously used at the top of the story, which showed a downtown building in Stockton displaying an ad for the Bank of Stockton. She indicated that the sub-title used for the photo when clicking on it appeared to indicate the Bank of Stockton itself was bankrupt, and she mis-stated the actual headline of the story, which remains as above. VOD responded that it would change the sub-title of the photo to clarify that it was not the Bank of Stockton that declared bankruptcy. Later, VOD received the following rather strongly, perhaps maliciously, worded email from the Bank’s attorney:

Rather than take the responsible action that I demanded, below, you reconfigured your story slightly to attempt to diminish the libelous nature and in so doing added a line, below a photograph of the advertisement for the Bank appearing on a downtown Stockton building, which now reads: “The Bank of Stockton is one of the city’s creditors.” And then you further called out the Bank by name in a list of creditors appearing below the referenced photograph. Your apparent source for the assertion that the Bank is a creditor of the City of Stockton is a document that is linked to your article. Your article references a linked document that you assert is “a creditors’ list from federal court records.” At the time I wrote my April 3 email, I gave you the benefit of the doubt that you had done adequate research to confirm the document was what you said it was and that the Bank was actually a creditor. We have since confirmed that neither is the case. The document is not an official creditors’ list as you claim, but likely is only a list of interested parties obtaining notice of the bankruptcy proceedings. In addition, the Bank is categorically not a creditor of the City. As a result, your article is false on two counts and both false claims adversely affect the Bank, particularly your falsely lumping the Bank in with the list of “capital market creditors [who] had failed to negotiate in good faith in a pre-bankruptcy mediation, as required by law, and [who were] also criticized [for] their refusal to pay part of the bill for mediation.” As a result of my April 3 demand and the exchange with Ms. Brusa, you apparently sought to temper the libelous nature of your original article by making the above-referenced modifications. The problem for your publication, however, is that in doing so you actually doubled down on the falsity of the assertions made against the Bank—assertions that—had you performed customary and appropriate research—should never have been made. You and your publication were therefore either reckless in republishing the story or are now republishing the story maliciously because the Bank pointed out the problems with your original story. Either scenario creates substantial liability for you and your publication. The Bank renews its demands for a complete retraction of the story, a cessation of use of the Bank’s advertisement in connection with the City of Stockton bankruptcy and an apology for the false assertions leveled against the Bank. You have two business days to do so. In all other respects, the Bank renews the demands and admonitions in my April 3 email. Please confirm by return email to me as soon as the required actions have been taken. Again, the Bank reserves all legal and equitable remedies to address this situation should you elect not to comply

Greg L. Johnson

Lewis Brisbois Bisgaard & Smith, LLP

VOD replied as follows when we finally got to the email among the hundreds we get every day, on April 14, 2013:

Well, you gave me two business days. I just got to this email today so I guess you’ve done whatever you plan to do. I should point out that this is a wire story from Reuters. Therefore I will not take the story down. Your problem appears to be with the photo and the inclusion of the Bank of Stockton as a creditor. You should be aware that the official U.S. PACER site advises users under bankruptcy courts to use the mailing matrix list instead of “creditors” because it says the creditor list may not be complete. https://ecf.caeb.uscourts.gov/cgi-bin/CreditorQry.pl?495514. Therefore, if I was in error stating that the Bank of Stockton is a creditor, I will publish a correction to the story indicating that the Bank of Stockton says it is not a creditor, and that this inclusion in the original story may have been due to a misreading of the federal PACER site. Plus I will remove the link to the mailing matrix list provided by PACER, since it DOES include the Bank of Stockton. To further allay your concerns, I will replace the photo (which is not mine but from another website) with a different photo with no reference to the Bank of Stockton. I apologize for any problem this may have caused the Bank of Stockton.

I completely take issue with the tone of your reply; there was absolutely no malice intended on the part of my publication. The Bank you represent should be more concerned about what it can do to help out the city of Stockton at this point. Let me know if you have any further problems.)

Mon, Apr 1 2013

By Jonathan Weber

SACRAMENTO, California (Reuters) – A federal judge on Monday approved the city of Stockton’s petition for bankruptcy in a case that sets the stage for a lengthy battle between bondholders and the California pension system.

In a case being studied by other cash-strapped American cities including Detroit, U.S. Bankruptcy Court Judge Christopher Klein’s decision was a setback for bondholders and insurers who had resisted the California city’s bankruptcy filing. Stockton is the largest U.S. city ever to file for bankruptcy.

The judge also signaled that the California Public Employees Retirement System’s [Calpers] position in the case was not above review. Stockton, a city of 300,000, has so far not reduced pension payments to retired city workers, although it has eliminated retiree healthcare benefits.

“This does not mean there is not potentially a serious issue involving Calpers,” Judge Klein said. “But at this point I do not know what that is.” He added that there were “very complex and difficult questions of law that I can see out there on the horizon,” relating to Calpers.

The decision on Stockton marks the start of a lengthy restructuring of the obligations that currently overwhelm its finances, which were crippled by the housing crisis and recession.

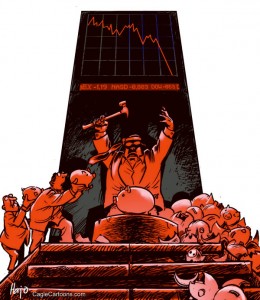

Investors in the $3.7 trillion municipal bond market are concerned that if Stockton is able to avoid paying bondholders in full without cutting pension payments, other cities will pursue a similar strategy as they struggle to cope with budget shortfalls.

Kenneth Naehu, head of fixed income at Bel Air Investment Advisors in Los Angeles, agreed that the case could cloud the issue of where bondholders stand in relation to retirees and pension funds in a municipal bankruptcy.

CALPERS ISSUE LOOMS; JUDGE REBUKES CREDITORS

In a lengthy preamble to his ruling, Klein delivered a stinging rebuke to the so-called capital market creditors – mainly the insurers for bondholders who own hundreds of millions of dollars of Stockton debt – who had opposed the bankruptcy filing.

He rejected the arguments of bondholders and insurers that Stockton was not truly insolvent when it sought Chapter 9 bankruptcy protection last summer and that it had improperly failed to seek relief from its pension obligations.

Klein said capital market creditors had failed to negotiate in good faith in a pre-bankruptcy mediation, as required by law, and also criticized their refusal to pay part of the bill for mediation.

Calpers is far from off the hook, but the city’s obligations to the retirement system are properly addressed as part of the effort to finalize a “plan of adjustment” for emerging from bankruptcy, the judge said.

Michael Sweet, a municipal bankruptcy lawyer with Fox Rothschild who is not involved in the case, said the judge’s remarks suggested that “somewhere along the line the city will have to go to Calpers, because otherwise they will have problems with discrimination in the plan.”

A plan of adjustment, like any bankruptcy reorganization plan, cannot favor one group of creditors over another.

“You’re going to see an issue teed up that could go to the U.S. Supreme Court,” Sweet said.

Calpers asserts that California law protects pensioners from any haircut even in bankruptcy, but that position has never been tested in court.

‘SCORCHED EARTH’ TACTICS

Bob Deis, the Stockton city manager who is largely responsible for managing the bankruptcy process, called the judge’s verdict a “vindication” of the city’s position.

He criticized the “scorched-earth” legal strategy of the bond creditors as a waste of time and money, and said the city had already spent $6 million to $7 million on the mediation and legal costs.

Assured Guaranty Ltd, one of the bond insurers, said in a statement that it “disagrees” with the judge’s ruling but that it looked forward to working with the city on a “consensual approach” to resolving its debts. A company spokesman also said that it had tried to negotiate with the city prior to bankruptcy, but without success.

Others opposing the city’s bankruptcy included National Public Finance Guarantee Corp, Wells Fargo Bank, the Franklin California High Yield Municipal Fund and Franklin High Yield Tax-Free Income Fund.

Throughout his two hours of comments, the judge made it clear that he thought the city had done everything it could to avoid bankruptcy. He noted that sharp cost-cutting had begun years ago, and that 77 percent of the city’s budget was devoted to already-diminished police and fire services.

Klein agreed that further cuts in public safety and other services were not options.

It was not clear on Monday if any of the capital market creditors would appeal the ruling. A spokesman for Assured Guaranty said the company wanted to see the written ruling before it determined next steps. National Public Finance Guarantee had no comment on a possible appeal.

(Reporting by Jonathan Weber; Additional reporting by Michael Connor in Miami; Editing by Chris Reese, Tiziana Barghini and Will Dunham)

Stockton, California eligible for municipal bankruptcy protection: judge

Related story on Assured Guaranty: http://www.capoliticalreview.com/top-stories/bond-insurer-may-contest-stockton-bankruptcy/

I’ve to show my thanks for you for rescuing me from this specific trouble. Simply because of surfing throughout the the net and coming across methods which were not advantageous, I was thinking my life was done. Becoming alive with out the answers towards the issues you have sorted out by way of one’s main review is really a critical case, and ones which may have badly damaged my entire career if I hadn’t noticed your internet weblog. Your own personal natural talent and kindness in dealing with almost everything was helpful. I am not certain what I’d have done if I had not encountered such a step like this. It’s possible to at this time relish my future. Thanks for the time so a lot for the expert and result oriented guide. I won’t be reluctant to recommend the website to anyone who needs and desires counselling about this issue.