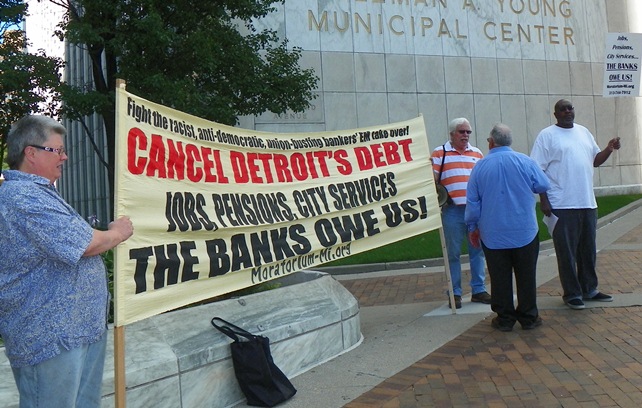

PROTEST EMERGENCY MANAGER ORR’S $350 MILLION “DEAL” TO MORTGAGE CITY TAXES AND ASSETS TO PAY OFF THE BANKS

MONDAY, OCTOBER 21, 2013 — 1:00 PM

COLEMAN A. YOUNG MUNICIPAL BUILDING, WOODWARD AND JEFFERSON, DETROIT

AFTERWARDS WE WILL GO UP TO THE 2:00 PM CITY COUNCIL MEETING TO DEMAND COUNCIL REJECT THIS GIVEAWAY TO THE BANKS

AFTERWARDS WE WILL GO UP TO THE 2:00 PM CITY COUNCIL MEETING TO DEMAND COUNCIL REJECT THIS GIVEAWAY TO THE BANKS

DETROIT — Emergency Manager Kevyn Orr is seeking City Council approval of a $350 million short term loan. $250 million of the proceeds of the loan are to pay Bank of America and UBS termination fees on interest rate swaps. This is in addition to the over $250 million these banks have already netted on these swaps based on the city paying the banks hedging derivatives amounting to 6.3% interest on bonds where the actual interest on the bonds was only 0.5 to 1.0%.

This new $350 million loan, which must be paid back in no longer than 3 years, is secured by a first lien of the city’s casino tax dollars, a second lien on income tax revenues and a lien on all other city assets worth more than $10 million if the other liens are insufficient. The bank being paid to service the loan is Barclays, which admitted to fraudulent conduct in the LIBOR scandal. Incredibly, the short term loan is tied to the LIBOR index.

The Emergency Manager negotiated a deal with the banks to try keep the interest rate swaps out of the bankruptcy proceeding, instead of challenging the swaps as potentially fraudulent instruments within the bankruptcy and arguing that the swaps should be liquidated. In fact, both Bank of America and UBS, on top of being subject to numerous investigations and even criminal convictions for their conduct in the municipal bond market, are also two of the most notorious subprime mortgage lenders whose practices contributed to over 100,000 foreclosures in a 5 year period in Detroit.

Bank of America and UBS are both clients of Jones Day, the Emergency Manager’s “former” employer and the so-called lawyers for the emergency manager in the bankruptcy. No wonder that rather than go after these banks, he is trying to award them this sweetheart deal.

Demand City Council reject this deal. The banks owe the people of Detroit billions of dollars for the destruction they caused to our communities.

Contact Moratorium Now! Coalition and Detroiters Resisting Emergency Management — 313-671-3715

AND REMINDER — DEMONSTRATE WEDNESDAY, OCTOBER 23, 2013, BEGINNING AT 8:00 AM, OUSIDE THE BANKRUTPCY ELIGIBILITY TRIAL AT 231 W. LAFAYETTE, DETROIT — STOP THE LOOTING OF DETROIT — DEFEND CITY SERVICES, ASSETS AND PENSIONS.