Members of various coalitions against “grand heist:” rally outside CAYMC before meeting Oct. 21, 2013,

Council votes down Orr’s deal but is to consider alternative Oct. 23

Councilwoman Watson lays out details of $1.5 B POC loan fraud

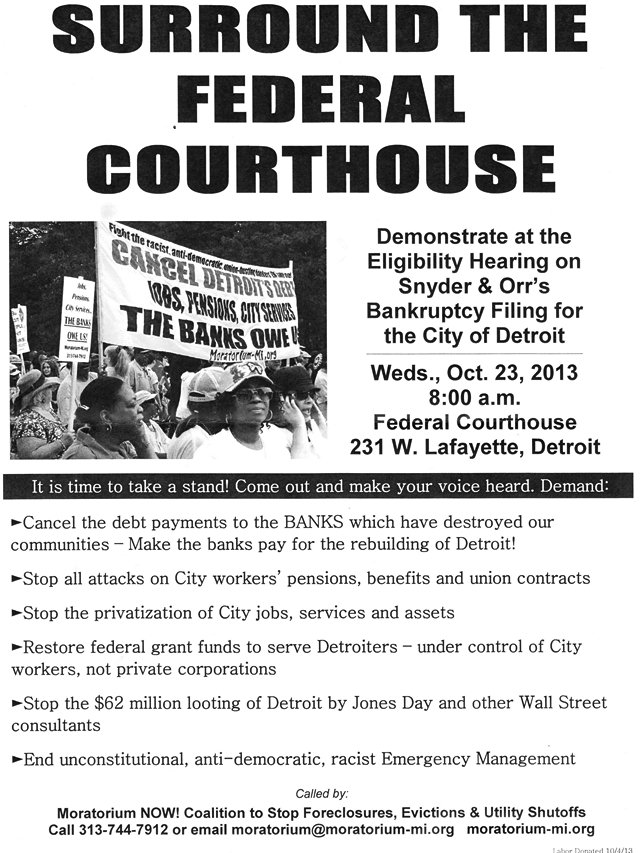

Mass rally set for Oct. 23 8 a.m. as bankruptcy eligibility trial begins in Federal Courthouse at 231 W. Lafayette in downtown Detroit

By Diane Bukowski

October 22, 2013

City Councilwoman JoAnn Watson at table Oct. 21, 2013. She also testified against bankruptcy eligibility in front of U.S. Bankruptcy Judge Steven Rhodes.

DETROIT – In a stinging rebuke to the banks which have virtually destroyed Detroit, and to Emergency Manager Kevyn Orr’s bankruptcy plans, the City Council on Oct. 21 unanimously rejected a proposed $350 million loan deal with Barclay’s Capital, a chief culprit in the world-wide LIBOR interest-rigging scandal.

City Councilwoman JoAnn Watson called the deal, embodied in Orr’s Executive Order #17, a “grand heist.” Prominent objectors in a packed chambers also denounced the package, saying they were “shocked and horrified” by its terms. They included representatives of the revered Shrine of the Black Madonna, Michigan Forward, Moratorium Now, Detroiters Resisting Emergency Management, Free Detroit/No Consent, and the National Cummings Foundation.

“You have the duty to stand up and fight against tyranny and the subjugation and oppression of our people,” Cardinal Baye Landy of the Shrine told the Council. Detroit is the largest Black-majority city in the U.S. and in the world outside of Africa.

The loan deal would throw the city deeper into debt, paying off a $250 million interest swaps arrangement with two other globally disgraced banks, UBS AG and Bank of America, at high interest rates. In the event of default, it would be backed by city and casino income taxes amounting to $96 million a year, as well as the proceeds from any sale of city assets exceeding $10 million.

Terms of the “forbearance agreement” embodying the loan would prevent the city from suing recoup losses from the related predatory $1.5 billion Pension Obligation Certificate (POC) loan negotiated in 2005 with UBS AG and Siebert, Brandford and Shank. U.S. Bankruptcy Judge Steven Rhodes still must rule on that agreement in the face of numerous creditor objections, particularly from the pension funds and the Official Retirees Committee.

Meanwhile, the daily media reports, Orr has introduced an alternate deal into the fray, which the Council is to consider at 8:30 AM Oct. 23, just as a mass protest takes place outside the federal courthouse, signaling the start of the bankruptcy eligibility trial.

City Councilwoman JoAnn Watson crystallized objections to the swap deal as well as the POC loan on Oct. 21.

“Barclay’s has the nerve to say the agreement would be in default if the Emergency Manager goes away,” Watson said. “That is outrageous on its face because Public Act 436 [the EM law] violates the Constitution. We need to sue those responsible for the 2005 deal. Wall Street came to the table to advocate the potentially fraudulent and biggest [POC] deal of its kind in the history of the country. Detroit’s CFO Sean Werdlow under Mayor Kwame Kilpatrick pushed for the loan then took a job with one of the lenders and is still with them today. The police were called out to force those Council members to the table who did not want a quorum present to vote on it.”

Former Detroit CFO Sean Werdlow, Bill Doherty of SBS, Joe O’Keefe of Fitch Ratings, Steven Murphy of Standard and Poor’s, and former Deputy Mayor Anthony Adams press for POC loan deal at City Council table Jan. 31, 2005/Photo by Diane Bukowski

Under PA 436, the Council has seven days to propose an alternative to the plan.

“This loan makes the banks richer and the retirees and the city poorer,” Councilwoman Brenda Jones said. “It is setting the city up for failure. Neither PA 436 nor Orr’s Executive Order #17 [on the Barclay’s loan] are helping our city. The alternative is to vote NO with a strong resolution.”

Watson added, “The alternative is also to pay nothing, and call for litigation to force them to pay back [the 2oo5 deal]. These are the same folks who got paid by destroying Detroit with foreclosures and are refusing to let $500 million in Hardest Hit Funds come to Detroit.”

Noting that Chase Bank has just been forced to pay a record $15 billion fine for fraudulent mortgages and foreclosures, attorney Jerome Goldberg of Moratorium NOW! said, “This is horrendous. Even in Jefferson County, Alabama, Chase had to give up 75 percent of money owed to it. It is only here in Detroit, the hardest hit city in the country, that we are paying the banks instead of them paying us.”

The terms of the Barclay’s loan would GIVE 75 cents on the dollar to UBS AG and BOA.

“The Wall Street Journal is reporting that there has been an increase in municipal bankruptcies now, with 20 filings in 2013,” Cindy Darrah, who was recently brutalized by Council police, noted. “Barclay’s is from England. Orr might as well go there too with the King of England because he thinks he’s the king here. This deal means we’ll have the Emergency Manager forever!”

Brandon Jessup of Michigan Forward testifies as city retirees Cecily McClellan and Cheryl Labash await their turn.

Brandon Jessup, CEO of the Michigan Forward Urban Affairs Group, said, “Since 2008, Detroit has sent nearly $800 million in unnecessary payments to Wall Street banks, including a $550 million pay-out just last year. Executive Order No. 17 puts big banks in front of our seniors and city retirees, costing them up to 90 percent of their income to secure hundreds of millions in predatory Wall Street lending.”

Jessup led the historic and successful referendum drive to put Public Act 4, the predecessor to PA 436, on the ballot, where Michigan voters trounced it by 53 percent last November, with 82 out of 86 counties voting “No.”

A briefing published by Michigan Forward says, “The loan repayments would have priority over all other post-petition claims, according to an analysis by Crain’s. And in addition to an undisclosed ‘commitment fee’ Barclay’s would get, the loan carries an interest rate based on the London Interbank Offered Rate (LIBOR) plus 2%, plus a 1% LIBOR floor, translating into an effective rate of 3.5%. If the city defaults, the spread rises by another 200 basis points.” (Click on MI Forward on Barclay deal for full document.)

Saquib Batti, a fellow with the National Cummings Foundation, told the Council, “This is just another example of big banks pushing predatory deals onto cash-strapped cities. The purpose of this special financing deal is to ensure that Bank of America and UBS can cash out on their swap deals with the city before a penny goes to city services. These swap agreements are a gold mine for Wall Street.”

Abiyomi Azikiwe of Moratorium Now added, “Barclay’s CEO was forced to resign in 2012 after their role in rigging interest rates in the LIBOR scandal was exposed. It is time to stand up against the banks and their racist government lackeys including Kevyn Orr.”

Sharon Feldman said, “I’m horrified and shocked at this deal negotiated by Jones Day, who also represents these banks. This is destructive to the youth of Detroit and to everybody. We don’t feel you are behind us. We cannot be left adrift without any support in the state from our officials.”

Karen Hammer pointed out, “Only four percent of the city’s debt is money owed in pensions. Ninety-six percent is owed to the banks. But you have enshrined using our tax dollars to pay law firms to get them more money.

A few related VOD articles:

http://voiceofdetroit.net/2013/08/20/

________________________________________________________________