Current and retired employees mobilizing people, legal and financial support for their cases

Next DAREA meeting Mon. Jan. 26 11 am, Nandi’s Knowledge Café, 12511 Woodward at Glendale

Stockton bankruptcy resulted in “pension-protecting” plan Oct. 30, 2014

Detroit EM Orr now on Atlantic City’s “emergency management team”

Senior resource list at end of story

By Diane Bukowski

January 23, 2015

DAREA Vice-President Cecily McClellan addresses packed meeting as Pres. Bill Davis listens at right.

DETROIT –Eight groups and individuals, including three retired City of Detroit attorneys, have appealed U.S. Bankruptcy Judge Steven Rhodes’ confirmation of Detroit’s bankruptcy plan. Briefs to go with their initial notices of appeal are due Tues. Jan. 27 in the courtroom of U.S. District Court Senior Judge Bernard Friedman.

The City of Detroit, still under state oversight, has moved to consolidate the eight cases, claiming, “The relevant law and facts underlying the issue of equitable mootness will be identical in every Appeal.” The motion is being challenged by appellant and attorney John Quinn, on the grounds that once briefs are filed, it will be clear that issues they cover differ substantially. Quinn said he is not averse to consolidation if all the appellants are included in the Court’s “ECF” filing system, to avoid heavy costs otherwise.

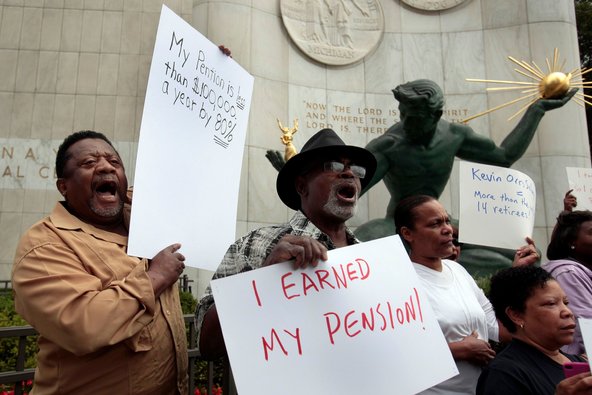

“The Detroit Active and Retired Employees Association (DAREA) is working on the final development of its brief, and it WILL be submitted Tuesday,” DAREA President Bill Davis told VOD. DAREA had a record turnout for its meeting Jan. 21 at St. Matthew’s and St. Joseph’s Episcopal Church, with active and retired workers packing the large church hall.

The City of Detroit plans to implement severe cuts to its retirees March 1, with many losing large chunks of their monthly checks as well as large portions of their total Annuity Savings Funds (ASF) accounts. Detroit General Retirement System workers average only $19,000 a year from their pensions. It is expected these cuts will drive at least 20 percent of the retirees below the poverty level. (An extensive list of senior assistance programs, compiled by retiree supporter Jean Vortkamp, is at the end of this story.)

“I’m going to fight this to the end,” Davis said. “They plan to rob me of $142,000 from my ASF, money that I planned to use to send my two sons to college. That money would be turned over to the banks, not city services.”

DAREA VP Cecily McClellan said their appeal will focus on issues of law, in particular the bankruptcy’s violation of the Michigan Constitution, Art. IX, Sec. 24, which says, “The accrued financial benefits of each pension plan and retirement system of the state and its political subdivisions shall be a contractual obligation thereof which shall not be diminished or impaired thereby.”

Even Michigan’s dictatorial Emergency Manager Law, Public Act 436, under which Gov. Rick Snyder and his corporate allies contrived Detroit’s bankruptcy, says, “The emergency manager shall fully comply with the public employee retirement system investment act, 1965 PA 314, MCL 38.1132 to 38.1140m, and section 24 of article IX of the state constitution of 1963, and any actions taken shall be consistent with the pension fund’s qualified plan status under the federal internal revenue code.”

It also mandates “The timely deposit of required payments to the pension fund for the local government or in which the local government participates.”

The City of Detroit has not paid into its two retirement systems since Emergency Manager Kevyn Orr filed for bankruptcy. Under terms of the confirmed bankruptcy plan, it will not pay regularly due amounts until at least 2023, if then.

City of Detroit worker Tony Brown said at the DAREA meeting, “We got screwed. The law never came into play. They did it to us in Detroit because we are a majority Black.”

Henry Gaffney, retired President of ATU Local 26, representing city bus drivers, said, “The D-DOT family, including members of AFSCME Locals 214 and 312 (bus mechanics) are angry. The city has saved millions on retirement and pensions under this plan, and they’re putting it on the backs of those who are still alive.”

Cornell Squires, who retired from the city on non-duty disability, told VOD he received a receipt for his notice of appeal from Friedman’s court and plans to file a brief Tuesday.

Cornell Squires believes criminal fraud involved in city debt is key issue to overturn bankruptcy plan. Squires was a city EMS technician who has been fighting for disability benefits since 1993. He said he was denied a ballot to vote on the Plan of Adjustment.

“I believe a very key issue should be that the bankruptcy involved criminal fraud,” Squires said. “Orr should never have withdrawn his lawsuit in the bankruptcy court against the $1.5 Billion COPS (Certificates of Participation) loan that called it ‘void ab initio, illegal and unenforceable.’ He and the Jones Day attorneys had a duty to report criminal actions to the authorities.”

Instead of issuing bonds, which would have put the city over the state debt limit and required a public vote, the loan’s executors, including global bank UBS AG, which has faced fraud lawsuits all over the world, and city leaders including CFO Sean Werdlow, created paper corporations to issue the debt. The city defaulted on the debt at least three times and it ballooned to $2.28 billion with penalties. Werdlow got a high level executive position with lender SBS Financial the same year and is now the company’s COO.

But the lenders and their insurance companies, FGIC and Syncora, made out like bandits in the Plan of Adjustment, not only receiving huge cash awards but getting city assets including Joe Louis Arena, the Detroit-Windsor Tunnel revenues, other priceless riverfront land, and revenues from the Grand Circus Park garage.

Squires said Detroit was specifically selected for the bankruptcy in violation of the 14th Amendment to the U.S. Constitution, because it is a majority Black city with a majority Black work force.

Jan. 31, 2005: (l to r) Detroit CFO Sean Werdlow, Fitch Ratings’ Joe O’Keefe, Standard and Poor’s Stephen Murphy, and Deputy Mayor Anthony Adams campaign for fraudulent $1.5 B COPS loan at City Council.

Attorney Jamie Fields represents the Ochadleus Appellants, a group of over 130 retirees, many from the Detroit Police and Fire pension system. He told VOD he will also file their appeal by Jan. 27. He said he suspects the city wants to consolidate the appeals, then argue that the plan is already in effect, and attempt to have the appeals dismissed.

“Issues in our appeal are very very broad, covering a lot more than the ASF issue, including pension protection,” he said. “In the long run, however, the underlying issues are political, not legal, so I am telling appellants not to bet the farm on success in court.”

Detroit EM Kevyn Orr (r) appointed by Michigan Gov. Rick Snyder (l) engineered phony bankruptcy with Jones Day and right-wing think tanks. Here they announce bankruptcy filing July 18, 2013.

The City of Detroit bankruptcy, based on a 2010 white paper authored by Jones Day, a global law firm largely representing banks and corporations, was meant to set a precedent for numerous other municipal and state governments across the country on how to raid pension funds. Michigan Gov. Rick Snyder got Public Act 436, the Emergency Manager Act, established with their assistance as well as that of right-wing think tanks.

New Jersey Governor Chris Christie has just appointed Orr to an “Emergency Management Team” for Atlantic City, N.J., where several casinos have gone bankrupt.

But on Oct. 30 last year, U.S. Bankruptcy Judge Christopher Klein approved a Chapter 9 bankruptcy plan for the city of Stockton, California Oct. 30 which protects public pensions in accordance with that State’s constitution, while making hefty cuts in workers’ pay.

Bloomberg News reported, “Stockton, California, won court approval of its plan to exit bankruptcy by paying bond investors pennies on the dollar while shielding public pensions, in a case watched by other cities facing heavy retiree costs.”

The California Public Employees Retirement System (CalPERS), the largest in the U.S. with 1.72 million members, voiced strong opposition to pension cuts, threatening to dissolve its contract with Stockton.

Bloomberg said, “Ending the contract with CalPERS would have reduced pensions by 60 percent and caused many employees to leave, Marc Levinson, Stockton’s lead bankruptcy attorney, has said. It would have taken years to set up a new pension system, he said.”

Levinson was hired by the city’s elected government, not an emergency manager as in Detroit’s case.

CalPERS, along with other pension systems and the AARP, filed amicus briefs to support Detroit’s retirement systems and unions in their appeals to the Sixth Circuit Court of Rhodes’ eligibility decision. However, those organizations decided to withdraw their appeals in exchange for the hotly-disputed “Grand Bargain,” which many re-named the “Grand Theft.”

CalPERS, along with other pension systems and the AARP, filed amicus briefs to support Detroit’s retirement systems and unions in their appeals to the Sixth Circuit Court of Rhodes’ eligibility decision. However, those organizations decided to withdraw their appeals in exchange for the hotly-disputed “Grand Bargain,” which many re-named the “Grand Theft.”

It involves voluntary contributions of $466 million over 20 years to the retirement systems from the private sector, and $194.8 million from the state. They will in no way compensate for the loss of city contributions to the systems, in addition to widespread outsourcing of city assets including the Detroit Water & Sewerage Department, meaning a drastic loss of retirement system members.

Bernard Friedman, Senior Judge for the U.S. District Court of Southeastern Michigan, was nominated to the bench by former President Ronald Reagan in 1988. From 2004-2009, he served as Chief Judge of the Court.

His record has been somewhat contradictory.

In March 2001, Friedman ruled that the University of Michigan Law School affirmative action admissions policies were unconstitutional because they “clearly consider” race and are “practically indistinguishable from a quota system.” His ruling was overturned by the Sixth Circuit Court. In the landmark case Grutter v. Bollinger in 2003, the U.S. Supreme Court upheld U of M’s policies, saying that the school had a compelling interest in promoting class diversity.

On March 21, 2014, however, Friedman struck down the state’s initiative-instituted ban on same-sex marriage in DeBoer vs. Snyder, finding it unconstitutional. He did not grant a stay, and the day after over 300 Michigan same-sex couples married. The Sixth Circuit Court of Appeals overturned his ruling the day after, but those marriages remained in place.

*********************************************************************************

DAREA SUPPORT PLANS FOR COURT APPEAL:

PETITION:

Sign the petition to halt changes to pensions and other benefits, to U.S. Justice Department, at http://petitions.moveon.org/sign/selective-enforcement?source=s.icn.em.mt&r_by=9645222.

FUNDRAISING:

To donate to DAREA’s LEGAL DEFENSE FUND, click on http://www.gofundme.com/pensiondefensefund. Or checks can be made payable to the Detroit Active and Retired Employees Association (DAREA), at P.O. Box 3724, Highland Park, Michigan 48203.

WEEKLY MEETINGS:

WEEKLY MEETINGS:

Mondays, 11 AM, at Nandi’s Knowledge Café, 12511 Woodward, Highland Park, 48203. These may be interspersed with evening meetings to allow day-time city workers to attend. To receive notices of meetings, updates on the appeal and events information please provide your email address and phone numbers via email at Detroit2700plus@gmail.com or call DAREA at 313-649-7018.

Read DAREA’s position statement at DAREA Call.

********************************************************************************

Related:

John Quinn Response to Motion to Consolidate

**********************************************************************************

Senior Help Organizations

From Jean Vortkamp: Detroit pensions are being stolen by lazy stupid rich people who think they will buy bigger boats and homes to fill their empty scrooge hearts with hard-earned Detroit pension money. First, of course, pensioners should fight in the streets and in the court. However, there may be a temporary setback for many Detroit pensioners until we win.

Below are places that provide assistance. The age “senior” starts at many different ages so if you are under 65, take a look and see if they will help you. These are not endorsed, just given for your information. If you know of others or if any of these is not useful, please let me know. Warning, strong language below. – Jean

OTHER SENIOR ADVOCACY GROUPS: Join them, fight for your rights!

- NLRN, “Based in Washington, D.C., the National Retiree Legislative Network (NRLN) is the only nationwide organization solely dedicated to representing the interests of retirees and future retirees.” http://www.nrln.org/

- National Committee to Preserve Social Security and Medicare http://www.ncpssm.org/

- Pension Rights Center http://www.pensionrights.org/

- FOOD Find a food pantry near you: http://www.foodpantries.org/ci/mi-detroit

- Sign up for a bridge card (food stamps) Bridge Card Assistance – Apply for benefits online, check your benefits, report changes to your case, view upcoming apts. 888-642-7434 www.michigan.gov/mibridges Meals on Wheels http://www.daaa1a.org/DAAA/nutrition-services (313) 446-4444 Food and Friendship (lunches at senior centers and community centers) http://www.daaa1a.org/DAAA/nutrition-services TRANSPORTATION (includes non emergency medical transportation) http://www.daaa1a.org/DAAA/transportation

- JOBS FOR SENIORS Mature Workers Jobs Program http://www.daaa1a.org/DAAA/mature-workers

- Retired Brains http://www.retiredbrains.com/

- HEALTH Medicare/Medicaid Assistance Program (MMAP) – The Medicare/Medicaid Assistance Program (MMAP) provides free health insurance counseling for people with Medicare and their families or caregivers: http://www.daaa1a.org/DAAA/community-services#sthash.H0Frgg4p.dpuf

- Wayne County Prescription Savings Program: http://www.waynecounty.com/hhs/2338.htm

- Pfizer Prescription Program: http://www.pfizerrxpathways.com/

- State of Michigan Medicare Savings Program: http://www.michigan.gov/mdch/0,4612,7-132-2943_4857-17716–,00.html

- Wayne County Senior Dental Program: http://www.waynecounty.com/hhs/2342.htm State of Michigan’s Prescription Drug Discount card: http://www.mihealth.org/mirx/index.html

- Medicare Savings Program: http://www.michigan.gov/documents/Medicare_10355_7.pdf

- Michigan Donated Dental Services: http://www.nfdh.org

- Tri-County Dental Health Council (News about Dental Health Coverage and Medicaid, referrals for low-cost) http://dentalhealthcouncil.org/

- University of Detroit, School of Dentistry, Dental Clinic http://dental.udmercy.edu/patient/

- Wayne County Community College Dental Hygiene Program http://mihealthinsider.com/content/wayne-county-community-college-dental-hygiene-program

- PROPERTY TAX City of Detroit Hardship Request for Property Taxes http://www.detroitmi.gov/CityCouncil/LegislativeAgencies/PropertyAssessmentBoardofReview/HardshipCommittee.aspx

- Detroit SENIOR PROPERTY TAX DEFERRED PAYMENT PROGRAM http://www.detroitmi.gov/?tabid=102 City of Detroit Solid Waste Fee Senior Discount (LOOK AT THIS!) http://www.detroitmi.gov/DepartmentsandAgencies/Finance/TreasuryDivision/SolidWasteFeeInformation.aspx

- Wayne County Property Tax Relief http://www.waynecounty.com/treasurer/773.htm

- HOUSING Detroit Housing Commission 877-8000 http://www.dhcmi.org/

- Detroit Eviction Defense http://detroitevictiondefense.org/ 429-5009

- United Community Housing – help for renters and homeowners, including help with Property Tax Hardship Application http://www.uchcdetroit.org/ 963-3310

- MSHDA Section 8 Detroit 456-3540, Detroit Housing Commission Section 8 877-8007

- Wayne Metro Community Service Agency 388-9799

- PHONES Free Cell Phones for elderly http://www.obamaphone.com/

- AT & T Lifeline for cell phone or landline http://www.att.com/gen/general?pid=22888

- LEGAL HELP Elder Law Advocacy Center at Hannan House: Services include assistance with wills, debts, mortgage, health proxy, medical bills, Power of Attorney, Social Security benefits, and Medicare or Medicaid benefits. Call 313-833-1300, x 32 for more information. http://www.hannan.org/index.php?option=com_content&view=article&id=38&Itemid=128

- HEAT/LIGHTS Thaw/WARM http://www.thawfund.org/ Phone: 800-866-8429

- Wayne Metro Community Service Agency 388-9799

- WATER: These fuckers are trying to put a lien on your house to take your land with this water shit. Get help, save African American home ownership and middle/lower class home ownership. No land grab. Wayne Metro Community Service Agency 388-9799 Detroit Water Fund: http://liveunitedsem.org/pages/detroitwaterfund-about

- MENTAL HEALTH: Yes, they are trying to kill you. You may need to talk about it with someone. Stay sane. Protest, scheme and plan and make them crazy until we win. 24 hour crisis help/referral: 1-800-241-4949 or 224-7000 Eastwood Clinics 800-626-3896 20811 Kelly Road, Eastpointe 48021 Northeast Guidance Center 245-7000 20303 Kelly Road, Detroit 48225

- BOOKS: Keep your mind busy so you don’t worry. Detroit Public Library Bookmobile. Large print books, books you can listen to. Free http://www.detroit.lib.mi.us/specialservice/library-wheels-low

- SENIOR CENTERS: Stay social to keep yourself busy between protests and court cases. Matrix Human Services at Patton Recreation Center, 2301 Woodmere, Detroit 48209 313.831.8650 St. Patrick Senior Center, 58 Parsons St., Detroit, 48201, 313.833.7080

- http://www.daaa1a.org/DAAA/community-services

- SENIOR DISCOUNTS: Be thrifty. When we win and you have your money back, you won’t believe how much extra money you will have! Extensive Senior Discount List (Grocery Stores, Clothes, Travel etc.) http://www.giftcardgranny.com/blog/senior-discounts/ Discounts with AAA membership on prescriptions, hearing aids and more. http://savings.michigan.aaa.com/default.aspx?&cid=5

Thanks for providing us fair and detailed coverage. This will help with getting the word out you must fight for what’s right and the law.