“I saw the light leave out of her eyes, and blood gushed out of her mouth. I knew she was dead.”

Jones sobs, undergoes brutal cross-exam as trial begins second week

By Diane Bukowski

DETROIT – Testimony from Aiyana Stanley-Jones’ grandmother, Mertilla Maria Jones, who was sleeping with the child when Detroit police officer Joseph Weekley shot the 7-year-old to death May 16, 2010, kicked off the second week of his trial on charges of involuntary manslaughter and reckless use of a firearm resulting in death.

“I figured what all of them came to do was murder,” Jones said, referring to the paramilitary police raid team that invaded her house before shooting Aiyana in the head with an MP 5 submachine gun. “From the way they came in, and they knew there were children in the house, they came to kill, and they just killed a 7-year-old. I saw the officer come in, put the gun to Aiyana’s head, and just shoot.”

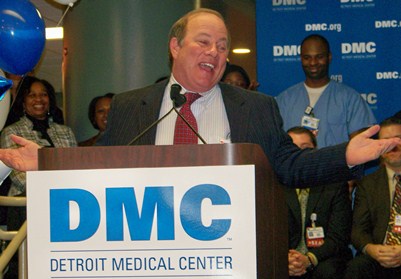

Mertilla Jones on stand during trial of Officer Joseph Weekley, who shot her 7-year-old grandchild Aiyana to death.

The trial is taking place in front of an all-white jury except for one Black male. The jury has never even been shown a photograph of the disarmingly pretty little girl.

“A few minutes before the police arrived, Charles had come and checked on us,” Jones said, referring to her son Charles Jones. “He pulled ‘Yana’s cover back over her. Then I heard a lot of commotion. The front window exploded, they hollered ‘police,’ and they kicked the door open, all at the same time. I was on the north end of the couch. Aiyana was on the south end with her head by the door.”

The living-room couch on which the two were sleeping was located directly under the front window that police hit with an incendiary stun grenade known as a “flash-bang.” “

I rolled on the floor,” Jones continued. “Glass had landed on me. “I was lying on my stomach looking at the front door, and all these police came rushing in, three or four of them. The gun was placed right there at Aiyana’s head, and they pulled the trigger. I saw the light leave out of her eyes, and blood gushed out of her mouth. I knew she was dead.”

Jones, who said that she and Aiyana were “very close,” broke down sobbing uncontrollably. Wayne County Circuit Court Judge Cynthia Gray Hathaway called a half-hour break. Jones was composed when she took the stand again.

“The police were in riot gear, all black,” she said. “I recognized it because I had watched ‘Detroit SWAT’ before.” A television crew from A & E, which sponsored Detroit SWAT, was filming the raid that day for its show “The First 48.”

“I had my eyes on Aiyana as well,” Jones said. “The gun went off and shot her in the head. Her eyes popped open and blood came out of her mouth. The TV in the room was on, so I could see. I started screaming and hollering and beating the floor, saying ‘Y’all fucked up, you killed my granddaughter.”

Aiyana Jones’ father Charles Jones is comforted by his aunt Joann Robinson on the porch of the Jones home the morning of Aiyana’s killing. Joann Robinson, who was in the home when Aiyana was shot, died a little over one year later. Photo by Diane Bukowski

Jones testified she had been about to warn the police that a child was on the couch, but did not have time to get the words out of her mouth. She said her sister Joann Robinson was sleeping on a black couch on the south side of the living room. Robinson died June 15, 2011. Jones has attributed her death to the grief and shock from the day Aiyana was killed.

“They started streaming into the house,” she continued. “I was steady screaming, ‘They killed Aiyana,’ but the cops weren’t paying me any attention. They didn’t detain me. They started going off into the bedroom on the side and the one behind, the one Charles and Dominika were sleeping in with their other three kids. They were moving very fast. They literally walked by me. I heard them in the rooms shouting, ‘Get on the floor, get on the floor.’”

She described how Aiyana’s father Charles exited his room.

“They made my son Charles crawl on his hands and knees like a dog,” she said. “He crossed the dining room and went into the living room. I got up on went to him and went to him, and he crawled to the couch.”

Aiyana’s cousin Mark Robinson in room where she was killed, the morning of her death. He testified he warned police there were children in the house.

Then, Jones said, “One of the officers cut on my lights and said, ‘Oh shit,’ grabbed her [Aiyana] and ran her out of the house. The other officers were still coming in. CJ started picking up bits of brains, and I told him, ‘That’s your baby’s brains and blood, Charles, they killed her, they blew her brains out.’ Then they told me to come outside, slammed me up against the house and handcuffed me, put me in the squad car and took me to homicide.”

She told Assistant Wayne County Prosecutor Robert Moran the police never said why they arrested her, or told her anything about Aiyana’s condition. She said she never grabbed Weekley’s gun, that physically she could not reach up and touch anyone. She said in earlier videotaped testimony shown to the jury that the police ‘would have shot the hell out of me’ if she had grabbed the gun.

Jones demonstrated how the officer she later came to know as Weekley was holding his MP5 submachine gun, cradled in one arm with the muzzle pointed at a downward angle, directly at the arm of the couch where Aiyana’s head lay as she slept. Earlier testimony showed Weekley was also carrying a large ballistic shield, although the MP5 is usually operated with two hands according to other testimony by officers.

Cop in real-life photo holds submachine gun in one hand and ballistic shield in the other, similar to Weekley’s stance, although Mertilla Jones testied Weekley held his gun pointed downward at a 45 degree angle.

Jones said she did not remember how long she was held and interrogated, only that “a lawyer had to come and get me.”

Defense attorney Steve Fishman then began a grueling cross-examination.

He asked her whether she had given testimony, starting with the police interrogation, and proceeding to the grand jury and civil case depositions. He said she had also given statements to the media.

Jones said, “I don’t talk to the media.”

Fishman said, “Oh, yes, then who is that over there?” pointing to this reporter sitting in in the audience. “I know Diane,” Jones said. “She’s my family’s friend.”

Fishman showed a brief clip of Jones’ interrogation by the police, and a police report in which she says “flying glass and gunshots” came through the window, attempting to impeach her earlier testimony.

Jones read the police report, and said she didn’t remember saying it that way. She testified she did not write the police report, and shouldn’t have signed it, but was in shock.

Fishman asked her whether she had testified that she reached up to grab her granddaughter.

“At the time, I was lying on the floor,” she said. “I started to ask them, ‘please let me get my grandbaby,’ I tried to get it out, but before I could say it, she was shot. . . .I didn’t grab my grandbaby, as soon as he came in the door, he just put the gun to her head and shot.”

She confirmed earlier testimony she had given that Weekley murdered Aiyana. The prosecution has charged him only with involuntary manslaughter and painted a picture of a professional police team that would never deliberately kill anyone. Fishman said during opening statements that if Weekley had deliberately pulled the trigger on the gun, he should have been charged with first-degree murder.

Other police officers have testified that they are trained in “trigger discipline,” to keep their finger off the trigger even if someone tries to take their weapon. Testimony has also been given that it takes 6 to 8 lbs. of pressure to pull the trigger on an MP5.

Without objection from Moran or the judge, Fishman then introduced more “facts not in evidence.”

He asked Jones if she hated the police for killing Aiyana, for arresting her son Charles and her daughter’s boy-friend Chauncey Owens in the killing of Je’Rean Blake, 17, and for arresting and successfully charging another of Jones’ sons, Norbert Jones, with first-degree murder. Norbert Jones was sentenced the month after Aiyana’s death. His mother has said he was unjustly convicted.

“Certain police officers are harassing us to this day,” Jones said. She acknowledged knowing at the time of Aiyana’s death, from television reports and neighborhood talk, that Je’Rean Blake, 17, was killed on the May 14, 2010, but only peripherally.

Jones’ son Charles and Owens are stilling awaiting trial in that case. Owens has been held without bond since May 16, 2010, while Jones has been held without bond since November, 2011. Weekley has been free on personal bond to go home to Grosse Pointe, where he lives.

The Jones/Owens trial has been delayed while prosecutors await a ruling from the Michigan Supreme Court on Wayne County Circuit Court Judge Richard Skutt’s action barring “jail-house snitch” Jay Schlenkerman’s third-hand hearsay testimony against Jones.

Jones denied she had ever seen her sons Charles Jones and Vincent Ellis, and her grand-nephew Mark Robinson with guns. Police have testified during the trial that an Officer Carmen Diaz gave them information that Owens had an AK-47 and a handgun. Diaz has not testified, nor has her alleged informant. Neither Moran nor Judge Hathaway has objected to that hearsay testimony or constant, unsubstantiated characterizations of Owens as a murderer and Mertilla Jones’ home as a “crack-house.”

Jones said Owens did not live with her, but in the flat above her. She said Mark and Markewell Robinson had been staying with her for two months after their grandmother’s lights were shut off.

Fishman then introduced photographs which had been the topic of a lengthy discussion without the jury present at the beginning of the day. They are from Mark Robinson’s Facebook page, allegedly showing Robinson and Ellis with guns. Fishman said he intended to use them to impeach witnesses, including Mark Robinson, who testified earlier that he warned the raid team there were children in the house. Although he did not testify about his own possession or use of guns, Robinson was banned from the trial that day because Fishman said he might recall him to the stand.

Assistant Prosecutor Robert Moran in front, at preliminary exam for Charles Jones, who he is also prosecuting in an apparent conflict of interest. Photo by Diane Bukowski 1 26 12

Moran objected to introduction of the photographs at length during that session, saying there is no evidence of when the photos were taken, where they were taken, and by whom. He cited the Michigan Rule of Evidence he contended they violated and said he would preserve his objection for an appeal.

Hathaway nevertheless ruled to admit the photos, saying she would give instructions to the jury on whether they could be used to impeach witnesses.

Moran, who is also prosecuting Chauncey Owens and Charles Jones, did not object in detail in front of the jury, indicating only that his objection had already been noted. Hathaway gave no instructions to the jury when the photographs were introduced.

Fishman then handed six full-page glossy photographs to the jury to pass among themselves. All photographic evidence until that day had been displayed only on video screens. The photos were not shown to the audience or media. A glimpse of them as they were passed along to the jury indicated that most were blurry.

The jury never saw or handled any photographs of Aiyana, which are numerous on Robinson’s website. Of 230 photos on the site, almost all are loving photos of Aiyana and of the many other children in her extended family. The site is no longer up.

Group of Aiyana’s cousins and other relatives with T-Shirts demanding justice for her kiliing. Photo from Mark Robinson’s Facebook page.

Fishman asked Jones to identify the people in the photos. Keeping her composure, she identified Mark Robinson, Vincent Ellis, and Mark’s brother Markewell Robinson, but said the guns appeared to be rifles, BB guns, or toy guns. On re-direct, she told Moran that she did not take the photos and did not know when or where they were taken, and re-iterated her testimony that she had not seen the individuals in question with guns.

Fishman asked her if she was aware that State Police found 14 shell casings in the backyard of the home, again “facts not in evidence,” at the current trial. Jones said she never went into the home’s backyard and that hearing gunshots in her neighborhood was common.

During later testimony from officers, Fishman asked each of them if any of them would go into a house and deliberately murder a child. “You must be joking,” one said. Fishman told this reporter after one day’s hearing that Jones should never have told her for a Voice of Detroit story that police murdered Aiyana. In fact, it has been this author’s experience during years of covering killings by police that family members frequently characterize the killings as “murder,” and in fact they are frequently deliberate.

Detroit police officer Eugene Brown bragged about killing (l to r) Rodrick Carringon, Lamar Grable, and Darrne Miller.

In the case of Lamar Grable, 20, shot 8 times to death by three-time killer cop Eugene Brown in 1996, his mother Arnetta Grable said she had spoken with Brown’s cousin. The cousin said Brown bragged about being able to kill people as a police officer and get away with it. Grable later won $6 million in a civil jury verdict in the case, but Brown has never been charged criminally and is still on the force.

Officers Barron Townsend and Steven Kopp chased Tommie Staples, Sr. into an alley in 2008 and shot him to death as he lay under their car, simply because he and his wife were advocates for youth in the neighborhood when they were stopped by police. The family won a $2.5 million lawsuit settlement in that case. Townsend and Laron York killed Dennis Crawford, a father of five, in 2005 during a domestic violence call.

Tommie Staples Sr. second from left, killed by Detroit cops in 2007 for monitoring police stops of neighborhood youth Family photo

His widow commented on Voice of Detroit, “For the record, I thank you for reminding others of these senseless crimes at the hands of our very own police force, ‘Detroit’s Finest.’ Dennis was shot 15 times; not 4 and he had no weapon at all. My son, who is now 20, has continued to suffer from the loss of his father through adulthood. As a mother, it’s very hard to keep my son from becoming a product of his environment. I fear that the judicial system does not analyze or own up to its contributions to the behavior patterns and emotional guilt of children who have lost parents (or loved ones) at the hands of those who have taken an oath to serve and protect.”

Police shot Anthony Scott, 25, to death in his car at a gas station on Detroit’s southwest side July 3, 2005, as he lifted his T-shirt to show them his surgical scars and beg them not to rough him up. Police claimed he had a knife. Others in the car denied he reached for it. His widow, Bobbi Jo Wethington, said during a press conference held by then State Rep. Hansen Clarke, “The police are about killing you.”

Fishman recalled that case, saying his law firm handled the civil suit against the officers. Scott’s family, and Fishman, won a settlement of $1.2 million in that case, as follows from the Detroit News:

“Detroit, MI: (Dec-03-07) The family of Anthony Scott brought a wrongful death lawsuit against the city of Detroit, alleging that Scott was shot to death by a police officer at a gas station in 2005. The family sued for gross negligence stating that on July 3, 2005, Scott and his two teenage cousins had left a birthday party to buy candles and cigarettes at a gas station at Michigan and Lonyo. A police car followed them to the gas station, and two officers then approached the vehicle with their weapons drawn. Another officer, Michael Reizin, who was working undercover nearby, also drew his gun after seeing the two other officers attempt to get the three men out of the vehicle. Scott was asked to step out of the vehicle and was shot twice because it appeared he was trying to reach for a weapon in his lap. Sources stated that Scott had an eight-inch hunting knife in his waistband when he was killed. As part of a settlement reached, the city council has tentatively awarded the family $1.2 million to resolve the wrongful death lawsuit.h”

http://www.finalcall.com/artman/publish/National_News_2/article_9953.shtml

Article on Tommie Staples lawsuit settlement in Final Call at

http://www.finalcall.com/artman/publish/National_News_2/article_7206.shtml