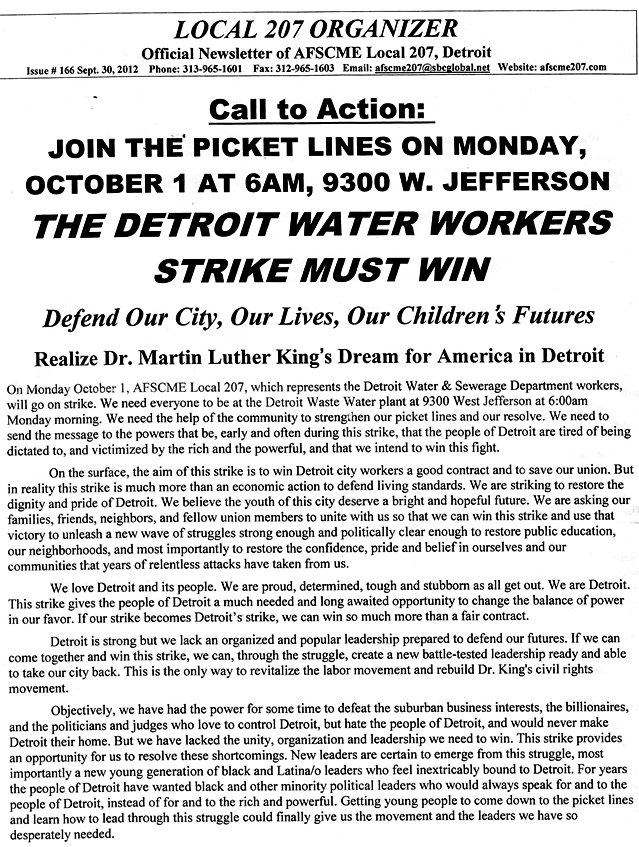

Detroit Wastewater Treatment plant workers outside the plant’s main gate Sunday afternoon, Sept. 30, 2012.

- Union locals call for mass community support on picket lines

- Will top union leadership join the battle?

By Diane Bukowski

September 30, 2012

DETROIT – Declaring they are battling for the future of Detroit, workers at the city’s Wastewater Treatment Plant (WWTP) walked off the job at 10 a.m. today. The afternoon shift, scheduled to start at 3:30 p.m., was shut down as well.

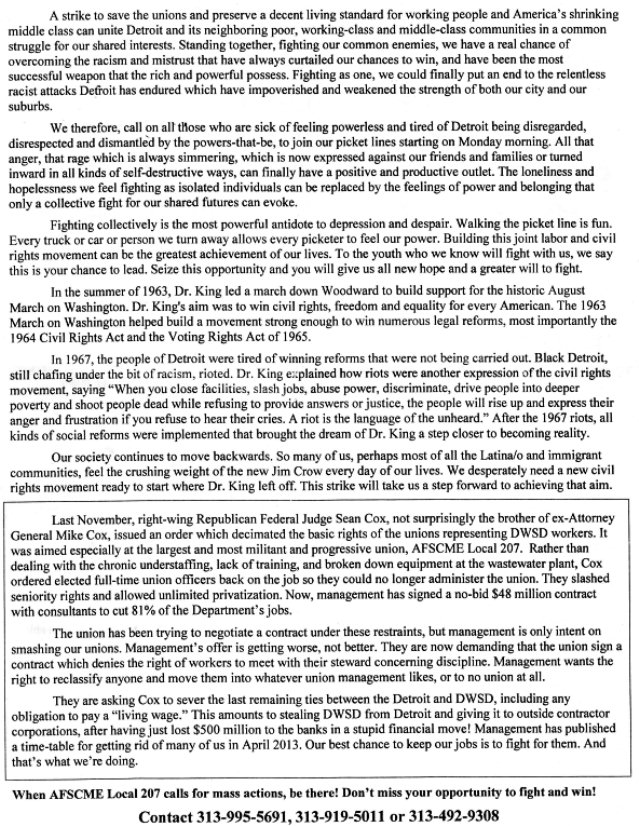

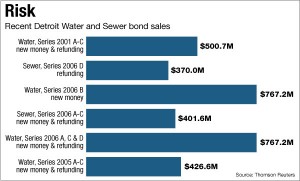

The Detroit Water and Sewerage Department (DWSD) serves 40 percent of Michigan’s residents, and is the third largest system in the country. The wildcat exploded after Locals 207 and 2920 0f the American Federation of State, County and Municipal Employees (AFSCME) took strike votes last week. Local 207, with 950 members, is the largest city public worker union.

“It’s about time the city stood up,” said A.B., who has worked at the plant for 11 years. “Enough is enough! The water department is the only entity in the city making money. But they came to an 80 percent Black city, where police and fire and water have become the new Big Three, and said they want to put 1,000 more people out of work, just adding to the blight in Detroit.”

Fifty-seven percent of Detroit’s children now live in poverty, according to A Kids Count study by the Annie E. Casey Foundation released Sept. 26.

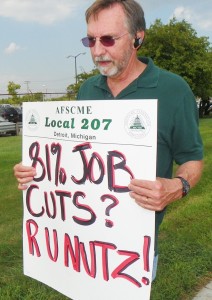

But two weeks ago, the Detroit Water Board approved a $46 million contract with the EMA Group to eliminate 81 percent of DWSD jobs. Rumors then circulated that U.S. District Court Judge Sean Cox, who oversees the WWTP under a federal consent decree, planned to issue an order Oct. 1 barring a strike.

- Worker at front gate denounces EMA, which wants to cut 81 percent of DWSD workforce, has caused disastrous floods in Toronto due to sewage backups.

So WWTP workers jumped the gun.

Local 207 Unit Chair Lakita Thomas said, “All the workers except for two were ready to walk out, and then those two changed their mind and came out with us too.”

The WWTP parking garage was empty, with “On Strike” signs posted on its locked gates.

Workers said the shutdown of the WWTP, which extracts sewage from water returning from tens of thousands of households before it enters the Detroit River,, will give the DWSD, EMA and Cox a taste of what it will be like if 81 percent of the workforce is cut.

“We went on strike today because we want that little dictator Sean Cox out of Detroit,” Local 207 steward Susan Ryan said. “We want DWSD under the control of the city. We are fighting for Detroit and all of its people. Everybody is welcome to join us on the picket line.”

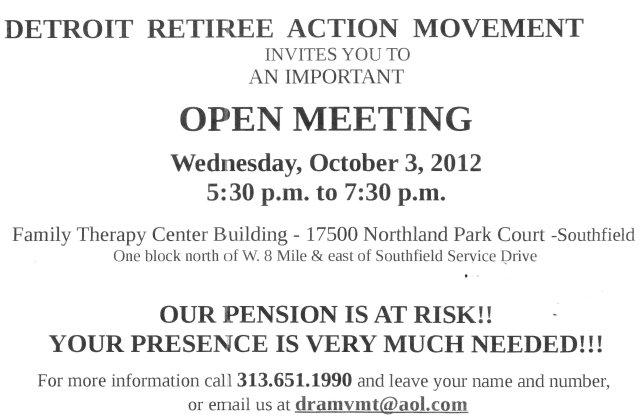

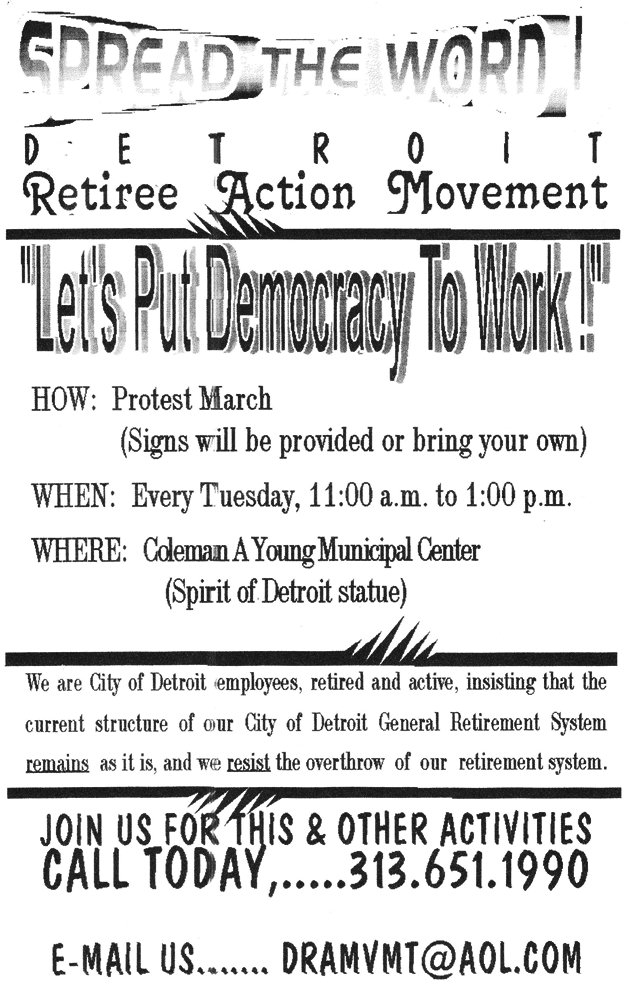

Local 207 Secretary-Treasurer Mike Mulholland said local members went to churches across Detroit this morning to mobilize support, and passed out fliers at a meeting of the Detroit General Retirees Sept. 25.

“This is just as much a battle for the retirees as it is for us, because under Detroit’s Public Act 4 consent agreement, their health care and other benefits are about to be cut. We all need to stand together in this fight,” Mulholland said.

Malcolm Garrett said, “We don’t want any more takeovers in Detroit. We’re sick and tired. We want them to leave Belle Isle alone and stop privatizing.”

- Worker demands stop to takeover of Detroit, the world’s largest Black-majority city outside of Africa.

Detroit Mayor Dave Bing has signed a no-rent 90-year agreement to “lease” Belle Isle, the largest island park in the U.S., to the state. It has not yet been approved by City Council. The city is shutting down its 187-year-old Health Department this week, handing $60 million in federal grant funds over to a newly-concocted private “Institute for Population Health.”

It is also closing two other federally-funded departments. Over the last three decades, Detroit has privatized Detroit General Hospital, the Detroit Zoo, Cobo Hall, the Institute of Arts, Eastern Market, and many other city assets.

Workers picketed at all three main gates of the WWTP, sending reinforcements as needed to other gates.

At the front gate, Nicole Spicer sat with her two-year-old daughter Mya and two other women workers on the picket line.

“They’re trying to put us all out of a job,” she said. “We will not stand by quietly while they give our jobs to contractors. We work in the city, and we live in the city.”

At the back gate, a mother who brought her children said, “People who work here have been committed to their jobs, and to providing good water for everyone, but they want to take our pensions, and cut 81 percent cut of manpower. The people who are doing this don’t know much about DWSD anyway. It’s been 10 years since we’ve had a raise, but they keep raising water rates, and they want us to pay more for health care. Most people out here don’t make any more than $15,000 to $18,000. We can barely feed our families now!”

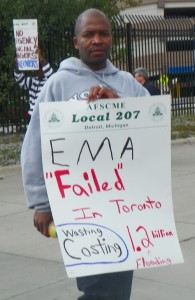

One worker carried a sign declaring, “EMA failed in Toronto, wasting $1.2 billion and causing flooding.”

The city of Toronto hired the EMA Group in 1996 to revamp its water department, and eventually cut large numbers of its sewage plant workforce. In June of this year, Toronto’s subways and many neighborhoods experienced massive flooding due largely to sewage back-ups during a rainstorm. Such floods have been commonplace since the cutbacks. Toronto voted to spend $1.2 billion in 2005 on the system, but EMA’s plans have not worked.

Workers from other unions came out to support the DWSD workers as well as word of the walk-out broke.

- Picketers cover street entrance to back gate. Plant security threatened to have them arrested, but Detroit police on the scene took no such action.

“This strike is happening in the wake of the victory of the Chicago Teachers Union,” said Martha Grevatt, of UAW Local 869. “It’s another example of workers standing up, not only for their jobs, but against the banks and corporations. Whether you work for a private company or in the public sector, your bosses are part of the 1 percent.”

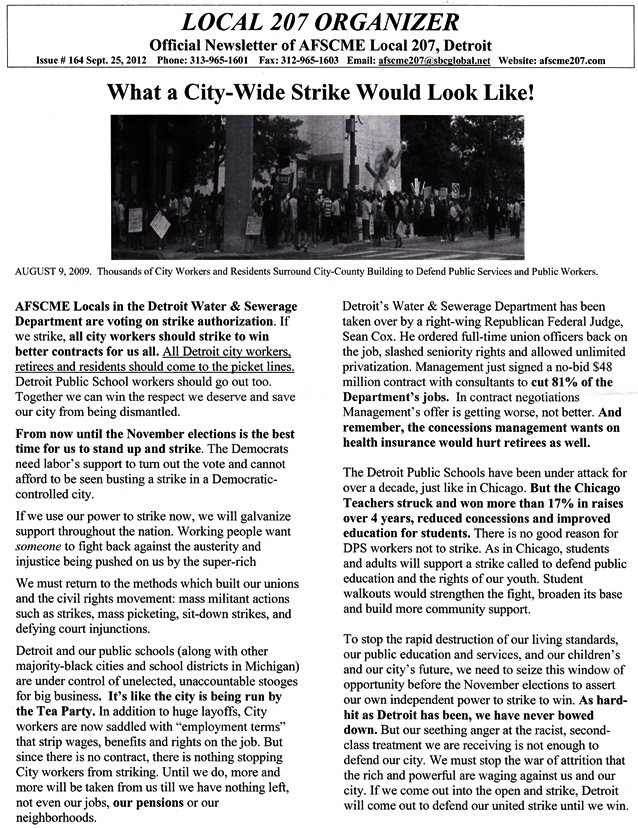

Local 207’s newletter, “The Organizer,” said, “We need to send the message to the power that be, early and often during this strike, that the people of Detroit are tired of being dictated to, and victimized by the rich and powerful, and that we intend to win this strike.”

A spokesman for Detroit Mayor Dave Bing said in a statement, “There has been no interruption of water service. Other than that, we have no comment at this time.”

- Al Garrett, President of Michigan AFSCME Council 25, threatens to “shut the city down” during Council meeting April 2.

Al Garrett, President of Michigan AFSCME Council 25, told Detroit’s City Council on April 2 that he would “shut the city down” as AFSCME did in during a city-wide strike in 1986 if the Council voted for the PA 4 consent agreement. It did so anyway, 5-4, on April 4.

On July 17 , using the consent agreement, Bing and the state-appointed, corporate-dominated “Financial Advisory Board” imposed unilateral “City Employment Terms” on the city’s workforce. The “CET” applied to every department except DWSD, which Cox ordered to conduct separate negotiations, and the Detroit Department of Transportation, which is bound by federal regulations against union-busting.

Garrett was not available for comment at press time. It remains to be seen if he will make good on his promise, and whether the leadership of the union movement across Michigan will join the battle.

The Wastewater Treatment Plant is located at 9300 W. Jefferson in downriver Detroit. Workers begin picketing at 6 a.m. every day and throughout three shifts. For information on how to support the strike, call 313-995-5691, 313-919-5011, or 313-492-9308.

See next post for Local 207’s statement on the strike and call for support.