State AG Schuette, Wayne Co. Prosecutor Worthy try to block Cortez Davis re-sentencing

By Diane Bukowski

August 16, 2012

DETROIT – Wayne County Prosecutor Kym Worthy and State Attorney General Bill Schuette are attempting to block one of the state’s first juvenile lifer re-sentencings, that of Cortez Davis, since the June 25 U.S. Supreme Court decision in Miller v. Alabama. That ruling outlawed mandatory juvenile life without parole. The two have additionally asked the Michigan Supreme Court to weigh in on Miller as a whole.

Michigan has at least 360 juvenile lifers, the second highest number in the nation.

A network established by prisoner advocacy agencies has recruited over 150 attorneys to represent all of them, pro bono if need be, in re-sentencing hearings. The attorneys took special training in the issues involved on July 27 and are targeting a core group for immediate re-sentencing hearings, those who have served the longest terms, and who were not the “principal actors” in the crimes involved.

A network established by prisoner advocacy agencies has recruited over 150 attorneys to represent all of them, pro bono if need be, in re-sentencing hearings. The attorneys took special training in the issues involved on July 27 and are targeting a core group for immediate re-sentencing hearings, those who have served the longest terms, and who were not the “principal actors” in the crimes involved.

Ironically, Davis, 16 when he was convicted of felony murder during a robbery, could be considered a poster child for nearly every aspect of the Miller decision.

Davis was not the shooter, faced “horrific” circumstances in his early life, and has thoroughly rehabilitated and educated himself while in prison, even getting married, according to a motion for relief from judgment filed by his attorney Clinton Hubbell, of the law firm Hubbell Duvall, PLLC.

“There are two issues, whether Miller is retroactive, and whether re-sentencing is appropriate,” Hubbell told VOD. “They [Worthy and Schuette] are hoping to narrow down what Michigan trial courts can do under Miller.”

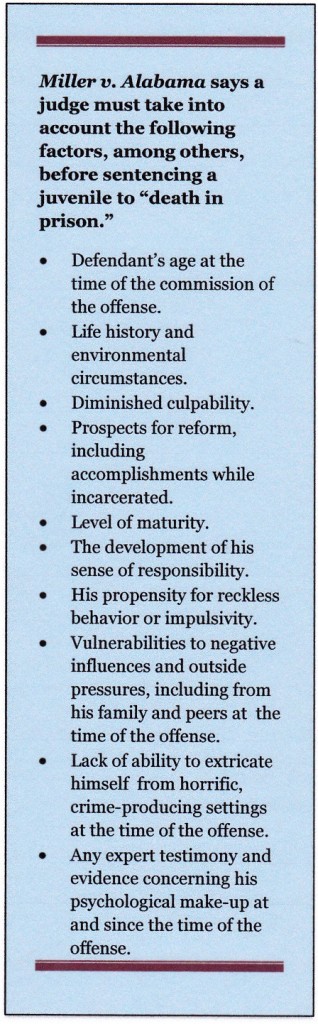

But, said Hubbell, “I don’t see them with a lot of legal traction. Our position is that Miller is pretty obviously retroactive. It was not decided in a vacuum, but as a culmination of other Supreme Court decisions outlawing the death penalty and life without parole for juveniles in non-homicide cases. There has to be a re-sentencing. Miller says the sentencing judge has to take into consideration a list of things, essentially that the defendant’s whole life must be put in front of the judge before sentencing.”

A hearing in front of Wayne County Circuit Court Judge Vera Massey Jones was scheduled for September 14, 2012 on Davis’ motion for relief from judgment. But Worthy and Schuette intervened, asking the Michigan Supreme Court to rule that the U.S. Supreme Court’s decision is not retroactive for juveniles in Michigan and that Davis should not be re-sentenced.

The Michigan Supreme Court has not yet granted leave to appeal in the case, despite numerous filings by Wayne County Assistant Prosecutor Timothy Baughman. Baughman earlier got the Court to ban judges from trying to remedy racially-imbalanced juries.

Schuette’s release says in part, “Wayne County Prosecutor Kym Worthy noted that the Supreme Court decision ‘affects more Wayne County families of murder victims than anywhere else in the State. I urge a prompt determination of the reach of the Miller decision by the Michigan Supreme Court. This will help avoid further trauma to those who lost their loved ones, some many years ago, and rightfully thought that the criminal justice system had provided them some degree of closure.’”

Schuette called all juvenile lifers “teen-age murderers” in the release. However, according to a study by the Michigan chapter of the American Civil Liberties Union (ACLU), most juvenile lifers were not the actual killers, as in Davis’ case.

“We are not victimizing the community or anyone else with these re-sentencings,” Hubbell said. “The individuals in question did not actually commit the offense for which they were sentenced, first-degree murder, and they had diminished culpability as juveniles.”

Davis’ sentencing judge first refused to give him life without parole, but the prosecution successfully appealed.

During Davis’ re-sentencing in Detroit’s now defunct Recorders Court, the judge said, “I think he’s salvageable . . . . I believe somebody’s been throwing this young man away from the day he was born. . . . And maybe when the [legislature], because they’re beginning to take a look at it, that they may change it. Though it will be years from now, but they may change it. . . .They’re going to find out how unjust it is to do this. So don’t give up hope. You may not be in there for the rest of your life.”

Legislative efforts during the administration of Gov. Jennifer Granholm, however, went nowhere. Worthy and other county prosecutors testified strenuously in front of a Senate sub-committee against “second-chance” bills that would have made juvenile lifers eligible for parole.

Davis’ motion for relief from judgment describes the “horrific” circumstances of his life before he went to prison.

“Davis’ mother was 16 years old at the time he was born, and she already had his two-year-old sister,” the motion says. “Mr. Davis’ father passed away in 1986 when Mr. Davis was nine years old, from drug use, at which time his mother turned to drug dealing and use. She began to neglect Mr. Davis and his siblings by failing to keep food in the house.”

Child Protective Services removed the children from the home twice, sending them to live with their grandmother. That placement failed when Davis’ sister was molested by an uncle.

The motion goes on, “Davis dropped out of school in 1993, in the 8thgrade to support himself and his siblings. At one point, Davis was homeless. Davis’ maternal grandmother stated that Davis’ mother introduced Davis to selling drugs from their home.”

- Cortez Davis completed numerous courses with the Blackstone Institute to obtain a certificate in paralegal studies.

An earlier Supreme Court decision, Graham v. Florida, held that “juveniles are more capable of change than are adults, and their actions are less likely to be evidence of ‘irretrievably depraved character’ than are adults.”

Davis has thoroughly rehabilitated himself since his incarceration, says the motion.

In addition to obtaining his G.E.D., Davis has taken 52 classes, including construction trades, and numerous courses from the Blackstone Career Institute involving the study of law. He qualified for a “Paralegal Certificate” in August, 2010.

He completed basic and advanced training in American Sign Language. He has also served as “Warden’s Forum Representative” and has applied to serve as a “youth mentor” in the Thumb Correctional Facility where he is incarcerated.

The extent of Davis’ current skills can be seen in a motion he filed pro se in the U.S. District Court of Eastern Michigan. (Click on Cortex Davis fed – COA Pro Se Mtn for Reconsideration July 21, 2009.)

He cited numerous legal precedents and the 1980 Michigan Supreme Court decision in People V. Aaron, which outlawed the use of “felony murder” charges.

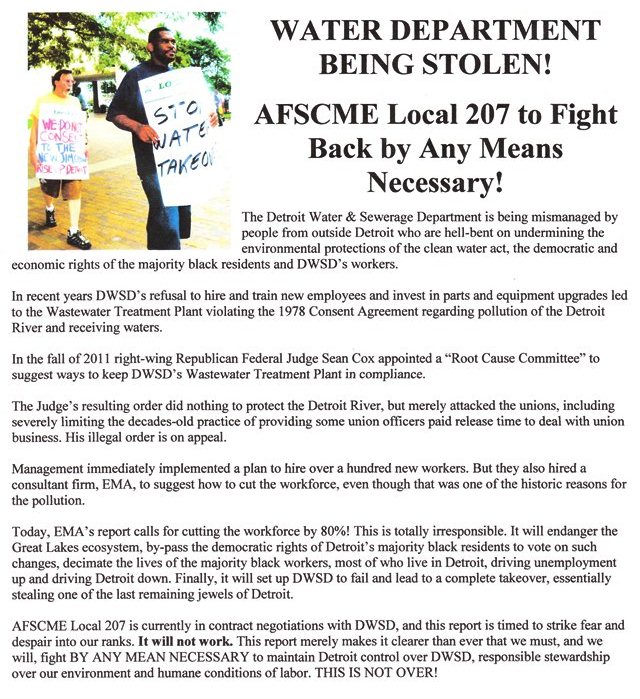

- Gracie Hines, the mother of juvenile lifer Bobby Hines, speaks at earlier press conference in Lansing. Hines is the lead plaintiff in a class action lawsuit filed by attorney Deborah LaBelle in U.S. District Court.

“Movant was not afforded his due process constitutional protection as a juvenile where he was arrested without a warrant and held in police detective custody unlawfully for four days without the assistance or benefit of counsel,” Davis wrote, using the third person. “He was not given fair notice of the charges against him where he was compelled to be a witness against himself in a criminal case, that’s contrary to the U.S. Constitution V, VI, and XIV, Lucas v. O’Dea 179 F.3rd 412 (6th Cir. 1999).”

His motion contended that he did not receive “effective assistance of counsel” because neither of his attorneys filed pre-trial motions to challenge the legality of his arrest, involuntary statement and juvenile waiver. Many of the nation’s juvenile lifers have faced similar problems with court-appointed attorneys, since most are poor and could not afford their own attorneys.

“Life without parole is the most severe penalty permitted by Michigan law and shares some characteristics with death sentences that are shared by no other sentences,” says the motion filed by Hubbell. “Since Michigan currently does not execute convicted felons, it is the most severe penalty available. While the state does not execute the offenders, life without parole alters the offender’s life by a forfeiture that is irrevocable. . . The sentence means denial of hope, that good behavior and character improvement are immaterial, and whatever the future might hold in store for the mind and spirit of the offender, he will stay in prison for the rest of his days.”

To print or save this story, click on Michigan Challenges U.S. Supreme Court on JLWOP VOD

Related stories and documents:

http://www.myfoxdetroit.com/story/19215742/pa-high-court-fast-tracks-juvenile-lifer-appeals

http://www.mlive.com/news/index.ssf/2012/05/mother_of_juvenile_lifer_pasto.html

Cortez Davis Successive Motion for Post Judgment Relief-signed

Schuette Worthy re Miller case

Second Chances Juveniles serving life without parole in Michigan prisons

Attorney Clinton Hubbell contact: clint@hubbellduvall.com

Attorney Deborah LaBelle’s office is coordinating the defender network for juvenile lifers. Phone: (734) 996-5620 Fax: (734) 769-2196 e-Mail: deblabelle@aol.com

Attorney Bryan Stevenson of the Equal Justice Institute, in video above, argued the Miller case on behalf of the defendant. He has devoted his life to such cases, despite the fact that his own grandfather was killed during a robbery by a group of teens.