VOD NEEDS DONATIONS NOW–LINKS IN STORIES

VOD WELCOMES NEW SUBMISSIONS!

If you want to be published on VOD, please submit your articles, etc. to diane_bukowski@hotmail.com. Call 313-825-6126 to alert us.-

Recent Posts

- 50 YEARS OF MASS INCARCERATION NOW COST U.S., STATES, PRISONERS & FAMILIES $445 BILLION/YR.

- DEATH OF IMAM JAMIL AL-AMIN/H.RAP BROWN REIGNITES DEMANDS FOR JUSTICE, RECOGNITION OF HIS HEROIC LIFE

- SENTINEL REPORT: KYM WORTHY, CIU’s, DPD, SADO LEAVE MASSES OF WRONGLY CONVICTED TO ROT AND DIE IN MDOC

- FREE WRONGLY CONVICTED LIFER DAVID MCKINNEY, CHARGE INKSTER COPS ANTHONY DELGRECO, OTHERS

- LET OUR BROTHERS GO! RICKY RIMMER, GREGORY ALLEN, DESHON STOKES! SAT. OCT. 11 @12 NOON MLK JR. HIGH

- WRONGLY CONVICTED, MICHEAL ‘MIKE D’ DEGRAFFINRIED FREED AFTER 26 YRS; NEW TRIAL HEARINGS OCT. 9, NOV. 11

- COUNCIL CANDIDATE JAMES HARRIS’ S.T.R.E.S.S. COP, DRUG DEALER DAD BUSTED BY FEDS; SPENT 20 YRS. IN PRISON

- WOMEN AT HURON VALLEY PRISON WIN FED. COURT RULING BLASTING HORRIFIC CONDITIONS, DENYING MDOC IMMUNITY

- FREE RICKY RIMMER! DETROIT MAYORAL CANDIDATE ATTY. TODD PERKINS MEETS WITH RR’S SUPPORTERS JUNE 8

- DONATE TO VOD BEFORE JUNETEENTH! KEEP STORIES OF CONVICTIONS BY CROOKED COPS, PROSECUTORS ON-LINE

- CEDRIC TOOKS HOME AFTER 47 YRS, RESENTENCED AS 18-YR. OLD JUVENILE, LEADS WAY FOR HUNDREDS MORE

- MICH. SUPREME COURT ORDERS RESENTENCINGS FOR LIFERS AGED 18, 19, 20, AFFECTING AT LEAST 830 IN MDOC

- WE REMEMBER AFENI SHAKUR JAN. 10, 1947 – MAY 2, 2016; “BLACK PANTHER PARTY HISTORY IS WOMEN’S HISTORY”

- PROF. PENNY GODBOLDO, DR. MARGARET BETTS SPONSOR “MEDITATION MOVEMENT & MEDICINE” SAT. MAR. 29 10A-2P

- MICH. SUPREME COURT TO RULE RE: LIFERS CONVICTED UNDER 21, OTHERS CHARGED WITH FELONY MURDER

- DUGGAN’S DECADES-LONG DETROIT DEMOLITION DERBY

- ATTEND FRIENDS OF RETURNING CITIZENS (F.O.R.C.) SUPPORT GROUP MEETINGS TUESDAYS 6 – 7:30 PM

- EXONEREE THELONIOUS SEARCY PACKS COURT; JUDGE DELAYS RE-TRIAL, DENIES TETHER REMOVAL PER NESSEL

- FREE DOUBLE R IN 2025! DETROIT PROTESTS FOR RICKY RIMMER FORCED ACTION, CASE GOING TO APPEALS COURT

- CHARGES DISMISSED VS. DEMETRIS ‘MEECH’ KNUCKLES EL, COUSIN JAN. 16, 2025; TONS OF SUPPORTERS SHOWED

- FIGHT THE POWER! JOIN THELONIOUS ‘SHAWN’ SEARCY IN COURT FRI. JAN. 10 VS. ‘INNOCENCE DENIER’ KYM WORTHY

- DONATE TO VOD IN 2025! HELP EXPOSE CRIMES OF COPS, PROSECUTORS, JUDGES WHO FRAMED 1,000’S IN MDOC

- GAYELON SPENCER, JR. FIGHTS MURDER 2 CONVICTION: COPS DESTROYED EVIDENCE, BIASED MEDIA COVERAGE

- WILLIE MERRIWEATHER MEMORIAL SAT. DECEMBER 14, 4PM: HERO WHO GAVE HIS LIFE TO SAVE OTHERS FROM PRISON

- DIRTY DETROIT COPS BEAT, MADE UP CONFESSIONS FROM ALTON HUBBARD, BROTHER IDOLTHUS, IN 2004 MURDERS

Monthly Archives

Links

- Al Jazeera news

- All of Us Or None, prisoners and former prisoners

- All-African People's Revolutionary Party

- American Tribune, the prison experience

- Black Agenda Report

- Black is Back Coalition

- Black List

- Block Report Radio

- Color Lines

- DBA Press

- Defend Freedom of the Press

- Detroit Parents with Special Ed Students

- Free Mumia Abu Jamal

- Free Mumia Abu Jamal news

- Gray Zone

- Hood Research

- Jamahiriya News Agency–Free Libya

- Kenny Snodgrass: You Tube

- Labor Notes

- Libya 360

- Mac Speaking: Leona McElvene YouTube site

- Maryanne Godboldo

- MI Emergency Ctte. v War & Injustice

- Michigan Welfare Rights Organization

- Monthly Review Online

- Nadir's Detroit music scene

- Photography is Not a Crime

- Press TV world news

- Prison Legal News

- Project B.A.I.T.

- Real News Network

- Russia Today

- San Francisco Bay View newspaper

- SCG News: World News, Politics and Analysis

- THE GRAYZONE

- We the People of Detroit

- Wikileaks

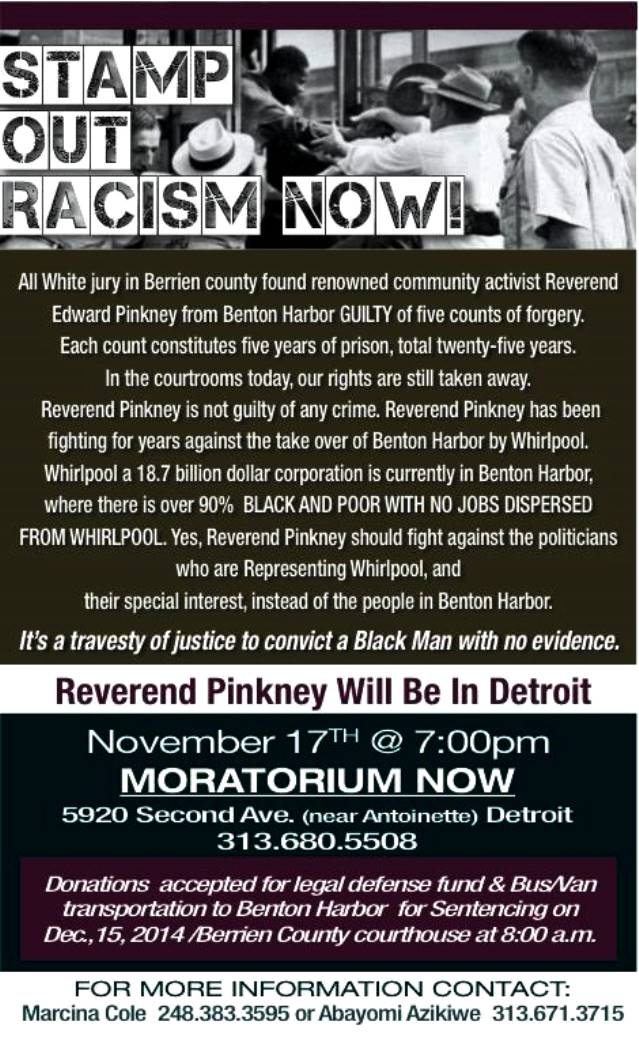

REV. EDWARD PINKNEY IN DETROIT MON. NOV. 17 @ 7PM; FACES LIFE IN PRISON ON CONVICTIONS WITH NO EVIDENCE

Posted in Uncategorized

Leave a comment

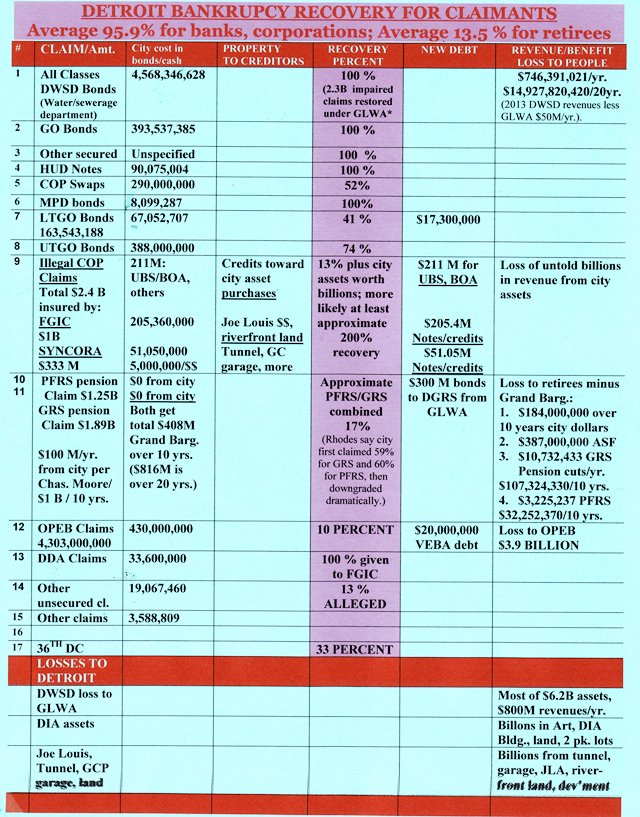

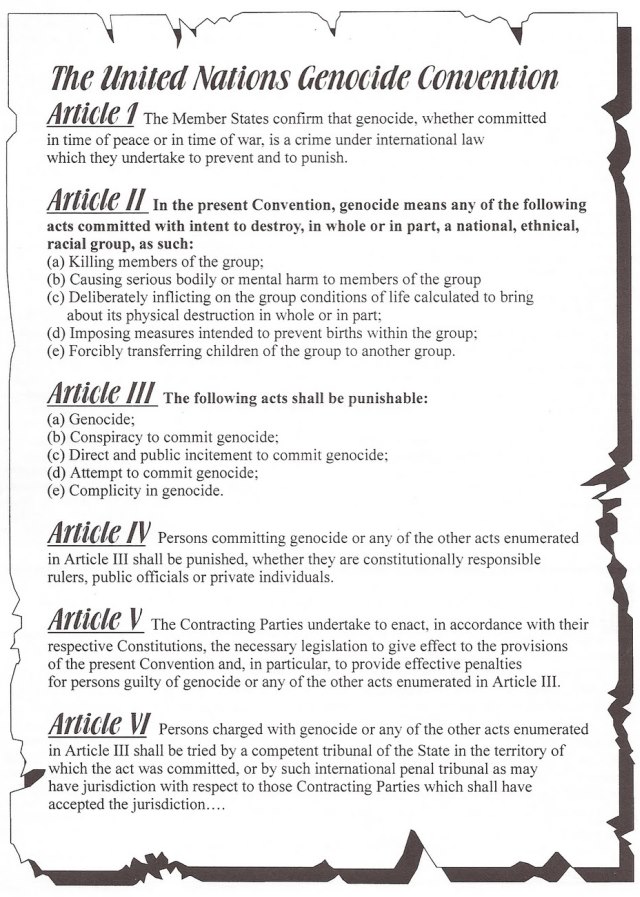

DETROIT BANKRUPTCY PLAN: GENOCIDE IN USA’S LARGEST BLACK-MAJORITY CITY; RICH GET 95.9%, POOR GET 13.5%

Objector James Cole called it another Greenwood massacre

Banks, corporations recover 95.9%; Detroit retirees get 13.5%

City carved up for corporate profit as water shut off to 31,300 households

By Diane Bukowski

November 13, 2014

DETROIT – U.S. Bankruptcy Judge Steven W. Rhodes confirmed Detroit’s “Eighth Amended Plan of Adjustment” Nov. 7, as Michigan Gov. Rick Snyder, Detroit “Mayor” Mike Duggan, and Emergency Manager Kevyn Orr, along with the vast majority of the mainstream media, celebrated unabashedly. See his order at Oral_Opinion_on_Detroit_Plan_Confirmation.

Michigan Gov. Rick Snyder and Detroit Mayor Mike Duggan celebrate bankruptcy plan confirmation Nov. 7, 2014.

Thus the largest Black-majority city in the U.S. has fallen victim to the largest Chapter 9 bankruptcy filing in the country’s history. Despite proponents’ statements that the plan represents a “rebirth of Detroit,” it actually constitutes genocide as defined by the United Nations. It will dismember the city, steal its assets on a grand, unprecedented scale, and impoverish its 82 percent Black population even further, inflicting “conditions of life calculated to bring about its physical destruction in whole or in part.”

Bankruptcy objector James Cole and several dozen others said in an earlier motion that Rhodes supported “parties/agents/carpetbaggers (the financial 1% leaders) that pursue a fast-track policy of plundering and pilfering the assets of Detroit’s Indigenous Citizenry under the bankruptcy fallacy and fiction.”

He compared the plan to the horrific, racist burning and looting of Greenwood in 1921, a prosperous community in Tulsa, Oklahoma known as “The Black Wall Street.” Three hundred Black residents of Greenwood were murdered during the assault.

A recent report from the independent Municipal Market Advisors, cited in The Bond Buyer, says the plan is likely built on sand.

“After privatizing or selling several of its assets, ‘Detroit has – in our opinion – set itself up to leave bankruptcy not only with a reduced debt load but with little financial and operational flexibility for the future,” [MMA] wrote. “We think that it is more than ‘feasible’ that the city finds itself facing fiscal difficulties over the next five years. In effect, Detroit may wind up, on its first day of out of bankruptcy, as one of the most likely candidates for Chapter 9 in the state of Michigan.”

MMA cited Detroit’s deliberately devastated public school system as a major detriment to new residency and investment in the city.

MMA also said that Rhodes’ “expert witness” Martha Kopacz, hired to review the feasibility of the plan, while affirming it, raised red flags. “The feasibility described to the court is fragile at best,” MMA said. “And, it is important to remember that the target is to provide just adequate basic services: hardly an effective marketing spin.”

This is not Detroit in 1967; it is the Black Wall Street in the Greenwood neighborhood of Tulsa, Oklahoma in 1921, consumed by flames set by KKK members and other whites. Three hundred Black residents died, thousands of homes and business were forever destroyed.

VOD looked at the ACTUAL recovery amounts for all Detroit creditors, not the phony reports from the mainstream media that focus only on “unsecured” creditors. They claim Detroit shed $7 billion out of $18 billion in debt under the Plan of Adjustment, with city retirees faring better than corporate creditors. VOD’s analysis shows that, including vast amounts of property and revenue ceded to the corporations, corporate creditors recovered 95.9 percent of their city debt. Retirees recover only 13.5 percent, combining a 17 percent pension/annuity recovery rate with a 10 percent OPEB (health benefits) rate.

Figures in the chart below include secured debt. They are from various sources including Rhodes’ opinion, retirement system annual statements, and the Plan of Adjustment. Some figures are approximate, such as the value of city assets handed over to corporations.

Gov. Snyder lauded the settlement, will may bring about the end of Detroit.

“People will long remember that when Detroit arrived at this troubling hour, its residents and leaders – with supporters statewide – started to pull together as one,” he said in a statement. “Our state has rallied around its largest and iconic city. It is no longer Detroit vs. Michigan, but the embracing of Detroit, Michigan.”

Meanwhile, Orr stuck his foot in his mouth, confirming opponents’ observations about the origins of the bankruptcy. Perhaps he was rushing to get out of Dodge back to Washington, D.C.

“What happened here in Detroit was a combination of leadership from the governor’s office — people forget that this process began in 2010 and 2011 and its culminating now, leadership from the legislature, tolerance and leadership from city officials, and the different set of rules and laws that applied in this case, as well as from the foundations and the DIA founders who brought in a significant sum of money to address those concerns,” he said at the press conference announcing the confirmation.

Thus, he said, the Detroit case does not set a precedent for other cities.

Jones Day partner Bruce Bennett roundly contradicted him in a Bond Buyer interview.

“[Rhodes] opinion not only proves and endorses the plan of adjustment, it also approves and endorses the city’s approach to the Chapter 9 case,” Bennett said. “The eligibility opinion and the opinion of the judgment are going to stand as important precedents in municipal bankruptcy law for a really long time.”

Of course, many Detroiters have known for a long time that Orr has been only a Black face for the bankruptcy. In an earlier email, JD partner Corrinne Ball condescendingly told him, “Kevyn- there are diversity related issues, you have to be the star on this stuff and be able to discuss what we can provide.”

Bankruptcy is racist assault on Detroit under slavemaster PA 436

By the “different set of rules and laws that applied in this case,” Orr referred to Michigan Public Act 436, which put him in office as EM with virtually unlimited powers.

The act has disenfranchised not only Detroiters, but over half the African-American population of Michigan. Rhodes barred objectors from challenging the constitutionality of PA 436 in higher courts. U.S. Attorney General Eric Holder and President Barack Obama ignored requests to investigate its predecessor act PA 4 as a violation of the Voting Rights Act.

No other city currently pursuing Chapter 9 is thus afflicted.

Events in 2010 and 2011 referred to by Orr included the publication of a Jones Day white paper entitled, “Pensions and Chapter 9: Can Municipalities Use Bankruptcy to Solve Their Pension Woes?” which laid out the plan of action that has governed Detroit’s bankruptcy proceedings. The parties including various law firms also conspired to ensure that the Emergency Manager act would remain on the books despite a state-wide popular repeal of PA 4.

In 2011, Ernst & Young held a secret meeting with the Detroit City Council claiming the city was going to run out of cash by June, 2012, which it did not. Ernst & Young were the auditors for the Lehman Brothers, whose collapse precipitated the global economic crash of 2008. The states of New York and New Jersey sued E&Y for their losses. E&Y’s Gustav Mulhatra was a major witness in bankruptcy proceedings, despite not being qualified as an “expert witness.”

In 2011, Ernst & Young held a secret meeting with the Detroit City Council claiming the city was going to run out of cash by June, 2012, which it did not. Ernst & Young were the auditors for the Lehman Brothers, whose collapse precipitated the global economic crash of 2008. The states of New York and New Jersey sued E&Y for their losses. E&Y’s Gustav Mulhatra was a major witness in bankruptcy proceedings, despite not being qualified as an “expert witness.”

Law firms originally hired by the state in 2011, including Jones Day and Miller Buckfire, were later brought on board by the city, under terms of the treacherous 2012 “Consent Agreement” with the state, to carry out the plan conceived earlier.

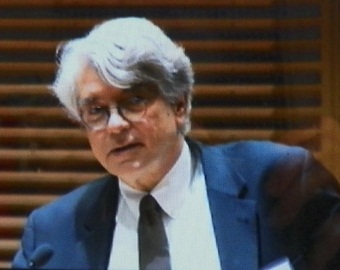

On Oct. 10, 2012, Judge Rhodes chaired a one-sided forum on Chapter 9 and Emergency Managers which consisted of key players in the Detroit bankruptcy. They included a co-author of the original EM law, PA 4, two EM trainers, and Charles Moore of Conway McKenzie, a major non-expert witness at the bankruptcy trial. Rhodes denied requests to recuse himself for this blatant conflict of interest.

Judge Rhodes at Oct. 10, 2012 EM/CH9 forum with (l to r) Frederick Headen of State Treasury, who has helped take over dozens of cities, Edward Plawecki, EM trainers Douglas Bernstein and Judy O’Neill, also a co-author of PA4, predecessor to PA 436, and Charles Moore of Conway McKenzie, chief witness for Jones Day at bankruptcy proceedings.

RHODES’ RULING: SIMPLE-MINDED, ERRONEOUS, RACIST

Rhodes is at the lowest end of the pecking order of federal judges. Above him are the U.S. District Court, the Federal Court of Appeals, and the U.S. Supreme Court. With the help of the mainstream media and betrayals by retirement system and union officials of their memberships, Rhodes kept constitutional appeals by city workers and residents out of those courts during the pendency of the bankruptcy.

His only previous experience handling a Chapter 9 bankruptcy was that of the tiny Addison Community Hospital Authority in Lenawee County, Michigan in 1992. Addison has a population of only 605 according to the 2010 U.S. Census.

These factors help explain the stunning simple-mindedness, subtle racism, and outright errors exhibited in his oral ruling as committed to writing.

In that ruling, Rhodes says the “major issues relating to confirmation” are “good faith, best interests of creditors, professional fees, unfair discrimination, fair and equitable, and the treatment of constitutional claims against the city.”

He left out at least one key issue contained in “11 U.S. CODE § 109 – WHO MAY BE A DEBTOR,” a basic requirement that the municipality be insolvent.

DETROIT INSOLVENCY: $132.6 MILLION

In his Nov. 2013 report on Detroit’s bankruptcy, Demos Senior Fellow Wallace Turbeville, a former Wall Street banker not allowed to testify in court, said,

“Detroit’s emergency manager, Kevyn Orr, asserts that the city is bankrupt because it has $18 billion in long-term debt. However, that figure is irrelevant to analysis of Detroit’s insolvency and bankruptcy filing, highly inflated and, in large part, simply inaccurate. In reality, the city needs to address its cash flow shortfall, which the emergency manager pegs at only $198 million, although that number too may be inflated because it is based on extraordinarily aggressive assumptions of the contributions the city needs to make to its pension funds.”

The full Demos Report is at Demos Detroit bankruptcy report highlighted.

The city’s 2013 Comprehensive Annual Financial Statement says, “The City of Detroit was insolvent on June 30, 2013 as the General Fund liabilities exceeded its assets by $73.0 million and cash and investments on hand totaling $102.2 million were insufficient to meet obligations then due. The City’s accumulated unassigned General Fund deficit was $132.6 million on June 30, 2013.”

So it was really $132.6 million? That was the sum total of Detroit’s alleged insolvency?

STATE OWES DETROIT AT LEAST $1.5 BILLION

Former Councilwoman JoAnn Watson speaks as groups take lawsuit for a referendum on PA 4 to the Court of Appeals.

At a hearing before Rhodes Oct. 15, former Detroit City Councilwoman JoAnn Watson declared, “The state has a conflict of interest because it is a debtor to the city.” She then went on to explain that Michigan owes Detroit at least $1.5 billion.

She cited the State’s deliberate refusal to pay Detroit over $224 million in agreed-upon revenue-sharing, the attendant loss of $600 million in non-resident income taxes, as well as the State’s cutting of $732 million in revenue-sharing to the city over the previous 10 years, cited in a report from the Michigan Municipal League.

Add to that the billions in tax abatements the City of Detroit has granted over the years to the various corporations which are feeding like pigs from the bankruptcy trough, and the billions of dollars lost in property and income taxes due to the massive and illegal foreclosure devastation of Detroit’s neighborhoods by those same banks and corporations.

So to avoid bankruptcy, all the state really had to do was cough up $198 million of what it and the corporations OWED the 82 percent Black population of Detroit.

Detroit Mayor Duggan (l) and others celebrate as Gov. Snyder signs “Grand Bargain,” a/k/a “Grand Theft”

THE GRAND BARGAIN: PENSION PLANS LOSE HALF-BILLION DOLLARS FROM CITY OVER 10 YEARS PLUS CUTS TO WORKERS, RETIREES

“The cornerstone of the plan is the grand bargain,” Rhodes says in his ruling, citing traitorous settlements by the Official Committee of Retirees, the General Retirement System, the Police and Fire Retirement System, AFSCME Council 25, the UAW, and various retirees’ associations.

“The settlements represented in the Grand Bargain are the pension settlement, the state contribution agreement, and the DIA settlement,” Rhodes says. “The plan of adjustment reflects the Grand Bargain in its treatment of class 10, which consists of the PFRS claims, and class 11, which consists of the GRS claims. The State of Michigan, a number of charitable foundations, the Detroit Institute of Arts and a number of individuals will contribute to the City’s two pension plans a total value of $816 million over 20 years.?”

Broken down, the pension funds will get contributions from the state of $195 million over 20 years, 13 percent of what Michigan owes Detroit. The DIA will contribute $100 million over 20 years, while the city loses title to billions pf dollars worth of art, which will be transferred to a bank trust, as well as the DIA building, its land, and revenues from two parking lots there. Private foundations will contribute $366 million over 20 years, no doubt using them as tax write-offs if they are not already tax-exempt non-profits.

Charles Moore, another chief “non-expert” pro-bankruptcy witness who is an accountant for Conway McKenzie, estimated the city averaged around $100 million a year in contributions to the two retirement systems, which will be eliminated until at least 2023. So that’s $1 billion. Since the Grand Bargain covers 20 years, half of it is $408 million over 10 years. That’s a LOSS in city contributions to the retirement systems of $592,000,000, over a half-billion dollars over the next 10 years.

But that’s not the end of the devastation wrought on city workers and retirees.

PENSION, ANNUITY SAVINGS, HEALTH CARE CUTS

The mainstream media is reporting that Wall Street bondholders are angry because they are allegedly being treated worse than retirees in the bankruptcy plan.

The Bond Buyer reported, “The case did not set legal precedent because the city reached settlements with all of its major creditors. But for muni bond investors, key lessons will be the city’s successful move – supported by the state of Michigan and driven largely by political considerations – to elevate pension debt over bond debt.”

Rhodes says, “The settlement will net approximately $190 million for the GRS, which is about 49% of the City’s calculation of its claim here.” Earlier, he said the GRS allowed claim totaled $1.879 BILLION. Didn’t he learn simple math in school? That amounts to 10 PERCENT of the GRS claim.

Later, he proclaims, “The City’s disclosure statement, which the Court approved, stated that the recoveries are 59% for PFRS and 60% for GRS. Based on a number of complex arguments, the City now asserts that the true recovery percentages are much lower and that there is no discrimination in favor of the pension class 10 and 11. . . .The Court concludes that even if the pension classes’ recoveries are what the disclosure statement declares, the resulting discrimination against the unsecured and convenience classes is not unfair.”

Protest recalls Memphis sanitation workers’ strike of 1968, which Dr. Martin Luther King Jr. supported, and was gunned down in the midst of it.

What about discrimination against the city’s majority-Black workers, retirees and residents?

The media says General Retirement System retirees will lose “only” 4.5 percent of their monthly pension checks. In fact, losses to retirees amount to far more. The total average loss of COLA to each GRS retiree amounts to $33,500. The hotly debated savaging of retirees’ annuity savings plans will result in an average loss of $27,000 plus 6.75 percent annual interest, to retirees who generally get only $19,000 a year in pension pay-outs. Rhodes says later the city expects to recoup $387 million from the ASF cuts alone. He says pension and ASF cuts will be capped at “only” 20 percent.

The late world renowned Detroit activist General Baker campaigned against VEBA’s in the auto plants.

Police and Fire Retirees, manipulated for use against non-uniformed workers, were rewarded with NO loss in their pension checks, but still a 45 percent loss in COLA.

This does not factor in cuts in health care for workers and retirees under the age of 65, expected to save the city $3.9 billion. Current retiree health plans will be replaced by “Voluntary Employee Benefit Associations” (VEBA’s), bank trusts with state-appointed boards. Language in the plan says the VEBA’s do not guarantee that ANY health care will be provided.

Rhodes says current city workers will have their pension plans frozen and replaced with “new hybrid pension plans” whose provisions are “less generous” than the current plans.

“PENSION REDUCTIONS WILL CAUSE REAL HARDSHIP. . .IN SOME CASES SEVERE” — Rhodes

In 2004, the City of Detroit had 13,486 employees. Ten years later, according to its Human Resources Department, it has only a little over 9,000 workers. Add to that the loss of thousands of health, workforce development, human services, sanitation, recreation and public lighting department workers to privatization, along with DWSD workers to the regional Great Lakes Water Authority. Clearly the retirement systems’ income from these members will diminish accordingly over the years.

Whether the systems will survive at all is open to question. ALL Detroit retirees may eventually find themselves depending solely on their Social Security checks.

Additionally, what becomes of thousands of decent jobs with union wages and benefits for the city’s increasingly unemployed population, especially the youth?

“PFRS and GRS will each have an investment committee that will make recommendations to, and in certain situations approve the actions of, their boards of trustees,” Rhodes says. These “investment committees,” largely appointed by the state, will thus decide which state business cronies get billions.

City retiree Ezza Brandon participates in protest outside Michigan AFSCME HQ after her union agreed not to appeal bankruptcy plan to Sixth Circuit Court.

Regarding appeals to the Sixth Circuit Court by unions and retiree organizations, Rhodes throws out a ball park figure, not based on any cited calculations, that they will have a 25 percent chance of success.

Not to worry, though. Those groups already told the Sixth Circuit the appeals would be withdrawn if the Grand Bargain and the Plan of Adjustment go through, and that they will not oppose PA 436 or bring up the State Constitution’s protection of public pensions under Art. 9 Sec. 24.

Ironically, PA 436 requires EM’s to adhere to the provisions of Art. 9, Sec. 24, which Rhodes of course does not note in his opinion.

Calling the pension settlement “miraculous,” Rhodes then admits, “At the same time, the Court must acknowledge that these pension reductions will cause real hardship. In some cases, it is severe. This bankruptcy, however, like most, is all about the shared sacrifice that is necessary because the City is insolvent and desperately needs to fix its future.”

COPS, SYNCORA, FGIC CLAIMS: CITY PAYS $472.4 M, BILLIONS IN ASSETS, CANCELS LAWSUIT SAYING CRIMINAL DEAL WAS ‘VOID AB INITIO”

Wall Street at City Council table advocating for disastrous $1.5 B COPS loan Jan. 31, 2005: Joe O’Keefe of Fitch Ratings speaking, Stephen Murphy of Standard and Poor’s to his left; Detroit CFO Sean Werdlow (l), Deputy Mayor Anthony Adams (r). PHOTO: Diane Bukowski

In January, 2013, EM Kevyn Orr filed suit against the parties involved in the infamous $1.5 billion Pension Obligation Certificate (POC), otherwise known as COPS (Certificates of Participation) deals of 2005-o6. He called the deals “void ab initio, illegal and unenforceable.” He cited the fact that paper corporations were created to handle the loans, and that they were a way of circumventing the city’s debt ceiling by not issuing actual bonds, among other issues.

He failed to cite the fact that city voters were deprived of their right to vote on the debt by hiding it as “certificates” instead of bonds, and the unethical involvement of then Detroit CFO Sean Werdlow, who took a top position with SBS, one of the lenders, in Nov. 2005, and is now its COO.

Currently, the city owes $2.8 billion on the COPS claims as they are commonly known, due to defaults, interest and other factors.

The original deal was brokered by Wall Street, whose representatives from Standard and Poor’s and Fitch Ratings came to the City Council table Jan. 31, 2005, threatening to lower the city’s bond ratings if the loan was not approved, which they did anyway at the end of 2005.

The lenders were the global bank UBS AG and SBS Financial, backed by the Bank of America. The loan was insured by Financial Guaranty Insurance Corporation (FGIC), and Syncora.

UBS AG and BOA have been criminally and civilly charged in hundreds of lawsuits around the world for manipulating the LIBOR interest rate to their benefit, and otherwise gouging profits illegally from mortgage loans and other sources. UBS AG paid a $2.5 billion settlement to the U.S. Department of Justice in one lawsuit.

Rhodes claims it is only 13 percent of the original claim. Rhodes LIES.

Settlements with UBS, BOA, FGIC and Syncora totaled $472.4 million in new debt, including the $33 million Downtown Development Authority claim.

But they also included the handover of city revenues from Joe Louis Arena and profits from later redevelopment of surrounding, priceless riverfront land, all city revenues from the Detroit-Windsor Tunnel and the Grand Circus Park parking garage, plus other unspecified claims on city assets. There has been no total computation of the worth of these assets, but they most certainly run into billions of dollars, far more than the outstanding debt.

‘GREAT INVESTMENTS’ IN DETROIT BY FGIC, SYNCORA?

Lawyers and financial advisors celebrate FGIC agreement. Hidden amongst all the whites is EM Kevyn Orr, crouching down in center. He wasn’t even named in Crain’s caption.

State and city leaders have touted the deals as great investments in Detroit. However, FGIC is currently under state oversight in New York City.

“FGIC emerged from rehabilitation on August 19, 2013, and is responsible for administering its outstanding insurance policies in accordance with the terms of the First Amended Plan of Rehabilitation for FGIC, dated June 4, 2013,” according to an FGIC release.

That is why it must get New York state approval for the deal.

Weiss Ratings said it was “on the brink of failure” in 2012.

“As of March 31, 2012, FGIC reported negative capital of $3.7 billion and losses year to date of $146.7 million, after $1.2 billion losses in 2011. It had been rated “Very Weak” by Weiss Ratings since January 2010,” the agency reported.

FGIC filed for Chapter 11 bankruptcy in 2010, citing $391.5 million in debt as compared to $11 million in assets.

Syncora has seen a downturn in its financial position as well. It is currently being monitored by the New York State Department of Financial Services.

A 2012 report from the department said, “Due to the deterioration of the financial condition of the Company, the Department denied the repayment of the entire unpaid principal amount outstanding and all accrued interest on the$150,000,000 short-term surplus note maturing on December 28, 2011.”

Puerto Rican workers have been demonstrating all year against proposed cutbacks to their pensions and jobs, to solve the island’s debt crisis, made in the USA. Their unions have threatened a general strike. Utility unions are calling on customers NOT to pay their bills!

Both FGIC and Syncora are on the hook for billions of dollars in insurance on various forms of debt in Puerto Rico, which is facing the possibility of default, forcing insurers to accumulate larger financial holdings.

The Bond Buyer reported, “Total net par outstanding exposure to Puerto Rico bonds by Assured, MBIA’s National Public Finance Guarantee, Ambac Assurance Corp., Syncora Guarantee and Financial Guarantee Insurance Corp was $15.7 billion by June 30, according to an analysis by the Bond Buyer. The financial guarantors have wrapped a wide spectrum of Puerto Rico debt, from commonwealth general obligations to below investment-grade aqueduct and sewer bonds.

“Puerto Rico is one of the major systemic risks they’re facing,” said Triet Nguyen, managing partner of Axios Advisors LLC. “If it does come down to substantial default, then bond insurance will get hit the same way they’re going to get hit on Detroit. The key is going to be the Puerto Rico economy, at the end of the day, it drives everything else.”

Does Detroit REALLY want these incompetent, greedy companies investing here?

Ironically, other business magazines report that the market for municipal bonds has improved since Detroit’s settlement with FGIC and Syncora. That is clearly because insurers figure that what they can’t get from tax-backed bonds they can steal from the assets of the cities they insure.

No wonder Rhodes rushed into these deals. After all, the stock market demanded it.

BEST INTEREST OF CREDITORS: ART, NOT WATER PRESERVED

Rhodes completely contradicts himself in this section.

“No provision of law allows the creditors to access the DIA art to satisfy their claims,whether in bankruptcy or outside of bankruptcy,” he says, referring to attempts by some creditors to monetize DIA holdings.

Rhodes then lauds in glowing terms the contributions of the DIA.

“The evidence unequivocally establishes that the DIA stands at the center of the City as an invaluable beacon of culture, education for both children and adults, personal journey, creative outlet, family experience, worldwide visitor attraction, civic pride and energy, neighborhood and community cohesion, regional cooperation, social service, and economic development,” he raves.

However, he says later, “Beyond that, the record reflects that the City has made reasonable efforts to monetize other assets, including the Detroit Windsor Tunnel, certain real estate properties, certain parking properties, the Joe Louis arena property and certain other property that it no longer needs. It also entered into the Great Lakes Water Authority memorandum of understanding with Wayne, Oakland and Macomb Counties, which benefits all creditors. The Court finds that the City has made reasonable efforts to monetize its assets to satisfy the best interests of creditors test.”

Wastewater Treatment Plant worker on strike Sept. 30, 2012 in heroic, last-ditch effort to SAVE DETROIT>

Thus, Rhodes says, it is all right to monetize and give away an asset like the $6 billion Detroit Water and Sewerage Department, which provides the most essential element of life aside from air to its customers—water.

This comes as no surprise, since he earlier ruled that there is no obligation under the State constitution to provide sanitary water at affordable prices to Michigan residents. He was responding to a lawsuit filed on behalf of tens of thousands of Detroiters, including seniors, children and disabled people, objecting to Detroit’s massive shut-off of water to their homes.

Remember part of the UN definition of genocide: “Causing serious bodily or mental harm to members of the group; deliberately inflicting on the group conditions of life calculated to bring about its physical destruction in whole or in part.”

UNFAIR DISCRIMINATION – “A MATTER OF CONSCIENCE” NOT LAW

Rhodes now declares, “In connection with this final step, the Court must determine the meaning of the phrase unfair discrimination in section 1129(b). The Court concludes that fairness and unfairness are matters of conscience and that determining fairness is a matter of relying upon the judgment of conscience.”

The 14th Amendment should protect the people of Detroit against unequal treatment; Rhodes thinks its up to his conscience, a sure sign of racist beliefs.

He proceeds to claim that the plan FAIRLY discriminates IN FAVOR OF PENSIONERS.

Of course, as can be seen from the chart above, that is not the case. Corporations get a 95.9 percent recovery, while pensioners get 13.5 percent.

As far as unfair discrimination being a matter of conscience, Rhodes, although he is a Federal judge, has apparently forgotten numerous Federal LAWS including among many, the Civil Rights Act of 1964, the Voting Rights Act, the 14th Amendment to the United States Constitution, the Equal Employment Opportunity Act, Age Discrimination Acts, Americans with Disabilities Act, Equal Pay Act, Family and Medical Leave Act, and the Homeless Bill of Rights.

These laws were not passed to protect the corporations and banks of this country, as Rhodes seems to aver. Many have been cited in lawsuits challenging the constitutionality of PA 436. Most glaring, of course, are the Detroit bankruptcy filing’s violations of the Civil and Voting Rights acts, and the 14th Amendment.

These laws were not passed to protect the corporations and banks of this country, as Rhodes seems to aver. Many have been cited in lawsuits challenging the constitutionality of PA 436. Most glaring, of course, are the Detroit bankruptcy filing’s violations of the Civil and Voting Rights acts, and the 14th Amendment.

This bankruptcy filing was brought down under a dictatorship, without the consent of Detroiters or their elected officials.

It GROSSLY violates the 14th Amendment.

“The 14th Amendment to the Constitution ratified on July 9, 1868, granted citizenship to ‘all persons born or naturalized in the United States,’ which included former slaves recently freed. In addition, it forbids states from denying any person “life, liberty or property, without due process of law” or to “deny to any person within its jurisdiction the equal protection of the laws.” By directly mentioning the role of the states, the 14th Amendment greatly expanded the protection of civil rights to all Americans and is cited in more litigation than any other amendment,” says a Library of Congress web guide.

The City of Detroit is the largest and poorest Black majority city in the U.S. It was deliberately targeted by Jones Day, which represents most of the major banks and corporations in the U.S., and by Michigan Gov. Rick Snyder and the think tanks behind him, which formulated the emergency manager laws. Those laws have targeted ONLY majority Black cities in Michigan.

The Detroit bankruptcy ruling seeks to turn back the clock to the days of slavery and Jim Crow, with Detroiters subservient to their plantation masters in the country’s white oligarchy. More than that, it seeks to LYNCH the City of Detroit, to commit genocide against its majority residents, by “Causing serious bodily or mental harm to members of the group and deliberately inflicting on the group conditions of life calculated to bring about its physical destruction in whole or in part.”

The Detroit bankruptcy ruling seeks to turn back the clock to the days of slavery and Jim Crow, with Detroiters subservient to their plantation masters in the country’s white oligarchy. More than that, it seeks to LYNCH the City of Detroit, to commit genocide against its majority residents, by “Causing serious bodily or mental harm to members of the group and deliberately inflicting on the group conditions of life calculated to bring about its physical destruction in whole or in part.”

Other parts of the UN definition of genocide are being carried out against the majority population of Detroit by other arms of the state. They include the disproportionate kidnapping of Black and poor children by Child Protective Services, the unbridled police murders and incarcerations of Blacks from Detroit and across Michigan and the U.S., and finally Detroit’s skyrocketing infant mortality rate, a direct effect of poverty and the destruction of available public health care through privatization of the Detroit Health Department, and the sale of the Detroit Medical Center to Wall Street hedge funds for profit.

What does a people do when faced with genocide? Organize an army, construct barricades to stop the water shut-off trucks, take over essential city services, take back DWSD and Belle Isle by any means necessary. Preserve the future for the children and grandchildren of the City of Detroit. THIS IS A GENUINE AND IMMEDIATE MATTER OF LIFE OR DEATH.

The video above is of a press conference held by the Detroit Retired and Active Employees Association. They can be contacted c/o Bill Davis at 313-622-6430. Other organizations active in the ongoing fight against the Detroit bankruptcy plan of genocide are Detroiters Resisting Emergency Management, at http://www.d-rem.org/, the Stop of Theft of Our Pensions Committee at 313-680-5508, and many more.

There are no related VOD stories posted here because they are too numerous. Just put “bankruptcy” or “emergency manager” or “consent agreement” in the search engine to bring up complete VOD coverage of the Detroit takeover over the past several years.

Posted in Uncategorized

1 Comment

DETROIT ACTIVISTS VOW TO FIGHT “ILLEGAL, UNCONSTITUTIONAL” BANKRUPTCY PLAN

By Sarah Cwiek

MICHIGAN RADIO

Having secured court approval for its bankruptcy restructuring last week, Detroit is now ready to emerge from bankruptcy.

But some Detroit residents and activists say that plan sacrificed both democracy and the public interest.

The group Detroiters Resisting Emergency Management says the bankruptcy process was about imposing financial solutions on social and political problems.

And they believe the newly-approved “plan of adjustment” won’t benefit the vast majority of Detroiters.

Reverend Bill Wylie-Kellerman of St. Peter’s Episcopal Church called Detroit a “testing ground” for “corporate urban fascism, and compared the city’s restructuring to the plight of debt-ridden developing countries forced to adopt austerity measures and other market-based reforms.

“If Detroit were a country in the global South under the debt burden of the International Monetary Fund and the World Bank, what’s happened in this bankruptcy would be called structural adjustment,” Wylie-Kellerman said.

A group of Detroit retirees also announced it will appeal last week’s ruling approving the plan of adjustment.

Retiree William Davis said that of the roughly $7 billion in debt Detroit shed in bankruptcy, a disproportionate amount–$4-5 billion—comes from pensions and other retiree benefits.

Davis said the retirees will pursue an appeal, whatever the cost. “I worked 34 years at the wastewater treatment plant, started out with a shovel, and I was shoveling something. And what I was shoveling smells better than this deal,” he said.

For further info: Detroiters Resisting Emergency Management http://www.d-rem.org/

Detroit Active and Retired Employees Association: text 313-820-6934

Related stories:

Posted in Uncategorized

Leave a comment

MISSOURI GOV. VOWS MILITARY CRACKDOWN AFTER MICHAEL BROWN GRAND JURY DECISION, EXPECTED SOON

Missouri gov. vows to stop any violence after Ferguson decision

Michael Brown’s parents meet with United Nations

Killer cop Darren Wilson testifies for four hours before grand jury

Protesters training in “direct action” tactics

Pathologist says St. Louis Post-Dispatch misquoted her on Brown autopsy: she did not say Brown “going for gun” or hands not up

WELDON SPRINGS, Mo., Nov 11 (Reuters) – Missouri Governor Jay Nixon said on Tuesday the National Guard would be on standby to respond to any violence after a grand jury decides whether or not to indict a white police officer for shooting dead an unarmed black teenager (Michael Brown) in Ferguson.

In addition to the National Guard, police officers from across the state could be called on to restore order if protests get out of hand, Nixon told a news conference.

A decision by the grand jury is expected in mid-to-late November.

The August shooting of Michael Brown, 18, by Darren Wilson sparked a national debate on race relations and led to weeks of street demonstrations. Some groups have threatened extensive protests if the officer is not charged with a crime.

“That ugliness was not representative of Missouri and it cannot be repeated,” Nixon said.

“These measures are not being taken because we are convinced that violence will occur, but because we have a responsibility to prepare for any contingency,” he said.

Nixon said 1,000 police officers had undergone more than 5,000 hours of specialized training ahead of the grand jury decision.

Some businesses in Ferguson have boarded up windows and made plans for protecting themselves and their property if protests ignite into violence.

State and local police, who were decked out in riot gear and fired rubber bullets into crowds during demonstrations after the shooting, have come under criticism for what many saw as a heavy-handed response that made a volatile situation worse.

Police have said they came under attack by some protesters who wielded weapons and gasoline bombs.

The American Civil Liberties Union and National Lawyers Guild said they plan to deploy observers to the scene after the grand jury decision to make sure police are not violating civil liberties.

The Ferguson-Florissant School District, which had to delay the start of the school year due to protests in August, has reviewed contingency plans in case there are serious protests and schools have to dismiss students early for safety reasons.

Rumors of an impending decision on the indictment have flooded social media for days, prompting St. Louis County Prosecuting Attorney Robert McCulloch on Monday to reiterate his expectation that the grand jury would not make a decision until mid-to-late November.

Mike Brown’s Parents Testify before UN

(The video earlier posted here was likely censored from the originator’s website; as was the video below from a separate website on Darren Wilson’s testimony. They are no longer working.)

Brandie Piper, KSDK-TV 5:38 a.m. CST November 12, 2014

Mike Brown’s parents testify before UN about their son’s brutal killing by Ferguson cop Darren Wilson. His mother can be seen at left rear with red hair.

GENEVA – The parents of Ferguson teenager Michael Brown have testified before the United Nations Committee Against Torture. Brown’s parents are urging international human rights experts to help make changes in the United States. Committee members will review their concerns and if they deem it necessary, determine if recommendations need to be made about how matters are being addressed in Ferguson, Missouri.

The UN Committee Against Torture reviews the federal government’s compliance with the Convention Against Torture. The convention against torture is an international human rights treaty that outlines specific guidelines to prevent governments from taking part in any kind of torture, or cruel, inhumane or degrading treatment or punishment.

Mike Brown’s mother, Lesley McSpadden was very emotional during her testimony, telling the committee that she missed her son.

Michael Brown’s parents are urging international human rights experts to help make changes in the United States..

Brown’s mother says she appreciates knowing that people are trying to make positive changes in light of her son’s death.

NewsChannel 5 photojournalist Don Galloway, who is in Geneva, tweeted the testimony occurred shortly before 5 a.m. CST.

“Whatever the grand jury decides in Missouri will not bring Michael back,” Michael Brown Sr. told members of the U.N. “We also understand that what you decide here may save lives. If I could have stood between the officer, his gun, and my son, I would have.”

Forensics expert to testify at Ferguson grand jury

Associated Press

November 12, 2014

Volunteers receive training in direct action tactics in preparation for grand jury verdict. Photo: Scott Olsen, Getty Images

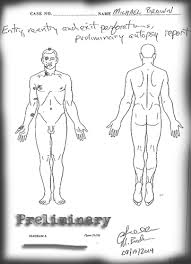

St. Louis — An attorney for Michael Brown’s family says a private forensic pathologist who performed an autopsy on the 18-year-old will testify Thursday before the grand jury deciding whether to charge the Ferguson police officer who shot him.

Attorney Benjamin Crump said Wednesday that former New York City Chief Medical Examiner Dr. Michael Baden is scheduled to testify.

Crump says Brown’s parents are pleased because they are concerned that the St. Louis County Medical Examiner’s office, which also did an autopsy, is too closely tied to police and prosecutors.

Brown was shot by Officer Darren Wilson in the St. Louis suburb on Aug. 9. The grand jury is expected to decide this month whether to charge Wilson.

A third autopsy was performed for the U.S. Justice Department, which is also investigating.

Darren Wilson, Officer Who Shot Michael Brown, Testifies In Front Of Grand Jury: Report

Posted: Updated:

Darren Wilson, the Ferguson police officer who fatally shot unarmed teen Michael Brown last month, testified before a grand jury convened to investigate the shooting on Wednesday, the St. Louis Post-Dispatch reported.The paper cited an unnamed source familiar with the investigation that said the Ferguson Police officer, who has been kept out of the public eye since the Aug. 9 shooting, testified for four hours. The source said that Wilson was “cooperative,” but no further details were released.A spokesman for the prosecution would not comment on which witnesses have testified before the grand jury. Prosecutors will present evidence, and the jury will decide whether to charge Wilson.

St. Louis County Prosecuting Attorney Robert P. McCulloch has ordered an audio recording of the proceedings, in addition to transcripts. If there is no indictment in the case, those records will be made public, McCulloch told the Post-Dispatch on Wednesday.

Protesters gathered peacefully to call for Wilson’s arrest in a demonstration Aug. 13. The crowd included Michael Brown’s parents.

“Is [Darren Wilson] getting peace? Now if he’s getting peace, I could respect him a lot better if he would come to Clayton right now, and turn himself in,” Michael Brown Sr. said Saturday.

Other protesters have disrupted meetings with calls to remove McCulloch, citing concerns about whether McCulloch could fairly oversee the case.

According to the Associated Press.

McCulloch’s father was a police officer killed in the line of duty when McCulloch was a child, and he has many relatives who work in law enforcement.

The AP also points out that McCulloch could have filed charges against Wilson himself, but chose to instead leave the decision up to a grand jury.

Wilson fatally shot Brown Aug. 9, sparking massive protests that garnered national attention.

PATHOLOGIST SAYS POST-DISPATCH ARTICLE GROSSLY MISQUOTED HER ON BROWN AUTOPSY

Did not say Brown “going for gun,” or that hands were not up

Forensic Sound Bites & Half-Truths

From the blog of Dr. Judy Melinek

October 23, 2014

A reporter from the St. Louis Post-Dispatch called me earlier this week, saying she had Michael Brown’s official autopsy report as prepared by the St. Louis County Medical Examiner, and asking me if I would examine and analyze it from the perspective of a forensic pathologist with no official involvement in the Ferguson, Missouri shooting death.

I read the report, and spent half an hour on the phone with the reporter explaining Michael Brown’s autopsy report line-by-line, and I told her not to quote me – but that I would send her quotes she could use in an e mail. The next morning, I found snippets of phrases from our conversation taken out of context in her article in the Post-Dispatch. These inaccurate and misleading quotes were picked up and disseminated by other journals, blogs, and websites.

This is the text of my actual email exchange with Post-Dispatch health and medical news reporter Blythe Bernhard:

“From: “Dr. Judy Melinek”

Date: October 21, 2014 at 5:53:21 PM PDT

To: Blythe Bernhard

Subject: Re: media request

Great talking to you. Here are the quotes:

“The autopsy report shows that there are a minimum of 6 and maximum of 8 gunshot wounds to the body. The graze wound on the right thumb is oriented upwards, indicating that the tip of the thumb is toward the weapon. The hand wound has gunpowder particles on microscopic examination, which suggests that it is a close-range wound. That means that Mr. Brown’s hand would have been close to the barrel of the gun. Given the investigative report which says that the officer’s weapon discharged during a struggle in the officer’s car, this wound to the right thumb likely occurred at that time.

The chest wounds are going front to back, indicating that Mr. Brown was facing the officer when he was shot in the torso, then collapsed or leaned forward exposing the top of his head. You can’t say within reasonable certainty that his hands were up based on the autopsy findings alone. The back to front and upward trajectory of the right forearm wound could occur in multiple orientations and a trajectory reconstruction would need to be done using the witness statements, casings, height of the weapon and other evidence from the scene, which have yet to be released. The tissue fragment on the exterior of the officer’s vehicle appears to be skin tissue, but only DNA analysis would confirm if it is from Mr. Brown or the officer. It is ‘lightly pigmented’ but even African-American skin can appear lightly pigmented on a small microscopic section, depending on what part of the body it came from.”

This is how I was quoted in the Post-Dispatch the next day:

Dr. Judy Melinek, a forensic pathologist in San Francisco, said the autopsy “supports the fact that this guy is reaching for the gun, if he has gunpowder particulate material in the wound.” She added, “If he has his hand near the gun when it goes off, he’s going for the officer’s gun.” Sources told the Post-Dispatch that Brown’s blood had been found on Wilson’s gun. Melinek also said the autopsy did not support witnesses who have claimed Brown was shot while running away from Wilson, or with his hands up.

Notice the difference? There’s a big difference between “The hand wound has gunpowder particles on microscopic examination, which suggests that it is a close-range wound. That means that Mr. Brown’s hand would have been close to the barrel of the gun” and “he’s going for the gun.”

I was very fortunate to have the opportunity to correct this, in my own words last night, when Lawrence O’Donnell invited me to appear as a guest on MSNBC. Mr. O’Donnell allowed me to explain the autopsy findings clearly and in context—if not in full. The show is called “The Last Word,” and Lawrence O’Donnell makes sure he gets it. Despite the guest-badgering and interruptions that are a signature of his television persona, however, Mr. O’Donnell did allow me to correct the record that the St. Louis Post-Dispatch created. I am even more grateful to Trymaine Lee, whose companion article to last night’s Last Word segment (linked above) serves as an excellent corrective to the Post-Dispatch article.

Posted in Uncategorized

Leave a comment

ZOMBIE DEMS VS ZOMBIE REPUBS: ZOMBIE CONSENSUS WINS AGAIN

Midterm Madness! Zombie Dems VS Zombie Repubs, Zombie Consensus Wins Again!

by BAR managing editor Bruce A. Dixon

Nov. 5, 2014

“Democratic zombie theatrics are quite a lot like Republican zombie theatrics.”

The day after the 2014 midterm elections it’s pretty clear that political control of the United States, its economy, its mass media and its politics are firmly in the hands of its wealthy, deeply entrenched elite of wealthy individuals and corporations. America’s elite are transpartisan, influenced very little or not at all by the needs, the wants, the desires of what Occupy used to call the 99% of the American people.

Even where Democrats won, it wasn’t good news for ordinary people. Pension-cutter Democrats, school privatization Democrats, mass incarceration Democrats, tax-the-poor and coddle-the-rich Democrats retained governorships in places like New York, Illinois, California and Colorado, not that the wise, just and efficient US electoral system offered much of a choice either way.

Democratic zombie theatrics are quite a lot like Republican zombie theatrics. Republican House leaders brought up and passed anti-Obamacare bills more than 40 times in the last 2 congresses, knowing full well these went no further than their own doors and press releases. Similarly while Barack Obama campaigned in 2007-2008 promising to raise the minimum wage, and swept into office with majorities in both houses of Congress, Democratic leaders in the US Senate waited till this summer, almost 4 years after they’d lost the majority, to pretend to bring it to the floor, where it predictably lost. So Republican zombies can pretend to campaign against Obamacare, and Democratic zombies can pretend to campaign for the minimum wage.

That’s an example of the system working. Under the good-cop-bad-cop rules of US partisan conduct, Democrats must pretend to be a party of minorities and the working people every couple years during election season. But the act is getting old, fooling fewer and fewer people.

Black voters turned out in substantial numbers yesterday, despite the fact that they’d been promised nothing and received a bit less than that. But their numbers were not as high as in presidential years. Latino voters did the same, despite the fact that they’d been explicitly promised a road to citizenship and received a massive wave of family and community-shattering deportations instead.

By not championing any breakthrough legislation or popular mobilizing initiative, the First Black President gave white Democratic candidates nothing in the way of coattails to ride on. So white Democratic candidates avoided him. By doing so, they not only didn’t help themselves any, they helped render the black political class’s shallow appeals to vote Democratic out of racial solidarity much less effective than they might have been.

“The last time Democrats gained control of the House of Representatives was when the American people imagined a Democrat congress would stop the Bush-Cheney wars in Iraq and perhaps impeach the president and vice president.”

There are polls saying that 60% of Americans believe that mitigating man-made climate change is a hugely pressing issue. But neither of the two parties is willing or able to take the public up on it. Republican zombies take the money and claim climate change is a myth, while Democrat zombies delay and do nothing with the executive and legislative power they do have. The Obama Administration is clearly running out the clock on deciding the Keystone Oil issue, maybe in hopes of not seeing all the oil money go to Republicans in 2016. Similarly the administration is running out the clock on rewriting enforcement language for the Clean Air Act, something it’s been doing almost six years now, at the same time that it hands out hundreds of licenses for deep water fracking in the Gulf of Mexico [1]. What could go wrong?

Republicans didn’t make him do this. It’s a clear example of the zombie consensus in action. The zombie consensus is independent of the political will of the living, breathing 99%.

The last time Democrats gained control of the House of Representatives was when the American people imagined a Democrat congress would stop the Bush-Cheney wars in Iraq and perhaps impeach the president and vice president. But instead of beheading the Republican zombies, the Democrats joined them, enabling Bush and Cheney to complete their terms, but not their wars, which Democrat national security zombies like the Republican ones, now assure us will last a generation.

You will hear Democrats discussing this election complain about the ingenious array of schemes to make registering and casting a ballot more difficult for students, the elderly, the black, the brown, naturalized citizens and the poor. Such schemes probably cost their party several million votes. But those legal schemes to restrict the vote, to make it harder to register took the best part of 20 years to develop and deploy in dozens of states and many hundreds of counties and cities across the land.

Michigan Slavemaster Gov. Rick Snyder won again. Neither Obama nor AG Eric Holder ever responded to requests for an investigation of Public Acts 4 and 436, which essentially stripped 51 percent of Michigan’s Blacks of their voting rights. Corporate and banking vultures are now stripping Detroit, the largest Black-majority city in the U.S., of its major assets and revenue, under a proto-fascist bankruptcy takeover.

On the issue of voting rights, Democrats, especially our black misleadership class, held the political and moral high ground from the seventies through the 90s and beyond. They’ve got plenty of lawyers and legal scholars and they’ve known perfectly well for decades that if the right to vote is NOT in the US Constitution any mayor, any county commissioner or state level elected official can pass laws or invent rules to block it. But no matter.

The black political class became careerist zombies themselves, deeply concerned with turning out a big black vote every election, but not interested at all in building the necessary mass movement it would take to amend the Constitution, protecting that vote in perpetuity. It wasn’t like the present black political class ever really believed that the vote was an instrument for deep social change anyway. If they had believed that, they would have tried to lock it down with a constitutional amendment. Instead they viewed the black vote as the means to an end — their own careers, and nothing more. So that’s all they got, and that’s all we have. Thus in their own way, the black political class too has joined the zombie consensus.

“under the rules of this capitalist system, the people are pretty much locked out, silenced, made irrelevant…”

For the last two years of Obama’s term in office, the zombie consensus will discourage him even further from addressing or rolling back mass incarceration, black unemployment, or the decline in black family wealth, the last two of which have not recovered from their drastic plunges in the last year of the Bush-Cheney regime and the first two years of his own. Obama may even try to “grand bargain” away social security again as he did in his first two years, and claim he is “resolving” gridlock. The minimum wage might be raised, but not by much and over several years, especially for restaurant workers, who still get less than $3 per hour. Obama won’t use his executive power to end mass deportations that will likely continue, or illegal surveillance or drone wars, or the vicious prosecution of reporters and leakers. Obama will not use his power over the Federal Elections Commission and the Internal Revenue Service to end or inhibit the open hijacking of electoral processes by large, often anonymous donors. A president is a powerful actor, and could have major impacts on any or all of these matters and more with a few speeches, firings, hirings and the strokes of some pens. But somebody or something has eaten his brain too.

For the last two years of Obama’s term in office, the zombie consensus will discourage him even further from addressing or rolling back mass incarceration, black unemployment, or the decline in black family wealth, the last two of which have not recovered from their drastic plunges in the last year of the Bush-Cheney regime and the first two years of his own. Obama may even try to “grand bargain” away social security again as he did in his first two years, and claim he is “resolving” gridlock. The minimum wage might be raised, but not by much and over several years, especially for restaurant workers, who still get less than $3 per hour. Obama won’t use his executive power to end mass deportations that will likely continue, or illegal surveillance or drone wars, or the vicious prosecution of reporters and leakers. Obama will not use his power over the Federal Elections Commission and the Internal Revenue Service to end or inhibit the open hijacking of electoral processes by large, often anonymous donors. A president is a powerful actor, and could have major impacts on any or all of these matters and more with a few speeches, firings, hirings and the strokes of some pens. But somebody or something has eaten his brain too.

The American people don’t particularly endorse any of this, and have never endorsed the closing and privatization of public education, a project upon which elected Republicans and Democrats pretty much agree. It’s the zombie consensus once again.

Ordinary people clearly don’t like it. The zombie president may be unpopular, but the zombie Congress is even less so. But under the rules of this capitalist system, the people are pretty much locked out, silenced, made irrelevant.

It’s time for some new rules.

Bruce A. Dixon is managing editor at Black Agenda Report. He lives and works in Marietta GA and can be reached via this site’s contact page or at bruce.dixon@blackagendareport.com .

Posted in Uncategorized

Leave a comment

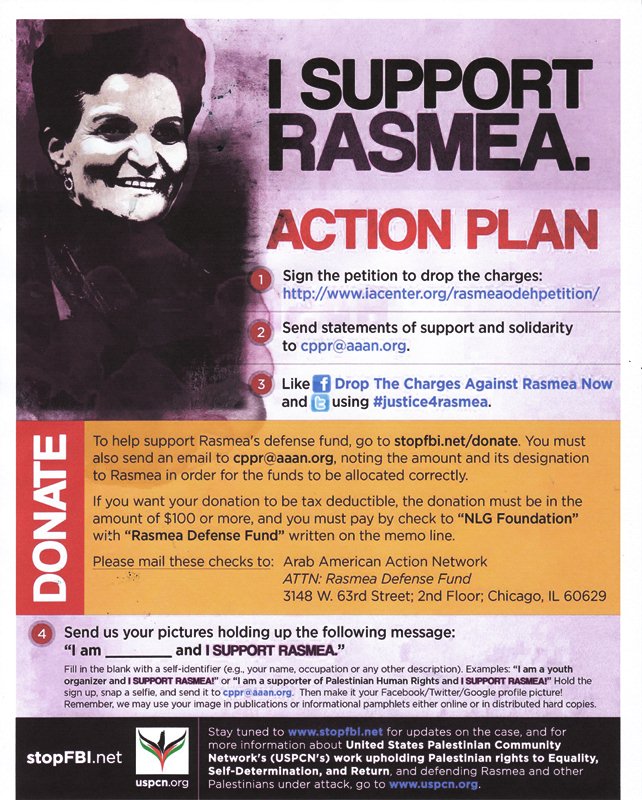

PALESTINIAN HEROINE, TORTURE VICTIM RASMEA ODEH CONVICTED, JAILED IN DETROIT; APPEAL PLANNED

UPDATE NOV. 10, 2014:

Rasmea Odeh taken to jail in handcuffs; defense to appeal

Judge Gershwin Drain’s repeated refusal to allow Odeh to testify re: torture that elicited false confession key to conviction

By Joe Iosbaker

November 10, 2014

Detroit, MI – The jury in the case of Rasmea Odeh returned a guilty verdict after less than two hours of deliberation this morning, Nov. 10. They accepted the charge against her for “unlawful procurement of citizenship.” In her application for citizenship a decade ago, she failed to disclose that she was a political prisoner in Israel 45 years ago, convicted after soldiers raped and tortured her into a confession.

The jury was unanimous in their decision, and then declined an offer for a final meeting with the defense attorneys for Odeh, choosing to only meet with the prosecution. During the jury selection process, the members of the jury all revealed that they didn’t know any immigrants.

Following the reading of the verdict, Judge Gershwin Drain complimented the jury. “I don’t usually comment on a verdict, but this was a just verdict.” Multiple rulings by Judge Drain placed severe limitations on Odeh’s defense a made the semblance of a fair trial impossible.

Odeh’s attorneys have vowed to appeal the conviction, following her March 10, 2015 sentencing.

Prosecutor launches final attack

Prosecutor Jonathan Tukel then motioned to revoke Rasmea’s bond and for her to be taken directly into custody. Judge Drain continued his pretense of pondering his decisions, and came back two hours later and gave the government this travesty as well. He said she was a flight risk, because she had no real ties to keep her in Chicago or the U.S.

This statement was made by the same man who ordered an overflow room to hold the scores of Rasmea’s supporters who packed the courtroom each day of the trial. He disregarded the love and dedication displayed by the Arab Women’s Committee members who spent a week away from their families to be in the audience throughout the trial.

Two U.S. Marshals then came in and led Rasmea away in handcuffs. After the judge left, Rasmea shouted to her supporters, “Don’t worry! I’m strong!” With this she showed the legendary spirit for which she was known back in Palestine, as well as among the community in Chicago.

The Rasmea Defense Committee is preparing a call for next steps in the continuing effort to free her. When Hatem Abudayyeh spoke to the crowd after the verdict was announced, he urged everyone to learn from her strength and continue to fight for justice for her, and to free Palestine.

Rasmea Defense Committee statement

Contact: Hatem Abudayyeh, 773.301.4108, hatem85@yahoo.com

Without a full and fair trial, Rasmea found guilty. Detention hearing at 2 PM.

In a travesty of justice, Rasmea Odeh today was found guilty of one count of Unlawful Procurement of Naturalization. For over a year, Rasmea, her supporters, and her legal team have been battling this unjust government prosecution, saying from the start that the immigration charge was nothing but a pretext to attack this icon of the Palestine liberation movement. And although there is real anger and disappointment in the jury’s verdict, it was known as early as October 27th that she would not get a full and fair trial.

RASMEA ODEH ON FEDERAL TRIAL IN DETROIT; SUPPORTERS PACK COURT

November 7, 2014

DETROIT — Rasmea Odeh, Israeli torture survivor and beloved human rights leader of Chicago’s Palestinian community, saw her supporters pack a Detroit courtroom Thursday for continuing testimonies and cross examinations of U.S. Citizenship and Immigration Services (USCIS).

U.S. District Court Judge Gershwin Drain has continued to strike any reference to Israelis brutally torturing her to force a confession about her role in a terror plot.

Under cross by defense attorney Jim Fennerty, USCIS agent Douglas Scott Pierce revealed a previous case in which he’d testified, saying that naturalization form questions can be “confusing,” especially for those not fluent in English. He acknowledged that older forms asked specifically about crimes, arrests, imprisonment, etc., “inside or outside the United States.” Today’s forms are less clear.

That set the stage for 66 year-old Rasmea Odeh’s argument that she’d always believed questions she’s been accused of answering falsely were asking about her time in the U.S., not Palestine. Jennifer Williams, the immigration officer who interviewed Rasmea back in 2004, testified, along with a fingerprint expert. The prosecution then rested its case.

Lead defense attorney Michael Deutsch called as his first witness University of Illinois-Chicago (UIC) professor Nadine Naber, a leading scholar on Arab women and other women of color, who first met Rasmea back in 2006. Naber testified to their work together, describing Rasmea’s organizing resulting in changing the lives of hundreds of Arab immigrant women by creating a space for them to face their collective challenges they experience. She testified about Rasmea’s character, a truthful person and community mentor.

Judge Drain then excused the jury to advise Rasmsea and Deutsch on his previous rulings, reinforcing his restrictions on her upcoming testimony. He asserted she would not be allowed to speak about her Israeli torture experience, stating he did not want to “retry the case” of 1969.

“It’s my life. I have a right to talk about the things that happened to me!” Rasmea responded.

Judge Drain refused to accede, restating that testimony referring to torture or her forced confession was inadmissible, and that if she violated his orders, there would be consequences.

Rasmea nevertheless delivered a heartfelt testimony, leaving the entire courtroom and the overflow courtroom where dozens more were seated, in tears, according to the United States Palestinian Community News.

She recounted her life story filled with tragedy and resilience, beginning with the Nakba, the ‘Catastrophe,’ what Palestinians call the founding of the state of Israel in 1948 when 750,000 Palestinians were driven out of their homes. She and her family were among those who lost their land and home, forced to live as refugees in a tent before making their way to Ramallah, where they lived during the 1967 Israeli war and occupation of the West Bank, Jerusalem, and Gaza.

Rasmea told the jury about the Israeli raid on her home in 1969, when she, along with her father and sisters, were arrested. That was when Israel swept up and arrested over 500 Palestinians. She broke down in tears recalling how that night traumatized her sister to the point of early death.

Although barred from testifying about Israelis torturing her, Rasmea told the court that she spent 45 days in an “interrogation” center. Prosecutor Jonathan Tukel objected. Judge Drain sustained the objection and reprimanded her.

Deutsch then asked her if she was convicted.

“They convicted me falsely,” she responded.

Again, the government objected and the judge sustained the objection.

“Did you try to escape?” Deutsch later asked her, in reference to one of Israel’s charges that the government has highlighted in this case. Rasmea answered boldly,

“Of course, any political prisoner [would] try to escape!” Rasmea reponded.

Supporters in the overflow courtroom applauded her answer. The main courtroom, however, heard another objection from Tukel and the he judge once again siding with the government. The political prisoner reference was struck from the record.

Rasmea described immigrating to the United States to care for her ailing father. When asked about the 1994 application for permanent residency filed in Jordan, she explained all answers on that form came from her brother. From the U.S., he had sent her a sample form, and she was to copy what he had written on the sample.

“I couldn’t read [English], and I trust my brother. I didn’t read anything, I just copied [what] my brother said,” she testified.

When Deutsch asked about her 2004 application for naturalization, and why she responded “No” to questions about whether she’d been arrested, convicted or imprisoned, she explained that those questions followed directly three previous ones explicitly about the U.S.

“When I continued, my understanding was [that these questions were also] about the U.S., so I continued to say no.”

Deutsch later asked what she’d have done had she understood the questions were intended to address imprisonment outside the U.S. as well.

“If I knew it was about Israel, I would have said…” she responded. “It’s not a secret that I’ve been in jail. Even the embassy knows.”

The U.S. embassy in Israel became involved in the initial arrests because her father was a U.S. citizen.

Rasmea was to continue testifying today. After cross-examination by the government, both sides will make their closing arguments.

The jury is not expected to begin deliberation until Monday, the earliest a verdict is expected.

Some 70 supporters were in the courtrooms Thursday. Inspired by Rasmea’s incredible testimony, rearranged their plans to stay through Monday. In Detroit, organizers were scrambling to ensure housing and transportation for people extending their stay and to prepare for more people arriving daily to join the fight for human rights and justice for Rasmea.

Sources: The Guardian, US Palestinian Community News

Image: USPC News

Statement from the Arab American Action Network

The Arab American Action Network (AAAN) condemns the politically-motivated arrest and indictment of Rasmea Yousef Odeh, our beloved Associate Director. The sixty-five year old was arrested at her home yesterday by agents from the Department of Homeland Security, alleging an immigration violation on a 20-year-old application. Rasmea, who has made it her life’s work to serve and help empower Palestinian and Arab families, is the victim of another witch-hunt by our federal law enforcement agencies, which continue to violate the civil rights of Arabs and Muslims with impunity, particularly those who are critical of U.S. support for Israel’s crimes against the Palestinian people.

Rasmea is a leading member of Chicago’s Arab and Muslim communities, and her decade of service here has changed the lives of thousands of people, particularly disenfranchised Arab women and their families. She has been with the AAAN since 2004, and as Associate Director, is responsible for the management of day-to-day operations and the coordination of our Arab Women’s Committee, which has a membership of close to 600 and leads our work in the areas of defending civil liberties and immigrant rights. She is a mentor to hundreds of immigrant women, as well as many members of our staff and board, and is a well-known and respected organizer throughout Chicagoland, the U.S., and the world.

Earlier this year, Rasmea received the “Outstanding Community Leader Award” from the Chicago Cultural Alliance, which described her as a woman who has “dedicated over 40 years of her life to the empowerment of Arab women, first in her homes of Palestine, Jordan, and Lebanon, where she was an activist and practicing attorney, and then the past 10 years in Chicago.”

Rasmea is a community icon who recently completed a Master’s degree in Criminal Justice from Governors State University. She overcame vicious torture by Israeli authorities while imprisoned in Palestine in the 70s, and is a proud reminder of the millions of Palestinians who have not given up organizing for their rights of liberation, equality, and return.

It is appalling that our government is now attempting to imprison her once again. We condemn this attack on our friend and colleague Rasmea, as well as the broader pattern of persecuting Arabs and Muslims who are outstanding and outspoken leaders in their communities in the U.S.

We ask all of our supporters to call Barbara McQuade, U.S. Attorney for the Eastern District of Michigan in Detroit, at 313.226.9501 or 313.226.9100, on Friday, October 25th, from 8 AM to 4 PM CST, to demand that she Drop the Charges Now!

And for more information, email the Coalition to Protect People’s Rights at cppr@aaan.org

Read more News and Views from the Peoples Struggle at http://www.fightbacknews.org. You can write to us at info@fightbacknews.org

Posted in Uncategorized

Leave a comment

ALL WHITE JURY CONVICTS REV. PINKNEY OF 5 FELONY COUNTS–PROSECUTOR WANTS LIFE SENTENCE

Above: Rev. Edward Pinkney of the Black Autonomy Network of Community Organizations speaks in Detroit at Moratorium NOW! meeting Oct. 20, 2014.

Nationally-known Benton Harbor freedom fighter vows to fight on for all the people

Challenges, appeal planned

Election petition violations are misdemeanors, not felonies under state law

Recent COA decision may impact case

By Diane Bukowski

October 4, 2014

Rev. Edward Pinkney at May 26, 2012 rally against the Emergency Manager and Whirlpool takeover of Benton Harbor, MI.

ST. JOSEPH, MI – An all-white jury found renowned Benton Harbor activist Rev. Edward Pinkney guilty Oct. 3 of five counts of “forgery under the Michigan election law,” related to a recall petition against Benton Harbor Mayor James Hightower. The charges were brought April 24. The day after, a SWAT team surrounded and invaded his home as if he were a violent criminal. He was not there and turned himself in later.

The jury acquitted him of six misdemeanor charges relating to the presence of duplicate signatures on the petitions.

The petitions cited Hightower’s opposition to a city income tax that would have brought substantial revenues to the poverty-stricken city from Whirlpool, which is headquartered in Benton Harbor.

Berrien County Circuit Court Judge Sterling Schrock set sentencing for Dec. 15.

The verdict followed five days of testimony beginning Oct. 27, during which a Michigan State Police forensics technician said there was no way to tell who allegedly changed petition dates, to bring them within the required time frame for the recall. Other prosecution witnesses testified only that Rev. Pinkney appeared to have originated the petition. But they, defense witnesses, and Pinkney himself testified that the petitions had gone through many hands.

Three defense witnesses also testified that they saw another woman changing dates on the petitions without Pinkney’s knowledge.

“I could not believe they could find me guilty without one piece of evidence,” Rev. Pinkney said. “It didn’t mean a lot to me that it was an all-white jury. I thought the jurists would have enough heart, enough courage and righteousness to do the right thing. They didn’t just fail me. They failed everybody that lives in the city of Benton Harbor. Now everybody in Benton Harbor is in jeopardy. They are saying they don’t need evidence to send someone to prison.”

He added, “Here, Whirlpool controls not only Benton Harbor and the residents, but also the court system itself. They will do anything to crush you if you stand up to them. That’s why it’s so important to fight this. I’m going to fight them until the end. This is not just an attack on Rev. Pinkney. It’s an attack on every single person that lives in Benton Harbor, in the state and around the country.”

Whirlpool is headquartered in Benton Harbor but decades ago moved all its manufacturing facilities out of state, leaving the 98 percent Black city with virtually no economic base. Since then, it has gobbled up public and private land across the city to build an $86 million headquarters on the St. Joseph River, along with a luxury condominium complex and a “world-class” golf course adjoining Benton Harbor’s public Jean Klock Park on a beautiful stretch of Lake Michigan beach.