Tamikia McGruder (top l) and Arthur Simmons (top r), whose children have been seized by CPS, with supporters Cornell Squires (top center), Helene and Diane (holding banner). Photo by Debbie Williams.

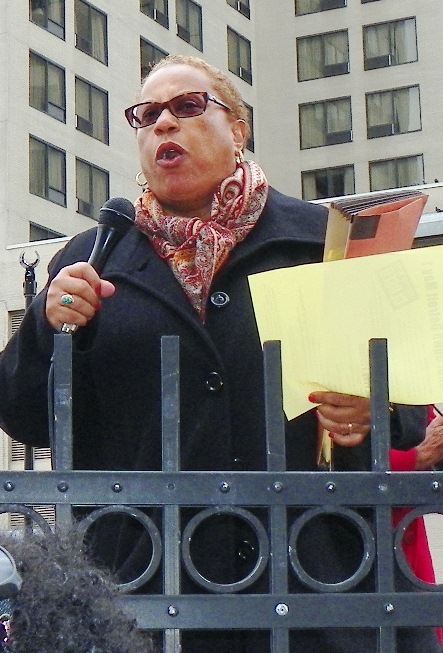

McGruder family court date adjourned until April 28, 1:30 p.m. after referee Mona Youssef sees VOD story on child’s attempted suicide and Risperdal Rx

By Diane Bukowski

April 13, 2014

- Foster father Timothy Searcy left the courtroom after press was allowed back in. He is shown here outside the courtroom. Photo by Debbie Williams.

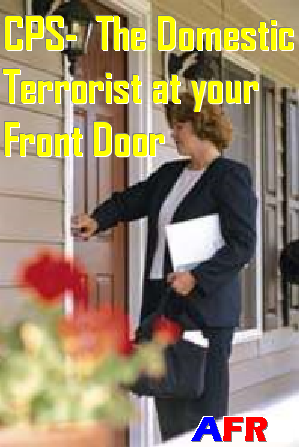

DETROIT — On April 3, Wayne County Family Court referee Mona Youssef adjourned a status review and permanency planning conference on the illegal seizure of six children of Tamikia McGruder, with Arthur Simmons the father of four, until Monday, April 28 at 1:30 p.m.

During their kidnapping, the couple’s 12-year-old child attempted to hang himself in the home of his foster father according to medical records from Hawthorn and Children’s Hositals. The foster father, Timothy Searcy, according to hospital records, did not call 911 but instead resuscitated the child, who was not breathing, himself and took him to CHM.

CPS supervisor Samantha Burks went to CHM after Searcy first talked to her on the phone, according to the child’s family. Both biological parents went to the hospital, but Burks told CHM personnel to remove Simmons from his son’s presence and instead have the foster father, Searcy, in the room instead. The child told his parents during an interview with Burks present at the Hamilton office of the Department of Human Services that he was sexually abused in the foster home.

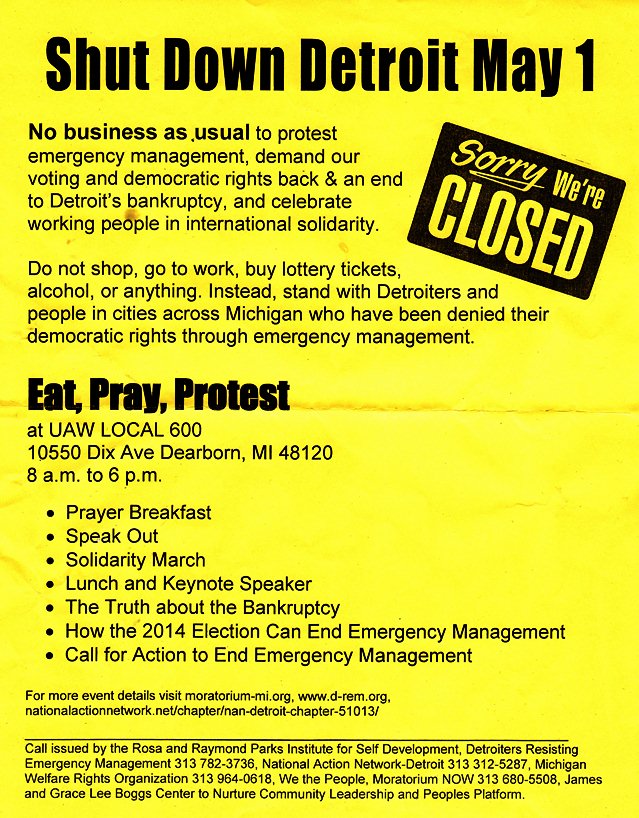

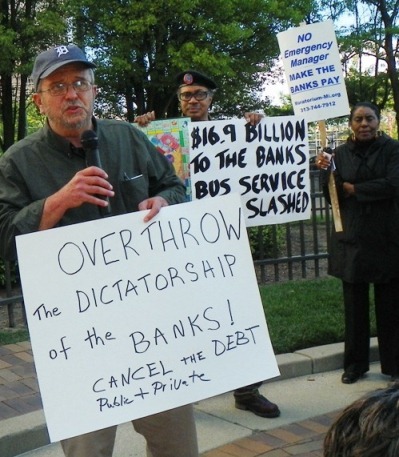

Supporters of the family, including members of We the People for the People and and other community groups, packed the small courtroom but were removed to make space for the foster parents, who have no legal standing in the case. This reporter was also temporarily removed until after Referee Youssef read the VOD story (none of the incidents in the story had been reported in court proceedings until then), and top court personnel cleared the presence of the media.

After the adjournment, Squires and Debbie Williams helped the parents file to get the full court file on their case. The parents then went to the Detroit Police Department Central District to file a police report with the Sex Crimes unit on the 12-year-old child’s alleged abuse.

- Alpolion Smith with his dad Arthur Simmons at DHS visit. He ran outside to greet him, shouting, DADDY, DADDY!!

Supporter Debbie Williams has herself been campaigning to get her grandchildren back for years, now represented by attorney Roger Farinkha, who represented the father of Ariana Godboldo-Hakim in the world-renowned kidnapping of that child and jailing of her mother Maryanne Godboldo for resisting police seizure of her daughter. Part of Williams’ story is detailed below; more will be forthcoming. The McGruder family and their supporters are calling for everyone to turn out at the new court hearing Monday April 28, 2014 at 1:30 p.m. in the courtroom of Referee Mona Yousseff, Room I-F.

VOD: following is a letter from grandmother Debbie Williams just sent to the “Guardian ad Litem” (GAL) assigned to her grandchildren, who were forcibly removed by Michigan Child Protective Services and adopted out. Ms. Williams, like Tamikia McGruder and Arthur Simmons, subject of an earlier VOD story, is battling to bring her grandchildren back into the loving arms of their family. VOD will be reporting on this case more extensively in the future.

Today’s date is April 14, 2014. Good Morning, James M. Kincaid (GAL): You did not give Mr. Roger Farinha my Home Assessment in court on 2-06-14. I am requesting a copy of my Home Assessment before you make any decision to adopt my grandchild Sanaya M. Jones (Tucker). I am informing you I did not abuse or neglect my children in 1992 or 1993. And I was expunged in June of 2009, from the charges; If you used that kind of information knowingly to omit me as a party to adopt or to have guardianship of my relative grandchild you are incorrect. (Professionals Please Read What Is (Kidnapping) Court Actors at http://unhappygrammy-grandparentsblog.blogspot.com/2010/10/cps-case-law-cases-no-immuntity-for.html.

- Debbie Williams is at left in this photo with mother Maryanne Godboldo and her sister Penny Godboldo (to her right), and Ariana Godboldo-Hakim’s father Mubarak Hakim behind them. Also shown are Sandra Hines and Ruyihah Shabazz.

I sent you documentation a few years ago that I was expunged from the Central Registry of false charges. James Kincaid and I sent you documentation about Malik Tyler Tucker, and this video. You was involved with the denial of me getting Malik Tyler Tucker, when I sent the documents and this Youtube.com video Washtenaw CPS Corruption, before Malik Tyler Tucker was adopted.

DUE PROCESS IS THE LEGAL REQUIREMENT THAT THE STATE MUST RESPECT ALL OF THE LEGAL RIGHTS THAT ARE OWED TO A PERSON.

DUE PROCESS HAS ALSO BEEN FREQUENTLY INTERPRETED AS LIMITING LAWS AND LEGAL PROCEEDINGS.

ALL OF THE ABOVE COPIED PARTIES USED THE HOME ASSESSMENT IN A COURT OF LAW WITHOUT ME VIEWING THE HOME ASSESSMENT AND REFUTING ANY FALSE ALLEGATION. AND I NEVER HAD A CHANCE TO VALIDATE THE HOME ASSESSMENT.

ALL OF THE ABOVE COPIED PARTIES USED THE HOME ASSESSMENT IN A COURT OF LAW WITHOUT ME VIEWING THE HOME ASSESSMENT AND REFUTING ANY FALSE ALLEGATION. AND I NEVER HAD A CHANCE TO VALIDATE THE HOME ASSESSMENT.

JAMES M. KINCAID IT APPEARS AS LONG AS MY GRANDCHILDREN HAVE BEEN IN YOUR CARE YOU HAVE MISUSED THEIR DUE PROCESS. IT APPEARS YOU HAVE DISTORTED THEIR CASES AND REPORTS AND LIED ON THE RECORD OVER AND OVER WITH YOUR COURT ACTORS ABOUT ME.

For more information, see Debbie Williams’ page at http://miparentalrights.ning.com/. Also call We the People for the People at 313-460-3175. Other useful national sites include http://fightcps.com/ and http://familyrights.us/how_to/fight_cps.html. Also http://familyrights.us/info/law/index.html and http://www.americanbar.org/groups/child_law.html,

Related article: http://voiceofdetroit.net/2014/03/26/12-year-old-child-hangs-himself-after-rubber-stamped-cps-seizure-from-family-prescription-of-drug-risperdal/.