- State debt is $70 BILLION

- Snyder budget slashes $1 billion in corporate taxes

- Taxes pensions, cuts education funding a total of 17 percent

- Cuts local government aid by $100 million

- Cuts public assistance by $70 million: 50,000 suffer first month

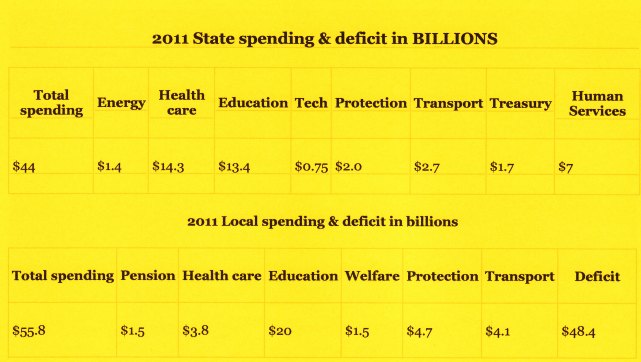

Michigan‘s Gov. Rick Snyder signed the FY2012 $47 billion state budget into law on June 21, 2011. The budget eliminates $1 billion in corporate taxes and initiates taxes on pensions. It also cuts school funding by 2.2%, higher education funding by at least 15% and lessens aid to local governments by $100 million.

The state’s fiscal year begins on October 1st and ends on September 30th of the following calendar year.[4]

Michigan has a total state debt of $69,418,882,370 when calculated by adding the total of outstanding debt, pension and OPEB UAAL’s, unemployment trust funds and the 2010 budget gap as of July 2010.

FY2012 State Budget

Gov. Snyder asked the legislature for $38.25 million from the state’s general fund to pay a portion of the $106 million the state owes in interest on Michigan’s $3.1 billion federal unemployment insurance debt. The remaining portion of the interest payment will come from a state solvency tax that went into effect this year on Michigan employers, and from state unemployment penalty and interest funds.

On June 21, 2011, Gov. Rick Snyder signed the FY2012 $47 billion budget into law. ]The two budget bills signed by the governor were House Bill 4526 and House Bill 4325. The last time the state had a completed budget in place this early was 1981.

The budget assumes $265 million in savings in 2011-12 from employee concessions. The governor hopes to convince state employee unions to reopen their contracts to provide those concessions, and delayed making layoffs in September 2011. The union contracts do not expire until the end of the 2012 calendar year. One of the concessions the governor seeks is having employees increase the percentage of health care costs that they pay for from 10% to 20%. At the unions’ urging, the governor agreed to study whether the state government had too many managers, and to consider reducing the number of managers. The state’s ratio at the time the study started was 6 employees to each manager. The union claims that if the ratio was 7 to 1 that the state would save $75 million. (VOD: Enough to restore public assistance cuts by itself.)

Before the budget was signed into law the state faced a projected $1.85 billion deficit in FY2012.

The governor said that the budget would foster a stable environment for business, due in large part to a tax cut that essentially does away with business taxes on companies except large corporations with shareholders. The elimination of that tax could cost the state $1 billion in revenue in FY2012. The budget taxes public pensions and reduced exemptions for private pensions.[13]

The budget includes several cuts in funding. The $12.7-billion School Aid Fund gives districts $12.7 billion, $300 per pupil less than FY2011, a 2.2% reduction. However, school districts that show cost-cutting initiatives could receive additional funds from a $100-million fund. Public universities will see 22% less in state aid — 15% if they hold down tuition costs to 7% or less. Local government will receive $100 million less.

The governor vetoed some portions of the budget bill, including a $4.25 million adoption subsidy, and he made it clear that some language in the bill was not legally enforceable, including provisions regarding universities offering health care benefits to employees’ domestic partners and ignore some language in the bill that’s not legally enforceable. That includes provisions added by Republican lawmakers that would have penalized universities that offered health care benefits to employees’ domestic partners and requiring public universities doing embryonic stem cells to report data to the state.

The state receives about $400 million a week from the federal government, which is approximately 44 percent of the total state budget.

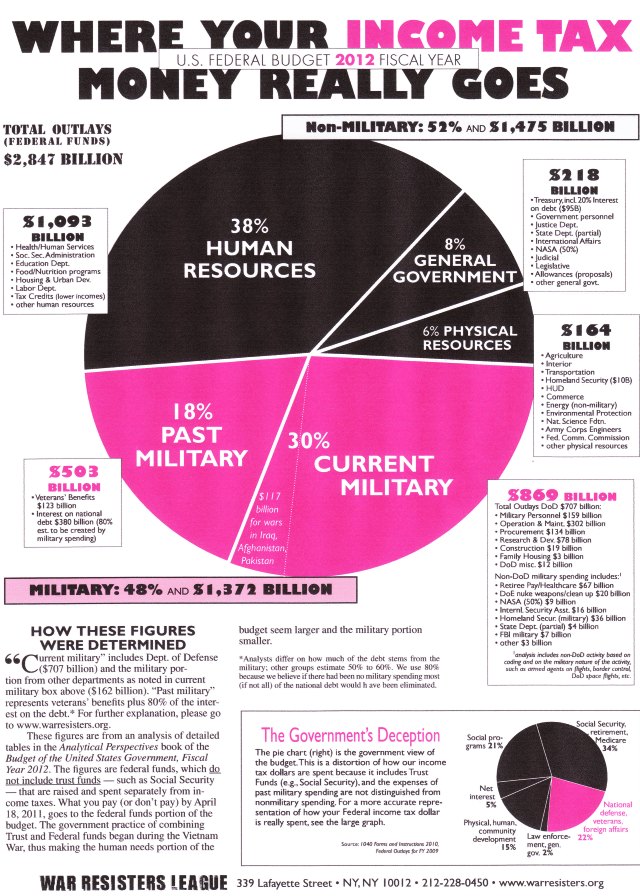

(VOD: At least 48 percent of the federal budget goes to the military. Stop all U.S. wars against Libya, Iraq, Afghanistan, and dozens more undercover operations.)

(VOD: At least 48 percent of the federal budget goes to the military. Stop all U.S. wars against Libya, Iraq, Afghanistan, and dozens more undercover operations.)