- Stephen Murphy of Standard and Poors and Joe O’Keefe of Fitch Ratings (center) lobbied for $1.5 billion pension bond deal at City Council table in 2004; with Detroit CFO Sean Werdlow at left; Deputy Mayor Anthony Adams at right; now Fitch has downgraded Detroit’s ratings once again over worries it will not pay; Wall Street as a whole engaged in maasive predatory lending to governments during that period, leading eventually to the historic collapse of 2008, signaled by the fall of Lehman Brothers

June 12, 2012

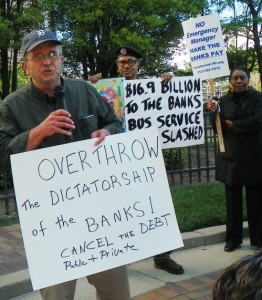

(VOD: note the article below says the state as well as Detroit could have prevented downgrade; it was the state which threatened to withhold the money Detroit’s CFO Jack Martin was counting on to pay the bond debt, in violation of the Fiscal Stability Agreement.)

(Reuters) – Concerns that Detroit may miss a payment due Friday on its pension debt led Fitch Ratings to lower the city’s already junk-level ratings into the C category on Tuesday, denoting a higher chance of default.

Fitch analyst Amy Laskey cited statements by Mayor Dave Bing that the city may not be able to make a payment on $1.5 billion of pension debt as it may run out of cash by Friday.

Michigan reached an agreement with Detroit in April to provide the city with some budget relief in exchange for more state oversight over the city’s finances.

But a lawsuit challenging the legality of that agreement has bottled up plans to raise $137 million through a debt sale to keep city operations going.

Michigan’s deputy treasurer said last week that the lawsuit needs to be withdrawn this week or the city will lose $82.5 million in state revenue-sharing payments. With the bond deal on hold, these payments would be diverted to pay off an interim debt issue placed privately in March.

On Monday, Bing sent a letter to Detroit Corporation Counsel Krystal Crittendon directing her to drop the lawsuit she filed earlier this month. The letter also said he is consulting with “outside legal experts in this matter in order to execute my duties.” Crittendon has not commented so far.

“All of the events in the last week point out the impressive challenges they face,” Laskey said.

Fitch said “there are actions available to both the city and the state of Michigan that would ensure the payment is made but that the current level of uncertainty so close to a bond repayment date is consistent with a higher probability of default than the prior B-category ratings implied.”

Crittendon’s complaint, which was filed against the state in Michigan’s Court of Claims, challenges the validity of the financial stability agreement on a claim that Michigan owes the city more than $230 million. A motion for an expedited hearing in the case is up before Judge William Collette on Wednesday, according to his office.

Ahead of signing the pact, the city and state agreed to a deal to provide some breathing room in Detroit’s budget by restructuring some outstanding debt to push $37 million in debt-service payments into the future.

The longer-term debt issue would also include $100 million of new bonds to fund the city’s fiscal 2012 and 2013 self-insurance payments.

The first step was an $80 million interim financing that was privately placed in March. The second step is issuing a longer-term bond issue later this month to raise $137 million and replace the interim debt.

But Tom Saxton, Michigan’s deputy treasurer, advised the city last week that the lawsuit was derailing issuance of the longer-term bonds and as a consequence $82.5 million in state revenue sharing due to Detroit between this month and December would instead be used to pay off the interim debt issue.

Fitch lowered the city’s unlimited tax general obligation rating on about $511 million of bonds to CCC from B and cut the rating on about $453 million of limited tax GO bonds to CC from B-minus.

The rating on Detroit’s pension obligation certificates of participation was downgraded to CC from B with a warning that the rating could fall to the lowest level of D if the city misses a debt service payment. The city’s GO bond ratings “will likely be adjusted to a level somewhat above D,” Fitch added.

The city has suffered a staggering population decline in recent years, causing its revenue base to shrink. Companies that once paid hefty taxes, including General Motors Co (GM.N), have reduced their presence in a city synonymous with the auto industry.

Naomi Patton, Bing’s spokeswoman, said earlier on Tuesday city officials were working to ensure money is available to make the $34.2 million debt service payment on the pension bonds.

As for the downgrade, Chris Brown, Detroit’s chief operating officer, said in a statement that the downgrade was not unexpected given the outstanding litigation.

“Ultimately, we are working to restore our financial reputation with the rating agencies by stabilizing the city’s finances,” Brown said.

Sara Wurfel, a spokeswoman for Governor Rick Snyder, said the lawsuit is creating uncertainty and delaying needed reforms.

“Governor Snyder and the state are continuing to stay focused on partnering with, and doing everything possible to work with the city to address its historic fiscal crisis, move forward and ensure Detroit succeeds,” Wurfel said.

In March, Standard & Poor’s Ratings Services downgraded Detroit’s GO rating to B with a negative outlook from BB, while Moody’s Investors Service dropped the rating to B2 from Ba3 and warned of a further downgrade.

There was no trading in the pension COPs in the U.S. municipal bond market, according to a Municipal Market Data analyst.

In the meantime, the situation led Detroit’s Water and Sewerage Department to postpone a $596 million sewer revenue bond issue that was slated to price this week, said Matt Schenk, the department’s chief operating officer.

“We want to get past the looming deadline on Friday,” he said, adding there was no firm date when the bonds, which are a separate credit from Detroit, will be priced. “There is some headline risk going on right now.”

(Reporting by Karen Pierog, additional reporting by Caryn Trokie in New York; Editing by Richard Chang and Carol Bishopric)