Contract includes unlimited charges for work, including asset sales

Brushes off “conflict of interest” re: Jones Day’s representation of most city creditors

Bars affirmative action in hiring, including U.S. EO 11246 compliance

Refuses to comply with “ban the box” city ordinance re: ex-offenders

By Diane Bukowski

DETROIT – The Detroit City Council is expected to vote on an open-ended, open cost “debt restructuring” contract with Jones Day at its regular session Tues. April 9, 2013 at 10 a.m. Detroit Emergency Manager Kevyn Orr worked for the firm beginning in 1984, allegedly terminating his tenure when Michigan Gov. Rick Snyder anointed him EM.

“My friends, why is this not an obvious conflict, obvious to even non-Detroiters who think an EM is a great idea for Detroit but not themselves?” Tom Barrow, President of Citizens for Detroit’s Future, asked. “Orr is so cold that he will now USE the Detroit city council to do what he could do by himself. . No, instead he wants the Detroit City Council to do it and thus make it appear and enable him to say “the city of Detroit hired” Jones Day. We have Miller Canfield, Buckfire and now Jones Day. I guarantee once they get their hooks into us, these folks will not let go until at least 100 million is charged. This is so wrong!!! So wrong!

Under the newly-minted EM act, PA 436, Detroit’s EM must approve everything city officials do. However, many Detroiters feel their Council could at least take a stand on behalf of the people, and vote a resounding NO!

The contract’s initial term of services is from March 15 to Sept. 15, 2013. But an attached letter to Mayor Dave Bing says it can last as long as Orr is EM. Under PA 436, he is supposed to stay 180 days, but only if Michigan Gov. Rick Snyder doesn’t want him to stay longer. Jones Day says it will charge $3.35 million for “Core Re-structuring.”

To read the complete contract, click on Jones Day contract.

CONTRACT COULD COST DETROIT HUNDREDS OF MILLIONS

However, the letter to Bing says the firm will charge additional costs for a massive amount of non-Core Restructuring work, which will be performed by its Managing Partner Stephen Brogan and partners David Heiman, Bruce Bennett, Corrine Ball, and Heather Lennox. (See profiles of these lawyers and their activities at the end of this article.)

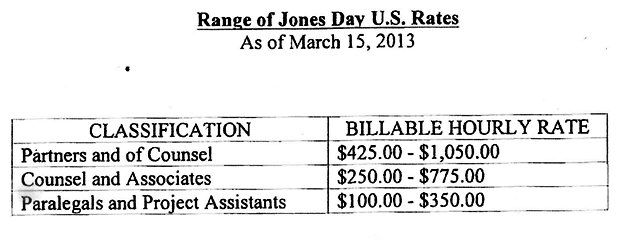

Rates quoted in the letter are:

JONES DAY PARTNERS COMING TO DETROIT

These Jones Day partners are specified in the contract. However, an unknown number of other staffers will also be hired. The contract specifically forbids the use of “affirmative action” in hiring.

That work includes “work related to Pension Certificates Participation and related swap and interest agreements,” other than legal analysis. It will charge to handle litigation relating to labor or pension disputes or proposed changes to the Detroit Water and Sewerage Department, now before U.S. District Court Judge Sean Cox.

Jones Day will charge Detroit for work on “(a) any asset dispositions, privatization, or similar transactions, or any other capital-raising transactions; and (b) any transactions necessary to implement a negotiated financial restructuring, such as new debt instruments, new labor contract, or other agreements beyond restructuring term sheets.”

It will charge for work relating to EM Acts PA 72 and 436 or challenges to Orr’s power, and for “contingency planning for a potential chapter 9 bankruptcy filing by the City, or the conduct or administration of such a case.”

Jones Day represents UBS AG and a partner of SBS Financial, the firms which sold Detroit a predatory “pension obligation certificate” (POC) loan of $1.5 billion in 2005. The city has had to pay an additional $1 billion to hedge funds for betting the wrong way on which way the market would go, prior to the great economic collapse of 2008.

UBS AG just paid a $1.5 billion fine to the U.S. Department of Justice for interest-rate rigging in the LIBOR scandal and faces other related litigation globally.

The firms are also involved in $474 million in fees Wall Street raked in as a result of interest swap deals. (See article below from Bloomberg Businessweek.)

Baltimore Mayor Stephanie Rawlings announces lawsuit against UBS, Citigroup, JP Morgan and numerous other banks for interest rate rigging. Why hasn’t Detroit joined in?

During Gov. Snyder’s press conference announcing Orr’s appointment March 16, VOD specifically questioned Orr about the UBS AG loan to the City of Detroit and the USDOJ fine, asking him what he would do about the banks. He responded only in generalities.

Later, VOD emailed him asking him if he would investigate whether LIBOR banks including UBS AG have caused the city economic damage, and pursue legal action against them, as did the City of Baltimore and many other municipalities and pension funds around the U.S. Orr never responded to the email, and never admitted that Jones Day had UBS AG and SBS as clients.

Jones Day admits in its letter to Bing, “Some of Jones Day’s clients may have, or develop, interests adverse to the City. . . We will promptly inform the City of any client relationships that may raise conflict concerns as such matters are identified over the course of our engagement. We will work with the City to address any conflicts as circumstances require.”

Jones Day says further that it “will not represent any person or entity in any matter adverse to the City without its express written consent.”

Jones Day says further that it “will not represent any person or entity in any matter adverse to the City without its express written consent.”

It appears to be a case of too little (or nothing), too late. As the Bloomberg Businessweek article points out, Wall Street firms including Jones Day clients are responsible to a great degree for Detroit’s economic decline, the matter which Jones Day is allegedly to address.

Kevyn Orr was Jones Day’s minority recruitment director, but he appears not to have done a very thorough job, as evidenced by photos of partners on the Jones Day website. Jones Day further states in its contract that it “shall not be required to comply with any affirmative action provision or related employee data-gathering or auditing requirements . . . . ” It also refuses to comply with U.S. Executive Order 11246, which requires affirmative action in hiring. Jones Day claims it is not subject to this order because it is not a federal contractor paid out of federal funds.

Supporters of the Voting Rights Act at U.S. Supreme Court during hearings on Shelby County v. Holder.

The contract also refuses specifically to comply with Detroit’s new “ban the box” ordinance, which would eliminate questions about previous criminal offenses until later in the interview process.

Jones Day partner Michael Carvin opposed Voting Rights Act Sec.5 as well as HHS contraception mandate in Obamacare.

Showing its racist tendencies, Jones Day has been an active supporter of Shelby County Alabama in recent hearings before the U.S. Supreme Court, in which it is trying to overturn Section 5 of the Voting Rights Act which requires many Southern states to obtain federal preclearance for all voting procedure changes before they are implemented.

Most recently, Jones Day partner Michael Carvin spoke at a Heritage Foundation briefing on the “(Un)Constitutionality of Section 5 of the Voting Rights Act,” in Washington, D.C, as the U.S. Supreme Court heard arguments in Shelby County v. Holder.

White voters are “wide open to electing black Democrats … as much as white Democrats,” Carvin told the audience, according to a Feb. 24 article in the Roll Call newspaper.

Many protesters of the EM appointment, in signs and at Council, have advocated “debt re-structuring,” appearing to confuse it with a moratorium on payments of the city’s debt or actual cancellation, actions which have been demanded in Third World countries for years and which are now being demanded in France, Italy, Spain, Greece, Cyprus, Ireland and other European countries.

“Debt re-structuring,” as it has been carried out in those countries, while getting the banks to back off some of their immediate demands for payment after massive general strikes and protests, is however, inextricably tied to austerity measures.

In 2004, the Detroit Public Schools District “re-structured” a $220 million loan taken out by then state-appointed CEO Kenneth Burnley. It spread the debt out over 15 years, resulting in soaring interest rates. The agreement to “re-structure” the debt specified that payments would come directly from the state’s per-pupil aid to DPS. As a result, to ensure re-payment of that and other loans, a state trustee gets DPS per-pupil aid and parcels out 80 to 90 percent of it to the district’s creditors. (Click on Banks take 90 cents of every state aid dollar for article by this author published in the Michigan Citizen in 2004.)

The devastation of DPS, and the destruction of the futures of Detroit’s children, is directly due to “debt restructuring.” DO NOT BE FOOLED.

PROFILES OF JONES DAY PARTNERS COMING TO DETROIT

STEPHEN BROGAN, JONES DAY MANAGING PARTNER

The current managing partner of Jones Day is Steve Brogan, a 1977 Notre Dame Law grad, and a current member of Notre Dame’s Board of Trustees. Brogan was a Deputy Assistant Attorney General during the Reagan Administration (1981-1983), Jones Day represented Brogan’s alma mater the University of Notre Dame, and other Catholic organizations, pro bono in their lawsuit challenging Obamacare’s contraception inclusion mandate. It has also represented the Catholic Diocese of Cleveland in its child abuse lawsuits.

DAVID HEIMAN

David Heiman has been part of teams representing WL Ross & Co., owned by billionaire Wilbur Ross, a conservative Mitt Romney supporter and global corporate buy-out specialist who was involved with the owners of Sago Mine in W. Virginia, where 12 miners died after numerous safety violation citations. Heiman has also been part of teams representing Lehman Brothers, whose collapse triggered the 2008 world-wide economic meltdown; the Chrysler LLC buyout by Fiat; Gould Electronics, accused of contamination at a site in Omaha, Nebraska by the US EPA, and USG Corporation, which went bankrupt settling asbestos personal injury liabilities.

BRUCE BENNETT

“Prior to joining Jones Day in May 2012, Bennett was the lead debtor’s counsel in the country’s largest municipal bankruptcy (County of Orange, California), following a $1.7 billion loss in county investment pools. As counsel to the debtor, Bruce was the architect of the plan of adjustment that . . . .resulted in the recovery of more than $870 million for the county. . .,” says the Jones Day website. “Bruce also successfully resolved many other large bankruptcy cases for lenders, note holders, and equity interest owners, including Adelphia Communications, Enron, Fountainebleau Las Vegas, Green Valley Ranch, Hawaii Medical Centers, Lehman Brothers Treasury Co., Olympia & York, and Tribune Company.

Corinne Ball

Jones Day announced in April, 2011 that Ball would lead Jones Day’s restructuring effort in Europe, where it has dozens of offices. She was the lead lawyer in the Chrysler bankruptcy and in the Dana Corporation global settlement in the UK which targeted the company’s pension systems, transferring them to Centerbridge and other investors. She obtained settlements to eliminate “an enormous accumulated liability for health and life insurance benefits for retirees from its unionized and nonunion workforces, and to modify its collective bargaining agreements with active employees, allowing Dana to compete in the troubled auto industry upon emergence from bankruptcy. This “Global Settlement” resulted in the elimination of almost $1.5 billion in accumulated post-retirement benefit obligations, and the creation and funding of Voluntary Employee Benefit Association (VEBA) trusts,” says the Jones Day website.

She also helped WL Ross & Co. with numerous acquisitions of European-based companies.

Heather Lennox

According to Jones Day, “Heather Lennox has . . . substantial experience counseling clients in fraudulent conveyance, illegal dividend, fiduciary duty, piercing the corporate veil, and mass tort issues in bankruptcy. She has represented a number of entities in the structuring and consummation of spin-offs, secured financings, distressed sales and acquisitions, ring-fencing transactions, and other out-of-court restructuring transactions.

Heather has represented, among others: Copperweld Corporation, CSC Industries, Dana Corporation, Fruehauf Trailer Corporation, Great American Communications Company (a prepackaged case), Hostess Brands, Inc., LTV Steel Company, Metaldyne Corporation, and Oglebay Norton Company as debtors’ counsel, and significant creditors in the Delta Airlines, Forum Health, HomePlace Stores, Northwest Airlines, Pittsburgh Penguins, R.H. Macy, Southern Air Transport, United Airlines, US Airways, and Wornick Company bankruptcies.

For a formatted printout of this article, click on COSTLY JONES DAY CONTRACT.

Related articles:

http://voiceofdetroit.net/2013/03/31/detroit-council-to-vote-on-jones-day-contract-firm-represents-criminal-banks-holding-citys-debt/

http://voiceofdetroit.net/2013/03/27/throw-out-detroits-em-power-to-the-people-not-the-banks/

http://voiceofdetroit.net/2013/03/27/detroiters-march-in-cleveland-tell-jones-day-and-banks-get-out/

http://voiceofdetroit.net/2013/03/26/vampire-capitalism-comes-to-detroit-mi-and-dekalb-county-ga/

http://voiceofdetroit.net/2013/03/24/from-detroit-to-cyprus-banksters-in-search-of-prey/

http://voiceofdetroit.net/2013/03/20/banks-behind-detroit-emergency-manager-takeover/

Spot on with this write-up, I seriously believe this website needs much more

attention. I’ll probably be back again to read more, thanks for the info!