Orr held meeting June 10 telling Detroiters to sacrifice, give up assets

Protest outside Orr’s meeting with the “public” June 10. Orr said he plans to lease Belle Isle to the state. BELLE ISLE BELONGS TO THE PEOPLE!

Orr holds PA 436 in one hand, Chapter 9 in the other as threats; both will devastate Detroit for generations to come

(Here is transportation information for Friday’s demonstration when EM Orr meets Detroit’s “creditors” Gather to car pool at 7:30 am at 5920 Second Ave., Detroit, MI 48202, at Antoinette, just above Wayne State University. If driving, take I-94 W to Metro Airport exit, left to Delta Departures. There is parking across from there at short-time parking lot up to 2 hours for $7.00.)

By Diane Bukowski

June 13, 2013

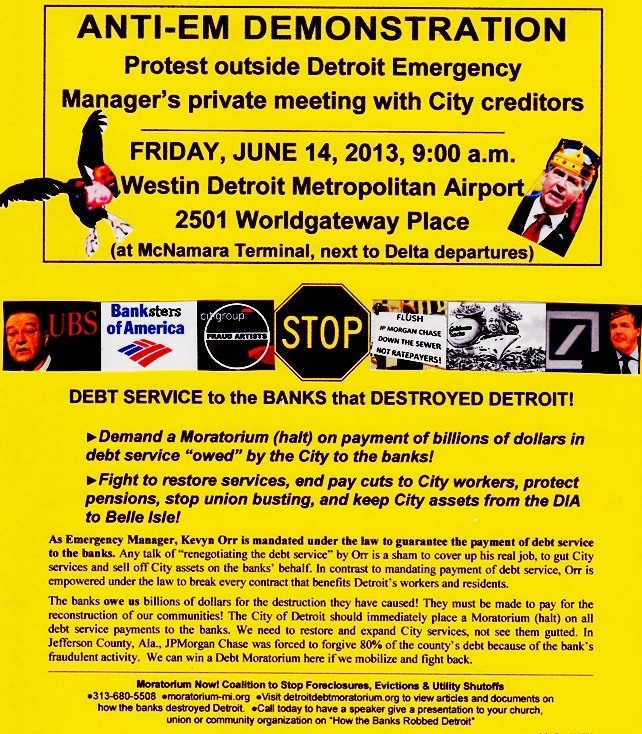

DETROIT – Detroit’s Emergency Manager Kevyn Orr and his racist, right-wing, “former” law firm Jones Day, the city’s “debt re-structuring consultant,” will meet with City of Detroit creditors June 14. One union official said Orr plans to “cram” an austerity agreement down the throats of the workers, instead of cramming debt reduction down the throats of banks and other financial institutions. The meeting is allegedly to prevent the filing of a Chapter 9 municipal bankruptcy, which would be the biggest in the country’s history.

Members of the Moratorium NOW! Coalition plan to be at the Westin Airport Hotel, where the meeting is to be held, at 9 a.m. to demand instead an immediate moratorium on Detroit’s debt to the banks, and to rally Detroiters to rise up en masse.

“The banks are guilty of criminal actions,” Andrea Egypt, a Detroit city retiree, said earlier. “With their predatory lending, their instruments of fraud and usury, their seizure of homes, land and assets, they conspired to destabilize our finances and destroy the lives of our residents, creating urban blight and crime. They set up the conditions for the financial collapse of the cities across the country and the world.”

The group says it will demand the retention of city assets, restoration and improvement of services to city residents, good wages and benefits for city workers, and protection of the city’s pension funds.

Orr told the public at Wayne State University’s Law School June 10 that his first priority is to guarantee “public safety,” i.e. deal with crime. His second priority, he said, is to pay the City’s debts in full, as mandated by Emergency Manager Public Act 436, the successor to PA 4. He said he plans to lease Belle Isle to the state among other measures. His press representative Bill Nowling has talked about giving up the $6 billion Detroit Water and Sewerage Department (DWSD), the city’s largest asset, as well.

Kriss Andrews, the city’s PA4 Project Management Director, (big fat white man with grey hair) is seen going into meeting June 10. Photo by Jennifer Teed.

“The City has at least $15.6 billion in unfunded debt,” Orr told an audience stacked with 43 seats reserved for VIP’s June 10. They included Financial Advisory Board members Kenneth Whipple and Glenda Price, City Council members Gary Brown, James Tate and Andre Spivey, former Council member Sheila Cockrel, and Bishop Edgar Vann, all of whom reacted to his talk in glowing tersm..

“The City’s revenue annually is $1 to 1.2 billion,” he said “Let’s assume you could dial in the fixed 80 percent of the budget . . . . and you wanted to address the $15.6 billion . . . nothing else, no fireworks, no potholes, nothing, it would take 68 years to pay off the debt, assuming you incur no further debt. That’s not feasible—the city would not exist as it is now. The alternative . . . outflows of demographics, lack of revenue, declining services is not a sustainable future.”

He continued, “The only answer they [former city officials] had to deal with the problems was ‘let’s borrow a lot at a very high rate.’ Now the bill has come due and we have to address it. This path will require sacrifices from all interested parties. . . . I have a very powerful statute, and I have an even more powerful Chapter 9.”

A look at recent Chapter 9 bankruptcy filings and a look at PA 436, which still faces legal challenges, shows that both options will devastate Detroiters and their children for generations to come.

The U.S. Courts website says, “The purpose of Chapter 9 is to provide a financially-distressed municipality protection from its creditors while it develops and negotiates a plan for adjusting its debt. . . .there is no provision in the law for liquidation of the assets of the municipality and distribution of the proceeds to creditors. Such a liquidation or dissolution would undoubtedly violate the Tenth Amendment to the Constitution.”

It goes on to say that during the pendency of a bankruptcy filing, payment of all the municipality’s general obligation debts is suspended, while the payment of special revenue debts, such as that DWSD owes, continues.

However, unlike state law, which provides protection for the pensions of public retirees, the U.S. government protects only the pensions of private workers. Currently, in the Stockton, Calfornia bankruptcy filing, the city’s retirees are being pitted against its banking and corporate debtors. (See article below.)

PA 436 proposes as an alternative a “neutral evaluation” process.

“The neutral evaluator shall inform the local government and all participants of the provisions of chapter 9 relative to other chapters of title 11 of the United States Code, 11 USC 101 to 1532. This instruction shall highlight the limited authority of United States bankruptcy judges in chapter 9, including, but not limited to, the restriction on federal bankruptcy judges’ authority to interfere with or force liquidation of a local government’s property and the lack of flexibility available to federal bankruptcy judges to reduce or cram down debt repayments and similar efforts not available to reorganize the operations of the local government that may be available to a corporate entity.”

If the evaluation process fails, the Act says, then Chapter 9 bankruptcy is an alternative only if approved by the mayor of the municipality and the governor of the state. It provides that, unlike the situations in Stockton and Vallejo, California, where the city governments stood firm on the side of retirees, the governor can appoint a special manager to handle the bankruptcy.

Nowling has called retiree pensions and health costs “low-hanging” fruit. Under Orr, it is inevitable there will be no such protection for retirees, many of whom make only a few hundred dollars a month, and have already faced drastic increases in their health care deductibles and co-pays.

Atty. Jerry Goldberg calls for prosecution of criminal banks outside Orr’s meeting June 10, Photo by Jennifer Teed.

PA 436 also says, “An emergency manager shall . . . .make a determination as to whether possible criminal conduct contributed to the financial situation resulting in the local government’s receivership status. If the emergency manager determines that there is reason to believe that criminal conduct has occurred, the manager shall refer the matter to the attorney general and the local prosecuting attorney for investigation.”

Attorney Jerome Goldberg of Moratorium NOW! confronted Orr June 10, telling him under that statute he has a duty to investigate the criminal banks, which precipitated the financial crisis in Detroit.

“We don’t owe the banks anything,” he said. “You should be DEMANDING that they cancel the debt.”

Stephen Boyle of Free Detroit No Consent raised the fact that JPMorgan Chase has been forced to forego 70 percent of payments in the proposed Jefferson County, Alabama bankruptcy settlement, because their officials were found to have bribed county officials to make the loans. (VOD: At the same time, however, the proposed settlement provided for higher sewage rates to county residents.)

“Orr acknowledged the legitimacy of our view, saying that wrongdoing by creditors is a basis for discounting the debt,” Goldberg said. “We plan to rally the people to win our demand to cancel the debt. The issue is becoming crystal clear to Detroiters, and it’s time for us to rise up.”

DWSD workers struck at Wastewater Treatment Plant in Sept. 2012, trying to spark a general strike. They were sabotaged by AFSCME Council 25.

What is needed, say the activists, is a return to massive struggles in the streets, including general strikes and boycotts like the Montgomery Bus Boycott in the 1960’s, which eventually defeated Jim Crow laws.

Instead of an investigation, protesters outside the meeting demanded immediate action, chanting, “Too big to fail, not too big to jail.” The city’s banking and insurance creditors, as well Wall Street ratings agency Standard and Poor’s, have already been found guilty of massive fraud by numerous entities, in the U.S. and across the world.

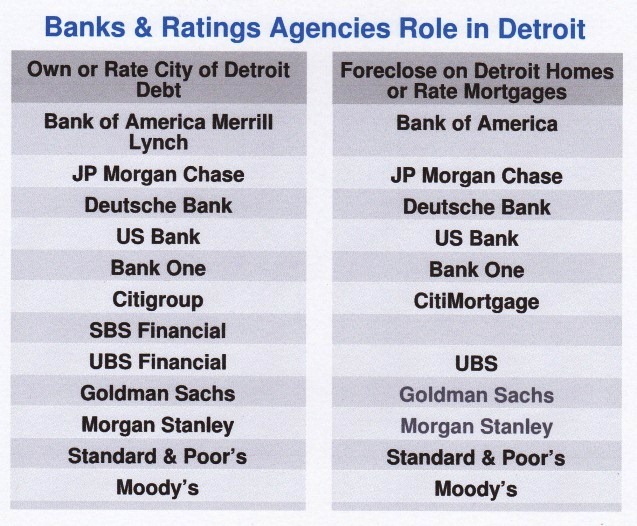

The Moratorium NOW! Coalition has identified many of the city’s creditors through a Freedom of Information Act request (to view the debt documents they received, click on http://detroitdebtmoratorium.org/.)

Following is a just a sampling.

(L to r) Then Detroit CFO Sean Werdlow, SBS representative, Joe O’Keefe of Fitch Ratings, Stephen Murphy of Standard and Poor’s, and then Deputy Mayor Anthony Adams foist predatory $1.5 billion POC loan from UBS on city Jan. 31, 2005.

UBS AG—2005 $1.5 billion POC predatory loan to Detroit facilitated by Standard and Poor’s and Fitch Ratins, grown to $2.5 billion with penalties and swaps termed “wrong-way bets” by Bloomberg Businessweek.

In a clear conflict of interest, UBS’ loan partner SBS hired then Detroit CFO Sean Werdlow as a top executive shortly after the transaction; he remains there. Many of the city’s debts discovered by Moratorium NOW’s FOIA are now with SBS Financial. They are guaranteed by Merrill Lynch, a subsidiary of Bank of America.

**Client of JONES DAY LAW FIRM, EM Kevyn Orr’s “former” employer, functioning as Detroit’s debt re-structuring consultant, in constant meetings with Orr according to his May 17, 2013 report

**Client of JONES DAY LAW FIRM, EM Kevyn Orr’s “former” employer, functioning as Detroit’s debt re-structuring consultant, in constant meetings with Orr according to his May 17, 2013 report

- UBS fined $1.5 billion by US Department of Justice for fraudulent practices.

- Ongoing lawsuits and criminal actions against UBS and other banks for interest rate rigging in the LIBOR (London Interbank-Offered Rate) scandal. The City of Baltimore, other government entities, pension funds, and creditors, as well as other countries including those in the European Union have brought suit against UBS, as well as arresting several of its executives.

- “Banks including UBS AG (UBS), Bank of America Corp.’s Merrill Lynch and JPMorgan Chase & Co (JPM) have enabled about $3.7 billion of bond issues to cover deficits, pension shortfalls and debt payments since 2005, . .The debt sales cost Detroit $474 million, including underwriting expenses, bond-insurance premiums and fees for wrong-way bets on swaps” (Bloomberg Businessweek)

- In a massive report, Senate Permanent Committee on Investigations found that UBS, Bank of American, JPMorgan Chase, Deutsche Bank, Wells Fargo, New York Mellon, and Citibank, all creditors of Detroit, engaged in a criminal conspiracy: “Our investigation found a financial snake pit rife with greed, conflicts of interest, and wrongdoing.”

- UBS is a prominent sub-prime mortgage lender in Detroit, responsible also for numerous foreclosures.

JPMORGAN CHASE

Involved in hundreds of millions in wrong-way bets on interest swap deals in Detroit (Bloomberg Businessweek—see above), as well foreclosures resulting from predatory lending here.

**Client of JONES DAY, which also represents National Public Finance Guarantee Corporation as a creditor in November 2011 chapter 9 municipal bankruptcy filing by Jefferson County, Alabama. Jones Day falsely claimed to the Detroit City Council that it represented the County in the case, according to Councilwoman Brenda Jones.

- Holds $1.22 billion of sewer stock in Jefferson County, Alabama; had to forego 70 percent of payments in pending bankruptcy settlement due to bribery of county officials.

- 2009 SEC complaint: Chase agreed to forgive all termination fees Jefferson County owed on sewer swaps, about $647 miliion.

- “All told, at least eight federal agencies are investigating the bank, including the Federal Deposit Insurance Corporation, the Commodity Futures Trading Commission and the Securities and Exchange Commission. Federal prosecutors and the F.B.I. in New York are also examining potential wrongdoing at JPMorgan.” (Dealbook—NY Times)

- Accused of foreclosure fraud across the U.S.

- Chief defendant in LIBOR interest rate-rigging lawsuits globally.

CITIGROUP

**Jones Day client

- Senate Report included Citibank, a Citigroup subsidiary, in its report detailing “greed, conflicts of interest, and wrongdoing.”

- Citigroup, Inc. agreed to pay $730 million to settle SEC claims it misled debt investors about its condition during the financial crisis of 2008.

- “Citigroup received the most TARP money, $45 billion, tying it with Bank of America as Wall Street’s top welfare recipient known at the time; Citigroup was alone among its peers in having its toxic assets, $306 billion of them, ring-fenced at taxpayers’ expense; Citigroup received more secret loans from the Federal Reserve–$2.5 trillion—than any other bank, $500 billion more than Morgan Stanley . . .” (Daily Bail)

- “Two Citgroup, Inc. executives are departing after federal prosecutors named them earlier this year in a mortgage-insurance fraud case that resulted in a $158.3 million settlement and an admission of wrongdoing by the bank.” (Bloomberg Businessweek) l

- Citigroup Exec Sentenced to Eight Years for $23 Million Fraud (Newsmax – June 30, 2012)

Below is YouTube clip from Orr’s “public” meeting June 10, 2013

Jerry Goldberg is right on the money! It is so refreshing to hear from a sane man!

I have worked in the financial industry for many years, however, not with any of the banks or companies that you listed in this article. My question to the protesters in this article is “How did the financiers force Detroit to borrow these large amounts of money? Did any of the financial groups put a gun to the head of the city leaders, and force them to borrow?” City officials frantically searched the financial markets to obtain funds. My belief is that, based on the financial parameters of Detroit, funds with these specific terms were the only method that the financial agents would accept.

Don S

Look first at the photograph of representatives from Standard and Poor’s and Fitch Ratings at the Detroit City Council table in 2005, pushing for approval of the $1.5 BILLION pension obligation certificates (POC) loan from UBS AG and SBS Financial to Detroit. a chief cause of the city’s current crisis. If you put “banks” in the site’s search engine, you will bring up numerous other stories, including a link to the stories I wrote in the Michigan Citizen at the time of the POC loan. That story says both Mayor Kwame Kilpatrick and the ratings agencies threatened lay-offs and service cutbacks, and downgrading of the city’s debt, if the loan was not approved. In fact, they did it anyway AFTER it was approved over the objections of the pension boards, unions, and citizens. This was part of the predatory lending tidal wave that swamped the U.S. and other countries prior to the 2008 economic collapse. THe city defaulted twice on that loan when Wall Street “went south” as a Councilmember warned during consideration of the loan. Even Bloomberg Businessweek ran an article saying, “Only Wall Street profits from Detroit crisis,” noting that loan as well as $474 million in predatory charges for swaps and other maneuvers. Other stories on this site say S&P has been charged with fraud by the U.S. Department of Justice for conspiring with the banks it rates, and that UBS AG was fined $1.5 billion by the USDOJ for fraudulent practices. Saying the banks didn’t hold a gun to the city’s head is like saying they didn’t hold a gun to the head of homeowners who were victimized by predatory sub-prime loans, and blaming the victim instead of the perpetrator. Wall Street profited enormously from these loans, both legally and illegally, and has not been held to account through criminal charges in this country to this day.