DPS as well as other Michigan cities, school districts face higher bond costs

Aug. 19, 2013/WSJ

Detroit’s public-school system is expected to pay a hefty yield premium as it looks to sell $92 million in debt Tuesday, about a month after the city sent shock waves through the municipal-bond market with its record bankruptcy filing.

Early discussions between potential investors and investment banks marketing the debt suggest the one-year debt could yield around 4.50%. That compares with 0.18% yield on a typical, one-year triple-A rated muni, according to Thomson Reuters Municipal Market Data.

“Detroit’s school system is paying” for the city’s bankruptcy, said Michael Camarella, vice president and senior portfolio manager on the Oppenheimer Rochester municipal investment team, which oversees about $33 billion in munis. “Anything with the name of Detroit or issued in the state of Michigan is facing a [price] discount because of Detroit’s actions.”

He said he couldn’t comment on his firm’s participation in the Detroit school deal, but said “obviously, given the yield, it is an attractive investment.”

Detroit’s bankruptcy, filed July 18, has sparked concerns that municipal bonds may not be as safe as many investors once assumed. Kevyn Orr, the city’s emergency manager, has proposed saddling some bondholders with significant cuts as the city looks to restructure more than $18 billion in debt. In the wake of the city’s filing, at least three Michigan local governments have postponed debt offerings, citing the higher interest rates investors are demanding.

While some cities and counties in Michigan may have the luxury of being able to delay their borrowings, Detroit Public Schools has a more urgent need. The district is using the proceeds of Tuesday’s sale, which is being sold through the Michigan Finance Authority, to cover operating expenses for 2013-2014 school year, which starts next month, bond documents said.

Detroit Public Schools is a separate legal entity from the city of Detroit, and the city’s emergency manager, mayor and city council don’t have “any authority over the District,” bond documents said. The debt has a rating of SP-1, Standard & Poor’s second highest short-term debt rating.

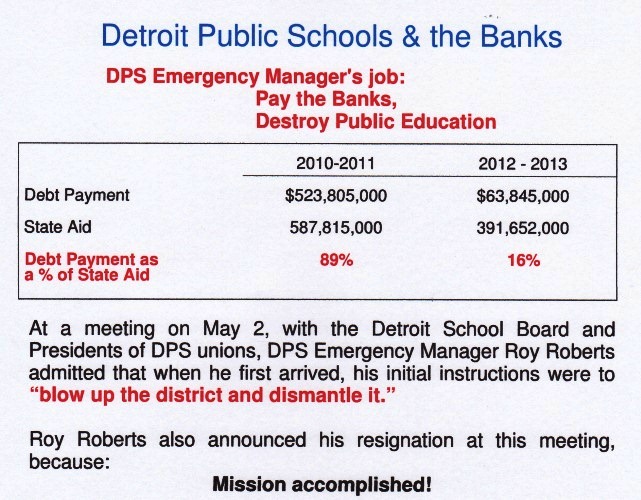

Still, Detroit Public Schools have been under state control, under a separate emergency manager, since 2009, given its fiscal distress. Detroit Schools has lost more than 33,000 students, or 40% of its enrollment base, since 2010, according to S&P, as charter schools have become more prevalent and Detroit’s fortunes have dwindled.

The district’s general fund deficit shrank from $283.9 million to $76.3 million, according to its fiscal 2012 audited financials, due in part to a debt restructuring.

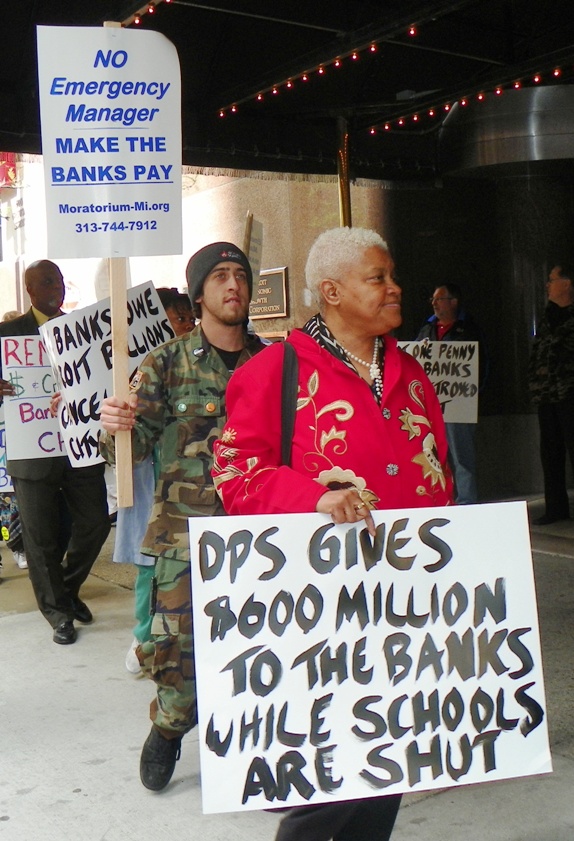

Detroit teachers struck for one day in 2001 to attend this massive protest in Lansing against charter school legislation.

Still, investors could be comforted by the fact Tuesday’s Detroit schools deal is backed by a pledge of state aid, which is allocated to pay bondholders before the school district gets its share of the money, said Robert DiMella, co-portfolio manager of the $965.3 million MainStay High Yield Municipal Bond Fund.

Greedy Banker vs. the World game. Banker says Detroit bankruptcy is “opportunity” to rake in more billions.

“The state backing on these bonds is very strong,” said Mr. DiMella, who said his firm would consider purchasing some of the Detroit school bonds. “We do believe Detroit’s bankruptcy is creating a lot of different opportunities but you have to be very careful.”

Detroit Schools’ enrollment could decline as much as 33%, and debtholders should still get paid, according to S&P. The estimated 51,070 students enrolled in Detroit schools for the 2013-2014 school year is down about 250 people from last year, and the district is projecting stable enrollment through fiscal 2016, S&P said.

The state aid pledged to the new Detroit schools debt is protected by state law, according to bond documents. Still, “the enforceability of this lien in the event of a Chapter 9 bankruptcy case of the District…is uncertain,” the documents said. A municipal bankruptcy isn’t currently being considered by the district’s emergency manager, according to S&P.

Detroit schools also has some other outstanding debt backed by its state aid, and those obligations will get paid off before the debt being sold Tuesday would, said Josh Gonze, portfolio manager at Thornburg Investment Management, which oversees about $10 billion in munis. State aid to Detroit schools could also be delayed or may decline, because it depends on student enrollment, he added.

Still, the high yield being offered on the school debt could make the risk of holding it worthwhile, said Mr. Gonze, who said his firm was considering participating in the deal. “It’s an enormous amount of yield” that is hard to find on other short-term debt, he said.

Sent to VOD by

Thomas C. Pedroni