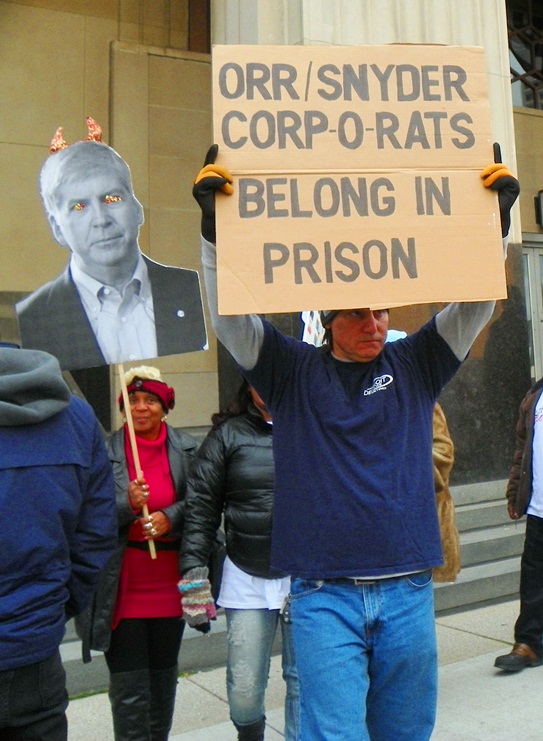

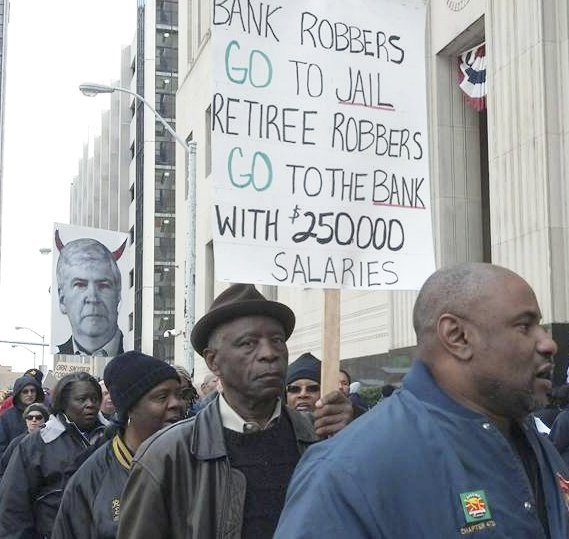

City retirees and supporters protest outside federal courthouse in downtown Detroit Oct. 28 as Michigan Gov. Rick Snyder, depicted as the devil in signs, testifies.

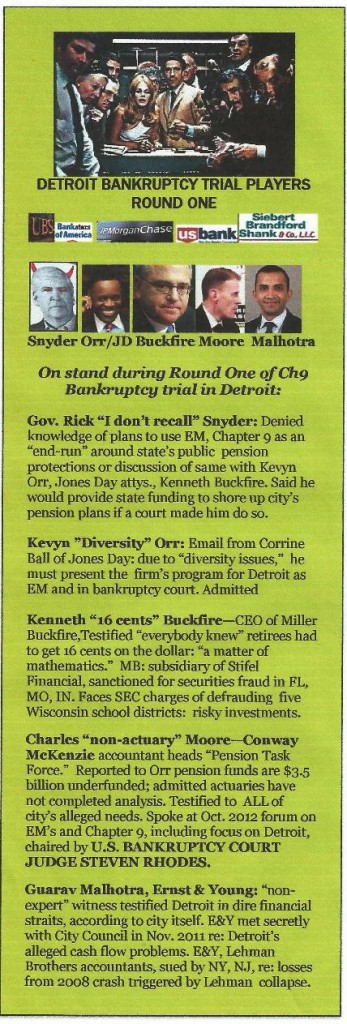

Snyder, Orr, “non-expert” witnesses testify in favor of bankruptcy

Contrast in Stockton: pensions, assets untouched, pension bonds hit

Analysis

By Diane Bukowski

November 3, 2012

DETROIT – As Round One of the Chapter 9 bankruptcy eligibility trial wraps up here in the nation’s poorest and largest Black-majority city, it has become clear that Wall Street is calling the shots. Michigan Gov. Rick Snyder, Detroit Emergency Manager Kevyn Orr, and the trio of well-paid “non-expert” consultants who testified in the first two weeks of the trial are obeying.

DETROIT – As Round One of the Chapter 9 bankruptcy eligibility trial wraps up here in the nation’s poorest and largest Black-majority city, it has become clear that Wall Street is calling the shots. Michigan Gov. Rick Snyder, Detroit Emergency Manager Kevyn Orr, and the trio of well-paid “non-expert” consultants who testified in the first two weeks of the trial are obeying.

One, Kenneth Buckfire, said “everyone knows” that retirees will only get 16 cents on the dollar. Another, accountant Charles Moore of Conway McKenzie, admitted that actual actuaries (not accountants) have not yet determined a final figure relating to alleged pension underfunding. The Proposal to Creditors presented by Orr June 14 said it was $3.5 billion, while the most recent finalized reports say it is $646 million.

Current developments in the Stockton, CA bankruptcy filing, transpiring under elected city officials, are making the Street all the more determined to set a precedent in Detroit by slashing public pensions and assets through an unelected “emergency manager,” while preserving billions in payments to bondholders.

MOODY’S ON STOCKTON

“Under Stockton’s plan, the unfunded accrued pension liability of its retirees remains untouched, and the city will continue to fully fund its required contribution to CalPERS [California Public Employee Retirement Systems],” Moody’s Investors’ Service reported Oct. 15. “We estimate that the city’s unfunded accrued pension liability, from both pension plans held by CalPERS, is approximately $500 million.”

Moody’s concurrently lowered its rating on the city’s $125 million worth of “pension obligation bonds,” peddled by the notorious Lehman Brothers, from “Ca” to “Caa3.” According to Reuters, Stockton pension bond holders face a loss of 50 to 65 percent of principal in the plan of adjustment, which would be paid by insurer Assured Guaranty.

(L to r) Jan 31, 2005: Former city CFO Sean Werdlow, Bill Doherty of SBS, Joe O’Keefe of Fitch Ratings, Stephen Murphy of Standard & Poor’s, former Deputy Mayor Anthony Adams press for $1.5 BILLION POC loan from UBS AG, SBS at Council table. Werdlow was hried by SBS in Nov. 2005, remains there.

The global criminal bank UBS AG sold $1.5 BILLION worth of the same type of bonds to Detroit in 2005-06, an evidently fraudulent deal. Instead of going after UBS AG, as Stockton went after Lehman, Orr wants to protect UBS AG’s grand heist through a “forbearance agreement” on $279 million of related interest-rate swaps. That will be debated during the plan adjustment phase of the case, to follow if U.S. Bankruptcy Judge Steven Rhodes confirms bankruptcy eligibility.

His confirmation is likely, despite arguments by attorneys for retirees, who say that the city is not eligible because the bankruptcy filing was done without exempting public pensions, protected by the Michigan Constitution, as they are in California.

After Denton’s attorney Anthony Ullman, representing the Official Retirees Committee, grilled Orr Oct. 28, Rhodes asked Ullman off the record, “May I ask you a question about your line of questioning regarding the Michigan Constitution—is it your position that it prohibits the city from asking retirees to negotiate [on cuts to pensions]?”

Rhodes chaired a forum on Chapter 9 and emergency managers in October 2012, whose participants included accountant Charles Moore of Conway McKenzie, a key witness for Orr/Jones Day in the trial, and attorneys, one who co-authored Public Act 4, the predecessor to EM Act PA 436, and two who trained emergency managers. (See http://voiceofdetroit.net/2013/10/27/a-thousand-take-streets-to-stop-detroit-bankruptcy-repeat-action-mon-oct-29-12-n-as-snyder-testifies-rhodes-should-recuse-self-led-pro-em-forum/.

SNYDER: “I DON’T RECALL” PENSION-CUTTING DISCUSSIONS

The “Proposal to Creditors” Orr presented June 14 calls for cessation of all city payments into its pension plans. It says, “There must be significant cuts in accrued, vested pension amounts for both active and currently retired persons.”

The State Constitution, Art. 9, Sec. 24 says:

“The accrued financial benefits of each pension plan and retirement system of the state and its political subdivisions shall be a contractual obligation thereof which shall not be diminished or impaired thereby. Financial benefits arising on account of service rendered in each fiscal year shall be funded during that year and such funding shall not be used for financing unfunded accrued liabilities.”

Orr has announced that as of Jan. 1, 2014, current and retired workers’ health care benefits, unprotected under the Constitution, will be eliminated, replaced with a $125 a month stipend to be used under Obamacare. He has also proposed a $9 billion sell-off of Detroit’s Water & Sewerage Department, the third largest in the country, and signed a state lease of Belle Isle, the nation’s largest public island park.

Noreen and Kenneth Buckfire square-dancing at event in NYC they chaired: “New York New York’s a Wonderful Town.” No wonder–Wall Street’s there.

Snyder testified that EM/bankruptcy-related efforts to score a direct hit on public pensions and assets began “two and one-half years ago.” He said the state would back up Detroit pension funds, as implied in Art. 9, Sec. 24, only under a judge’s order.

Snyder was asked whether he met with Kenneth Buckfire and Jones Day attorneys on June 5, 2012 to discuss a contingency plan if the state’s original Emergency Manager law, Public Act 4, was overturned, and the use of Chapter 9 bankruptcy as an “end-run” around Michigan’s constitutional protections of public pensions.

“I don’t believe so,” he replied.

Shown an email from Heather Lennox of Jones Day indicating that she was “going with Kenneth Buckfire June 5, 2012 to meet with the governor in Michigan,” he said, “I recall meeting with Buckfire, not this specific meeting. I literally do thousands of meetings.”

Asked whether he recalled the Jones Day attorney or Buckfire talking to him about state public pension protections at the meeting, he replied, “I don’t recall.”

Miller Buckfire, a subsidiary of Stifel Financial, embroiled in numerous securities fraud actions across the U.S., and Jones Day were hired in January, 2013 as the city’s “investment banker” and “restructuring consultant” respectively, after City Council approval, despite a public outcry.

SNYDER IGNORED TOP ADVISORS ON BANKRUPTCY APPROVAL

Regarding any discussions with Orr during preliminary EM interviews over whether “vested pension benefits could be reduced or modified under Chapter 9,” Snyder repeated, smiling smugly, “I don’t recall.”

Eventually, city retirees in the audience shouted out “I don’t recall” prior to one of his final responses.

Snyder admitted that he authorized Orr to peremptorily file bankruptcy on the city’s behalf only three months after the EM’s appointment, despite the disagreement of his own top advisors.

Attorney William Wertheimer, representing a group of individual city retirees known as the Flowers plaintiffs, displayed an email from state records regarding Orr’s formal request for bankruptcy approval, dated July 8, 2013 and forwarded to Snyder on July 12.

Former State Treasurer Andy Dillon was showing signs of exteme wear and tear back in 2011, during Detroit Financial Review Team meeting.

The email chain includes, among others, Snyder’s chief of staff Dennis Muchmore, top adviser Richard Baird, and former State Treasurer Andy Dillon, who recently resigned in the midst of a messy divorce and allegations of alcoholism.

“Andy [Dillon] . . . and Baird are in favor of a more deliberative approach at your end, not an authorization but more in the nature of probing and questioning Kevyn’s assumptions/conclusion,” Muchmore’s email says. “. . . I favor this approach primarily because I think we should exercise the Governor’s ability under PA 436 to place conditions on his authorization for a bankruptcy filing. These could include such items as pre-approval by Treasury and/or the Governor of any plan in bankruptcy Kevyn might wish to submit for example. The conditions could also include such items as pre-approval for anything having to do with vested pension benefits, General Obligation debt, or the disposition of certain assets or assets greater than a certain amount in value.”

Dillon is expected to testify, apparently on behalf of eligibility objectors since Orr/Jones Day rested their case Nov. 4, on Nov. 5.

KEVYN ORR: “STAR” FOR JONES DAY; FIRM MET WITH STATE BEGINNING MARCH 2012 TO ENSURE EM, CHAPTER 9

Although Orr resigned from the global Jones Day law firm prior to his appointment March 18 as EM, another email made it clear he is taking orders from the pro-corporate, ultraconservative, racist leaders of the firm.

Jones Day represents most of the world’s largest banks and most of Detroit’s major creditors, including UBS, Siebert, Brandford and Shank, JPMorgan Chase, Deutsche Bank, and others. Many have been caught up in global scandals over interest-rate fixing under LIBOR and the ISDAfix, among other crimes.

An email from Corrine Ball, a Jones Day partner, to Orr dated Jan. 15, 2013, ironically the birthdate of Dr. Martin Luther King, Jr., regarding Orr’s proposed appointment as EM, was admitted into evidence.

“Kevyn- there are diversity related issues, you have to be the star on this stuff and be able to discuss what we can provide,” Ball wrote.

Another email dated Feb. 11, 2013, said, “Preparation for the EM appointment is important. We must prepare for an orderly transition, not a flash landing. Not sure the state, Dillon, Baird, and the Governor are really thinking and preparing on an operational level. It would be a better process if the firm is well prepared. Jones Day should be there before the EM is in place.”

Dentons attorney Anthony Ullman of the Official Retirees Committee asked Orr, “Were you aware that Jones Day was in discussion on March 24, 2012 with the state of Michigan about the possibility of the repeal of Public Act 4?”

Ullman displayed a two-page Jones Day email, referring to a meeting with a “state treasury official” about achieving a “Consent Agreement” before the referendum election, as a step towards the installation of an Emergency Financial Manager.

The City Council passed that consent agreement on April 4, 2012, less than two weeks after the email, and the anniversary date of Dr. King’s assassination. PA 4 was defeated by 53 percent of Michigan’s voters Nov. 4, 2012.

“As such, state legal counsel and Jones Day provided guidance on whether a Chapter 9 filing could be upheld if PA4 was pulled back?” Ullman asked Orr.

Orr testified he was “not aware” of that.

“Are you aware that Jones itself was involved in suggesting an appropriations measure to PA 436?” Ullman asked. PA 436 was enacted in Dec. 2012 including a financial provision which made it referendum-proof.

“I never heard that from anyone at Jones Day,” Orr said.

“Prior to the Chapter 9 filing, were you aware of any legal precedent allowing an Emergency Manager to use Chapter 9 bankruptcy to trump the state constitution?” Ullman asked Orr, who has boasted that federal law trumps state law.

“I handled cases involving federal law over state law, but whether I was I aware of specific cases [involving Chapter 9]—I don’t think there were any specific cases,” Orr replied.

During his testimony, Orr admitted to making what one city retiree called “threatening” statements about his powers during a “public meeting” held at the Wayne State Law School’s tiny Spencer Partrich Auditorium on June 10.

The statements were played back from the videotape: “I have a very powerful statute—I have an even more powerful Chapter 9. I don’t want to use it but I’m going to accomplish this job—that will happen—Pay me now or pay me later. That is going to happen.”

At one point during his testimony, Orr said “Chapter 9 had been considered since 2005.”

Orr denied knowledge that he would receive bonuses to his $275,000 salary for early conclusion of the Chapter 9 proceedings, set out in one communication admitted into evidence. He said he was under pressure because his term is 18 months. However, PA 436 provides for the Governor to extend that term, and for a state-appointed “transition team” to govern city affairs for an indefinite period once the EM leaves.

Other emails to Orr from Jones Day partners were introduced into evidence.

They stated variously, “Food for thought – the Bloomberg Foundation has a keen interest in this area, about financial support for the project and particular for the EM,” and “Making this a national issue is not a bad idea. It provides political cover, and more than enough patronage to allow either Bing or Snyder to look for higher callings in the Cabinet, Senate or corporations. Further this would give you cover and options are on the back end to make up for your lost time here.”

Attorneys for retirees and unions contended that Orr had no intention to negotiate in good faith, a requirement for bankruptcy eligibility approval. They introduced a “roll-out plan” for events included in the June 14 Proposal to Creditors, which allowed a period for counter-proposals and review that ended July 19.

Orr admitted that he crossed out the date July 19 at the top of the bankruptcy petition, replacing it with “July 18.”

He said the date was moved up because three lawsuits, filed earlier by Flowers et al, Weathers et al, and the city’s retirement systems asking a state judge to bar any bankruptcy filing without a specific exemption for public pensions.

Thirtieth Circuit Court Judge Rosemarie Aquilina ruled in favor of the plaintiffs during a meeting July 18, as Orr was filing the bankruptcy petition at 3:47 p.m. the same day. Rhodes later put a bankruptcy stay on the state lawsuits, along with two federal lawsuits challenging the constitutionality of PA 436, before U.S. District Court Judge George Caram Steeh.

“I was getting ready to lose control,” Orr said. “I ignored the lawsuits for almost three weeks. . . . I was concerned one of the lawsuits could undermine my authority under PA 436 to get the job done.”

Asked “What authority?” Orr responded, “All of my authority.”

Attorney William Wertheimer, representing the Flowers plaintiffs, who re-filed in bankruptcy court, asked Orr, “Have you ever in your meetings or communications with the governor or his staff in any way communicated to him that it was your intention as the representative of the City of Detroit to make a legal claim that state would be obligated to pay any pension obligations under Art 9 sec. 24? In any of your conversations with the governmor, did you ever communicate that because of state law in Michigan, pensions are sacrosanct?”

Resorting to Engler’s ploy the previous day, Orr said, “I don’t recall.”

Resorting to Engler’s ploy the previous day, Orr said, “I don’t recall.”

To many further questions, he pled attorney-client privilege, claiming attorneys were present at his meetings with the governor.

On Oct. 28, before Snyder’s testimony, attorneys grilled Orr about statements in the Proposal for Creditors that the city’s pension systems are underfunded by $3.5 billion.

Charles Moore of Conway McKenzie testified Oct. 24 that he conveyed that figure to Orr, although Moore is not an actuary, and also that actuarial analyses of the level of pension underfunding have not yet been completed.

Attorney Ullman asked, “Was it your understanding that Milliman, Inc. said the systems are $0.6 billion underfunded, and perhaps significantly more once appropriate actuarial assumptions are made? As of June 30, 2011, most recent actuarial reports showed the pensions’ unfunded actuarial assumption liability (UAAL) at $646 million. The OPEB (Other Public Employment Benefits) stood at $5. 7 billion. Utilizing more current dates and or/more conservative foundations could cause that liability to rise into the billions of dollars?”

Orr admitted that was the case.

(Further reports on earlier testimony by Guarav , Charles Moore, and Kenneth Buckfire will be forthcoming if time permits. Meanwhile, readers can hear the audiotapes of the bankruptcy hearings to date by going to http://www.mieb.uscourts.gov/apps/detroit/DetroitBK.cfm and clicking on “Hearing audio files” under “Quick Links.” A PDF file will download. Click on the paper clip icon on the upper left side, and audiotape will come up.)

Related articles on Stockton bankruptcy:

http://www.reuters.com/article/2013/10/15/stockton-downgrade-idUSL1N0I500W20131015

https://fiscalbankruptcy.wordpress.com/2013/10/08/10-8-13/

Pingback: JUST IN! Non-Corporate Detroit News Reports… | I Do Not Consent

Pingback: DETROIT BANKRUPTCY TESTIMONY: RETIREES GET 16 CENTS, WALL … – voiceofdetroit | ISDAfix

***AS THE WALLS COME TUMBLING DOWN*** ??? 🙂

Take Care! “GREAT ARTICLE “DIANE” !!

***Me KEITH D-II DAVIS AEROSPACE TECHNICAL HIGH SCHOOL (“Moth Balled”?) 1973 ALUMNI / FREE DETROIT / HOOD RESEARCH***

***Love*Peace*Out***

Great work Diane, as usual! Thanks!