Rhodes has scheduled no hearing on lawsuit

Banks, Wall Street reps not named in lawsuit, media reports on Werdlow

Is lawsuit a paper tiger for mediation purposes?

By Diane Bukowski

February 11, 2014

DETROIT – A lawsuit FINALLY filed by Detroit Emergency Manager Kevyn Orr against the 2005-06 Pension Obligation Certificates (COPS) loan in U.S. Bankruptcy Court on Jan. 31 says, “. . . the total amount of the outstanding COPs is approximately $1.45 billion.” It seeks a declaratory judgment and injunction against any further payment by the City of Detroit on what it calls transactions that were flagrantly illegal and void ab initio.

- Former Mayor Kwame Kilpatrick accepts “Bond Buyer” award for innovative (and criminal) POC financing scheme, as Sean Werdlow hovers in background.

That SHOULD be $1.45 billion back in the city’s coffers. Additionally, an argument SHOULD be made that the money already paid out, estimated by a Detroit News report to be $2.8 billion with interest, fees and penalties, should be returned.

Former Detroit CFO Sean Werdlow, now COO of the minority lender involved, Siebert, Brandford and Shank, has FINALLY been all over the front pages and on TV news as one perpetrator of the shady loan, the largest such deal in state history. This reporter has fingered him since 2005 in the pages of the Michigan Citizen, Voice of Detroit, and in a filing before U.S. Bankruptcy Judge Steven Rhodes in Aug. 2013.

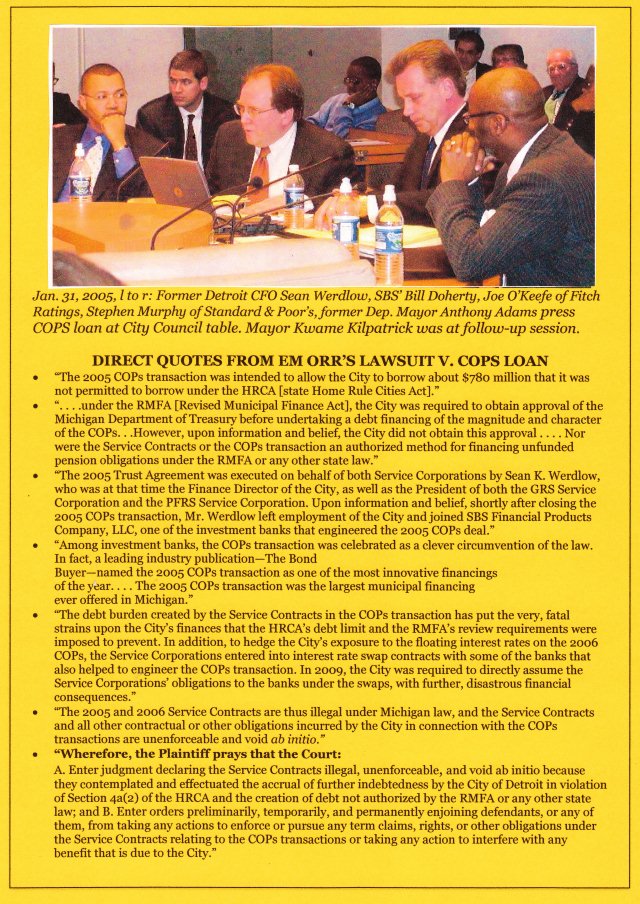

Despite this welcomed vindication, VOD notes that the chief lenders in the deal, UBS AG and later Bank of America, and co-brokers Stephen Murphy of Standard and Poor’s, and Joe O’Keefe of Fitch Ratings, (seen in photo taken by this reporter in box below) are nowhere cited as likely criminal lead conspirators and racketeers by the big business media. They are also NOT defendants in the lawsuit.

“To uphold his oath and protect the rights of pensioners, Attorney General [Bill] Schuette has asked the 6th Circuit Court of Appeals to decide this question,” Michigan’s AG says in a release. “Michigan’s Pension Clause in the constitution is more than just a contract right: its inviolability is a part of Michigan’s fundamental law.”

(VOD has a request in to Schuette’s office for a copy of the filing, which a diligent search on numerous court sites did not turn up.)

So why are news reports still replete with such headlines as “Detroit may tailor pension cuts to ages, incomes?” (Detroit News, Feb. 11, 2014).

Judge Rhodes has yet to schedule a hearing on the lawsuit, two weeks later. The City (i.e. Kevyn Orr and the Jones Day law firm), claims it will be filing a proposed “plan of adjustment” next week, presumably including pension cuts and health care reductions for both active and retired workers.

Yet the violations cited in the lawsuit are mind-boggling. They say the “Service Corporations” and a Trust set up to handle the transaction only existed on paper, repeating contentions made in a Demos report by Wallace Turbeville in Nov. 2013, and that the debt incurred to them is void ab initio. Below are some sections, with the complete lawsuit at DB POC lawsuit.

The lawsuit does not cite the additional fact, as does Turbeville, that as debt, the COPS should have been treated as bonds and therefore have been subject to a city-wide vote.

It also claims falsely that the State Constitution ensures pension rights outside of bankruptcy, and that it was the Retirement Systems themselves who insisted on payment of 30 years of unpaid obligations. The retirement systems, as correctly noted in the Channel 7 video at top, in fact vehemently objected to the issuance of the mammoth debt, as did many union leaders, city workers, and retirees, at Council hearings covered by this reporter.

It appears evident that EM Orr, in likely collusion with Judge Rhodes, who chaired a pro-EM, pro-PA 4 conference on Oct. 2012, are using the lawsuit simply as a paper tiger to threaten the city’s creditors into some concessions. They are also trying, in mediation, to elicit concessions from the pension systems, whose ELECTED officials have been strangely silent outside of court filings, and have not mobilized the massive protests that retirees as well as current city workers and residents, should be conducting to safeguard their livelihoods and their city.

Judge Steven Rhodes (3rd from l) at “Municipal Distress Forum” on Ch. 9 and EM’s, with participants (l to r) Frederick Headen of the state treasury, a participant in dozens of city takeovers, Edward Plawecki, Douglas Bernstein, an EM trainer, Judy O’Neil, a co-author of PA 4 and an EM trainer, and Charles Moore of Conway McKenzie, a chief witness for Orr/Jones Day during the bankruptcy hearing, and advocate of pension cuts.

Related:

We colu’dve done with that insight early on.

Voice of Detroit has been reporting on this Loan since its founding. Previous to that, VOD editor Diane Bukowski reported on the COPS Loan from its outset in 2005 in the Michigan Citizen.