Stephen Murphy of Standard and Poor’s (at mike) and Joe O’Keefe of Fitch Ratings sell snake oil to City Council Jan. 31, 2005: COPS loan of $1.44 billion which caused the city to default in 2009 after 2008 global economic collapse due primarily to predatory mortgage lending.

![]() Moody’s Sees Detroit COPs Repudiation as Isolated

Moody’s Sees Detroit COPs Repudiation as Isolated

FEB 14, 2014 10:00am ET

CHICAGO — Detroit’s attempt to invalidate $1.4 billion of pension certificates as part of its bankruptcy is a “radical” move that is unlikely to be copied by other issuers even if successful, according to Moody’s Investors Service.

“The attempted repudiation of municipal debt is an extremely rare and unusual act,” Moody’s said in a comment released Friday titled “Desperate Times Call for Desperate Measures: Detroit’s Attempted COPs Repudiation an Extreme Act.”

“Ultimately, the city’s repudiation attempt is unlikely to impact the broader municipal market because it is so rare. Should the city prevail, the case is still likely to have limited implications for COPs holders elsewhere,” analysts wrote.

Detroit filed the lawsuit challenging the certificates of participation on Jan. 31, arguing that the debt structure, which relied on service corporations, is illegal because it was set up solely to allow the city to avoid state debt limits.

The lawsuit is part of the city’s ongoing effort to settle with its swap counterparties, who hedge $800 million of the COPs.

If the city wins in court, it could be positive for other creditors because it would mean more money to go around, Moody’s notes.

But it’s also possible that the city could be made to return the proceeds of the $1.4 billion sale, which were used to fund its two pension systems. That would severely weaken the pension funds’ assets and could roil the bankruptcy case.

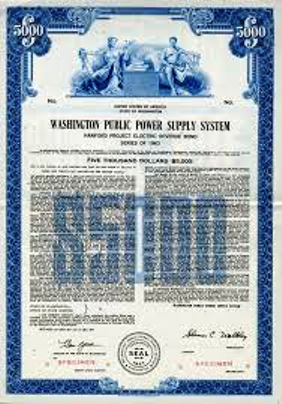

The last time a government tried to repudiate debt on such a scale was in 1983, when the Washington Public Power Supply System successfully argued that its take-or-pay contracts were illegal and invalidated $2.25 billion of revenue bonds.

“We do not expect debt repudiation to become a frequently used tactic for local governments given the very strong credit fundamentals of the vast majority of COPs issuers,” Moody’s said. There are very few other Michigan issuers who have used similar debt instruments, and many states recognize lease-back obligations as valid, according to Moody’s.

“We do not expect debt repudiation to become a frequently used tactic for local governments given the very strong credit fundamentals of the vast majority of COPs issuers,” Moody’s said. There are very few other Michigan issuers who have used similar debt instruments, and many states recognize lease-back obligations as valid, according to Moody’s.

In related news, Bankruptcy Judge Steven Rhodes, who is overseeing Detroit’s Chapter 9 case, set a hearing date of Feb. 19 for a key dispute that goes to the heart of the city’s effort to treat its unlimited-tax general obligation bonds as unsecured.

National Public Finance Guarantee Corp. and Assured Guaranty Municipal Corp. sued Detroit in November over the city’s treatment of the ULTGOs as unsecured. Ambac Assurance has filed its own suit, which includes the limited-tax GO bonds.

The insurers are arguing that the ULTGOs are secured because they are paid for with a special property tax levy imposed specifically for those bonds and as such are special revenues. State law requires that those tax revenues raised under the levy not be diverted for any other purpose than debt-service on the bonds, in or outside of bankruptcy, according to the insurers.

Detroit is current using the tax money raised under the levy for general operations.

“The ‘pledge’ of special ad valorem taxes is not, and is not intended to be, a mere ‘promise,'” the insurers argued in a recent filing that counters the city’s claim that a pledge is distinct from a statutory lien.

The city claims that the pledge is similar to the “pledge of allegiance,” and therefore not a promise or a lien, the insurers say in a footnote.

“In fact, it is a pledge of specific and identifiable property,” the insurers claim. “The appropriate analogy is not ‘I pledge allegiance to the flag,’ as defendants argue, but rather, ‘I pledge this flag for repayment of my debt.'”

The issue is a key one for the municipal market, which traditionally has treated ULTGOs as among the safest debt available, secondary to treasuries, noted Richard Ciccarone, president and chief executive officer of research firm Merritt Research Services LLC.

Critics point to the apparent lack of a statutory lien, but from a “common sense perspective, it has all the markings of a special revenue designation,” Ciccarone said. “Going to intent and common sense, you have to ask, what else are you going to use that money for?” he said. “It doesn’t make sense and it’s harmful to the entire municipal credit structure if you let the GO go that easily.”

MOODY’S: DESPERATE TIMES CALL FOR DESPERATE MEASURES: DETROIT’S ATTEMPTED COPS REPUDIATION AN EXTREME ACT

On January 31, the City of Detroit, MI (Caa3 negative) filed a motion with the bankruptcy court to invalidate $1.45 billion of pension obligation Certificates of Participation (COPs). The attempted repudiation of municipal debt is an extremely rare and unusual act. A successful repudiation is still subject to court approval and would be credit negative for holders of the city’s COPs and potentially for pensioners and other bondholders if the city were also required to return the proceeds of the certificate sale. The return of proceeds is a possibility since they were used to fund the city’s previously unfunded pension liabilities and are part of the assets of the pension system. Ultimately, the city’s repudiation attempt is unlikely to impact the broader municipal market because it is so rare. Should the city prevail, the case is still likely to have limited implications for COPs holders elsewhere.

While repudiation is radical, some creditors may actually benefit if the court invalidates Detroit’s COPs, simply by making more funds available for unsecured creditor recovery. The city would no longer need to include repayment for $1.45 billion in COPs principal in its reorganization plan, including a projected $676.3 million in cumulative COP debt through 2023 and $498 million of forecasted expenditures for swaps related to the COPs, according to analysis presented in the city’s Proposal to Creditors in June 2013. Because COP proceeds funded pension liabilities, the funded status of the pensions could be severely weakened, however, if the court disgorges those proceeds following the repudiation. The ultimate disposition of the proceeds, should disgorgement occur, is unknown.

It is rare for a US municipal issuer to repudiate debt. The most recent example of a successful repudiation occurred in 1983, when a state court ruled that the Washington Public Power Supply System’s (WPPSS) Projects 4 and 5 take-or pay contracts were illegally executed. The municipal participants challenged the contracts after the projects were cancelled due to cost overruns and other complications. After the court invalidated the contracts, WPPSS defaulted on $2.25 billion of revenue bonds secured by the contracts. In contrast, Richmond Unified School District, CA failed in its attempt to repudiate its COPs lease obligation after defaulting on a COP lease payment in August 1991. While the district argued that the COPs were invalid because the underlying lease created debt in violation of the state’s constitutional debt limit, the court ultimately ruled that the lease was valid and enforceable. The district settled with the trustee for repayment. Neither of these examples involved an entity in bankruptcy.

Detroit similarly alleges that it issued pension obligation COPs illegally by violating the city’s statutory debt limit, despite the legal disclosure at the time of issuance to the contrary. Setting aside the legal merits of the city’s claim, the broader market impact of a favorable ruling for the city would likely be limited. COPs and instruments of this type are extremely rare in Michigan. Only one other Moody’s rated issuer has used a similar structure, and there is little precedent or case law in other jurisdictions where financings of this type are more common. In many states, the law recognizes lease-backed obligations as valid structures. Moreover, in the context of Detroit, debt repudiation is not completely surprising, given the depth of Detroit’s credit challenges. We do not expect debt repudiation to become a frequently used tactic for local governments given the very strong credit fundamentals of the vast majority of COPs issuers.

VOD: The reports above from the Bond Buyer and Moody’s belie Wall Street’s role in pushing the COPS loan, and profiting from it. They also show alarm at the lawsuit filed against it, and threaten Detroit’s pension systems with having to repay the loan, instead of UBS AG, Bank of America Merrill Lynch, and Siebert, Brandford and Shank, the lenders who profited from it.

It was predatory mortgage lending by these banks and others that was largely responsible for the 2008 global economic collapse, and for the devastation of Detroit’s neighborhoods and tax base. Wall Street reps shown at top pushed this loan KNOWING that danger lay ahead, but assuring the City Council it was safe. S

See former Councilwoman Sharon McPhail’s deposition on the matter at DB McPhail 12 16 13.