Commentary

By Attorney Jerry Goldberg (first speaker in video above)

March 21, 2012

DETROIT – On March 12, 2012, Michigan Governor Rick Snyder proposed a “consent agreement” between the state and the City of Detroit for oversight of the city’s finances in lieu of the state imposing an emergency manager over the city. This “consent agreement,” just like the Emergency Manager act, guarantees that the banks will have direct control over the city’s budget.

Article 11 of the consent agreement states: “This agreement shall remain in effect until (a) the earlier of (i) the end of the third consecutive fiscal years of the city in which . . . (ii) the city has achieved and maintained for at least two calendar years a credit rating by two or more nationally recognized securities rating agencies . . .on the City’s outstanding long-term unsubordinated debt in either of the two highest long-term rating categories of such rating agency.”

These “rating securities agencies,” who will make the determination on the city’s financial solvency, are for-profit corporations who earn their revenues through payments from the banks and financial institutions. By giving the financial institutions the ratings they want to hear, regardless of whether these ratings are justified, these agencies maximize their own revenues and profits.

A report from the United States Senate Permanent Subcommittee on Investigations, “Wall Street and the Financial Crisis,” dated April 13, 2011, documented how in their drive for profit in collusion with the banks, these agencies gave sub-prime and other exotic mortgage securities the highest ratings despite knowing they were fraudulently created and doomed to fail.

The Senate report noted how analyses from Moody’s and Standard and Poor’s, two of the largest rating agencies, continued to give sub-prime mortgages the highest AAA rating despite knowing “of increased credit risks due to mortgage fraud, low underwriting standards, and unsustainable housing price appreciation.”

The Senate report noted how analyses from Moody’s and Standard and Poor’s, two of the largest rating agencies, continued to give sub-prime mortgages the highest AAA rating despite knowing “of increased credit risks due to mortgage fraud, low underwriting standards, and unsustainable housing price appreciation.”

The reason: “Competitive pressures, including the drive for market share and need to accommodate investment bankers bringing in business, affected the credit ratings issued by Moody’s and S&P.”

The city of Detroit was the hardest hit in the country by the predatory lending practices endorsed by these rating agencies, with approximately 85 percent of the city’s mortgage loans being sub-prime, leading to 150,000 foreclosures rom 2005-10, the loss of one-quarter of the city’s population and the leveling of the city’s tax base.

Video and editing by Erik William Shelley of march on Chase Bank 3/13 12

If the consent agreement is implemented, these ratings agencies will be in position to ensure that the same banks, which they collaborated with in destroying Detroit with their criminal foreclosures, continue to get first lien on the city’s tax dollars.

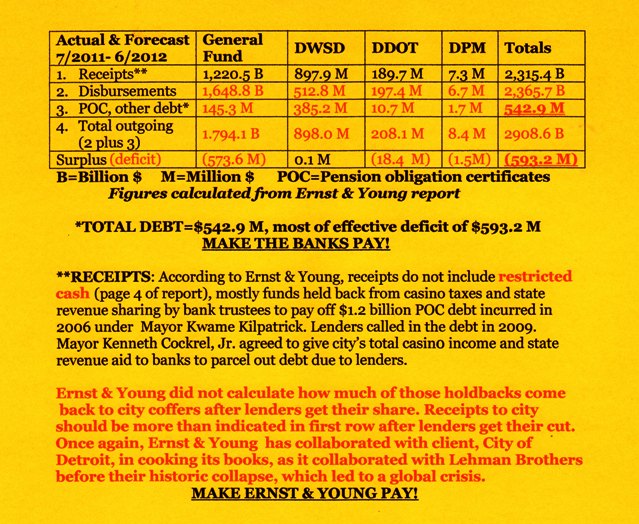

A 2011 Ernst & Young report on the city’s finances noted that for the current fiscal year the City will pay $226.3 million to the banks for debt service out of the general fund, and an additional $399.3 million in debt service from the water, transportation and parking departments. By holding the power to extend the consent agreement indefinitely, the ratings agencies can ensure that their sponsors, the criminal banks, get full payment on the debt service even if it means city services are destroyed, city workers are laid off, and the city’s assets are privatized.

This is consistent with Public Act 4, the Emergency Manager Act, which guarantees the banks “payment in full of the scheduled debt service requirements on all bonds, notes and municipal securities.”

Rather than agree to the Governor’s consent agreement or an alternate agreement, or to the imposition of an emergency financial manager on behalf of the banks, Mayor Bing and the City Council should declare a moratorium or halt on all debt service payments to the banks. A suspension in debt service payments would immediately resolve the city’s fiscal crisis and allow for the restoration of city services and the recall of laid-off city workers. It would give time for the city to go after the banks to repay the billions they have stolen from the people through their fraudulent lending practices.

You make a compelling argument. I have tried to look up this information on my own. I went to the City of Detroit website and found annual debt service payment for 2011-2012 was around $77 million. Do you know where I can the information about how much we owe the banks? Is the Ernst & Young report public information? I would really like to read it!

Pingback: NO CONSENT AGREEMENT OR EM! MAKE THE BANKS PAY! » National Conference for a Moratorium on Foreclosures & Evictions