Detroit bankruptcy protesters listen to Abayomi Azikiwe during lunch break outside federal court July 15, 2014.

Rhodes: “City getting a bad reputation around the world” for shut-offs

Ballots did not disclose that retiree annuity “clawbacks” include additional 6.75% compounded interest rate; is re-vote needed?

Others cite huge health care costs, 75% reduction in retirement income

By Diane Bukowski

July 16, 2014

DETROIT – This city’s barbaric, now world-renowned mass water shut-offs, and a major mistake on ballots sent to retirees that could force a re-vote, lit a flame of hope for individual objectors at a bankruptcy hearing July 15 in front of Judge Steven Rhodes.Rhodes has ordered attorneys for Jones Day, Denton’s and city officials to return to court Monday July 21 to resolve these issues.For the first time in the bankruptcy process, Detroit resident Kris Hamel, who works with the Moratorium NOW! Coalition, raised the issue of the water shut-offs in morning session. Many others followed her lead all day, referencing the notorious practice, which has been condemned by the United Nations, in their remarks.

DWSD bondholders get $537 million on swaps, $5 billion on bonds, while Detroiters’ water is shut off for owing $150

“While the poorest Detroiters have their water cut off for owing $150, JPMorgan Chase, UBS, Loop Financial and Morgan Stanley were paid $537 million in termination fees on interest rate swaps out of $1 billion in bonds . . . that were earmarked to fund repairs of the water infrastructure system, not line the pockets of these four banks,” Hamel told Judge Rhodes.

The Plan of Adjustment lists a total of $5 billion in uncontested claims for DWSD bondholders, who are considered secured creditors not required to take cutbacks.

“It is up to you to stop the national and international disgrace and humanitarian disaster of mass water shut-offs . . . You must immediately enjoin these shut-offs by placing a moratorium on them TODAY and ordering [EM Kevyn] Orr to implement a real water affordability plan for the poorest Detroiters.”

Hamel noted that Orr’s office has called the shutoffs “a necessary part of Detroit’s re-structuring.”

In her objection, Jean Vortkamp talked about two of her neighbor’s small children, Simea and James.

“In concentration camps, there was water,” Vortkamp said. “Many of the children in my neighborhood had their water cut off. Families are taking money from things like rent to pay the bill that they could not afford with our high water rates. My neighborhood is a 10 minute drive to a pumping station on a river connected to the Great Lakes but my water bill is higher than the average U.S. water bill. Privatization usually causes water rates to double or triple. How would that make Detroit a more attractive place to live post-bankruptcy?”

Rhodes ordered Jones Day attorney Heather Lennox to produce a Detroit Water and Sewerage Department representative at the afternoon session to explain the situation.

Jones Day, DWSD excuse shut-offs, are warned by Rhodes

Testimony from DWSD Deputy Director Darryl Latimer began the afternoon session. He claimed the shutoffs began in the fall of 2013 but were suspended until March due to winter temperatures.“Our bill is to the resident, we bill the property,” Latimer said. “We don’t know what or how many individuals live there or whether they can afford their bills.”

He claimed the average outstanding balance on delinquent water bills is $540, and that monthly bills average $75. He said shut-offs happen after 60 days if the outstanding balance is $150 or more.Latimer said DWSD has various resource programs to help “people that come forward.”He claimed an initial payment of 30 percent of the outstanding balance could be waived.

He was later contradicted by objector Cecily McClellan, who headed the Water Affordability Program at Detroit Human Services before the department closed in 2012. McClellan said the 30 percent payment is mandatory. She also noted that delinquent water bills are attached to property tax rolls, so customers can lose their homes as well.

According to DWSD documents, Detroit residents are already penalized with higher sewerage rates than suburban customers to make up for delinquent bills, causing even more delinquencies.Latimer said DWSD has insufficient staff to send to customers’ homes to warn them of pending shut-offs due to recent lay-offs and cutbacks.The original Water Affordability Plan, proposed after massive water shut-offs in 2002, called for rates to be geared towards customers’ incomes, but that provision was shot down in the final version.In contrast, cities like Cleveland have an income provision for up to 40 percent reduction in rates in their water affordability programs. Click on Cleveland water affordability program for description.

Delinquent commercial accounts not being shut off?

Latimer appeared to discount media reports that DWSD plans to shut off commercial customers with higher delinquencies.

Trucks shutting Detroiters’ water off have this insignia. Watch for them! Do not let them in your neighorhood!

“Those are different because regular crews can’t shut off commercial accounts because they have larger valves,” Latimer contended. He admitted later that a contractor [Homrich Wrecking] is doing the shut-offs, exposed by a militant sit-in and arrests

outside Homrich’s facility at 2660 E. Grand Boulevard July 11. Homrich, which is demolishing the Brewster high rises, and earlier did in the Jeffries projects and J.L. Hudson’s downtown store, has very heavy equipment.

“The residential shut-off program has created not only a lot of anger and hardship, but bad publicity that Detroit doesn’t need right now,” Rhodes said. “Cost reductions come at a price. The citizens are very angry and the city is getting a bad reputation around the world . . . this problem is affecting the bankruptcy proceedings.”He asked that Latimer and Lennox return Monday, July 21 for a status conference on their progress in establishing more aggressive assistance programs for Detroiters. He stopped short of ordering a moratorium on water shut-offs as Hamel had asked.

Retiree ballots leave out whopping interest rates on annuity ‘clawbacks’

Objector Steven Wojtowicz, a 30-year retiree from the Detroit Water & Sewerage Department, dropped another bombshell. He said Orr and attorneys from Jones Day did not disclose on ballots mailed to 32,000 retirees that Orr’s Plan of Adjustment (POA) charges a 6.75 percent compounded interest rate on the top of the allegedly illegal annuity savings fund (ASF) interest the EM wants to “recoup” from retirees.

“I looked at my ballot package,” Wojtowicz said. “It said the city will recoup a total of 89,000 from my annuity payments in 12 years. But that should be $189,000 because there is no mention of the 6.75 percent interest [from the POA]. The City says it will save $230 million by the ASF recoupment, but that is actually $400 million with the interest.”

Retiree Belinda Myers-Florence noted in an email that a Freedom of Information Act request has been submitted for an actual accounting of the proposed clawbacks.

“The Judge questioned the Retiree Committee representative and the Jones Day lawyer,” she said. They both began to stutter, fumble, dodge and avoid direct questions posed by the Judge.”

Rhodes asked whether that information was omitted from all 32,000 ballots mailed to retirees.

“6.75 %! RE-VOTE!”

Jones Day attorney Heather Lennox tried to claim the added interest rate was only omitted from 3,200 ballots earlier identified as erroneous because they included interest from 2002, when the amounts were supposed to cover the years from 2003 to 2013.Denton’s attorney Carol Neville, allegedly representing the Official Committee of Retirees, ran to the podium to assist Lennox, but only clouded the matter further.“We are attorneys, not actuaries,” she complained.

On their way out of the courthouse, the attorneys heard chants of “6.75 percent! RE-VOTE!” While the daily media has been trumpeting that most retirees are voting “Yes” on the POA, in fact such a major error may invalidate the ballots and require a massive re-vote.

Denton’s, which recommended a yes vote in its mailing, is supposed to represent the Official Committee of Retirees (OCR). But at least three members of that committee, Gail Wilson, Gail Wilson-Turner, and Michael Karwoski, a retired Law Department attorney, have filed official objections to the Plan of Adjustment. (Click on DB Gail Wilson objection re UMTA, DB Karwoski ASF, and DB obj Gail Wilson Turner to read their objections.)

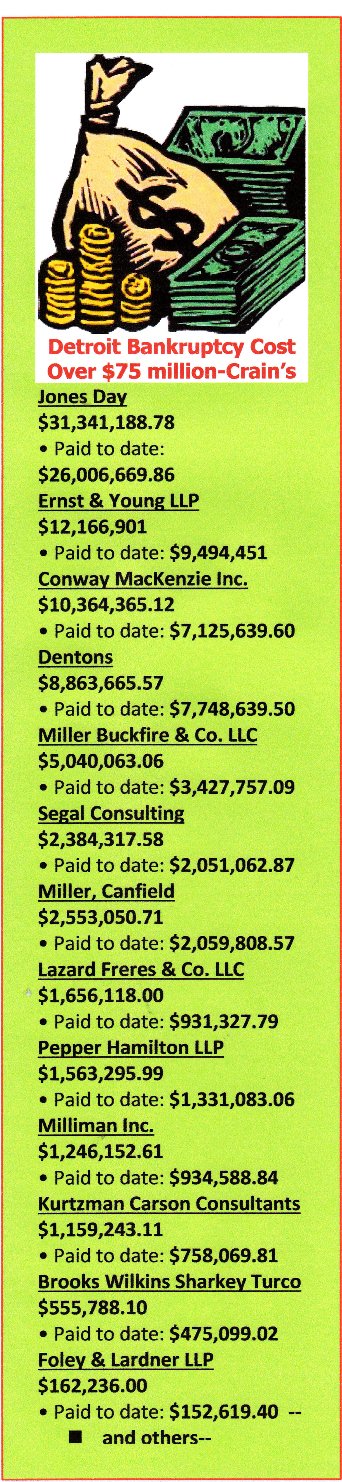

Denton’s has been paid over $7.4 million so far by the City of Detroit, allegedly to represent the OCR. But its letter to retirees says it is represents itself and the city only.

Denton’s has been paid over $7.4 million so far by the City of Detroit, allegedly to represent the OCR. But its letter to retirees says it is represents itself and the city only.

Retiree Irma Industrious questioned whether the clawback itself is legal, noting that 11 USC 547 of the Bankruptcy Code sets a limit on recoupment of 90 days prior to the filing of the bankruptcy petition.

“Why not recoupment of debts from state, banks, feds?”

Cecily McClellan is a leader of the Detroit Concerned Citizens, Active Employees, and Retirees, which has been conducting “NO” vote drives throughout city neighborhoods in U-Haul Trucks festooned with banners.

She said, “The Governor places no value on the people of the City of Detroit. The retirees are being scapegoated. The Great Recession of 2008 was not caused by the retirees, but by Wall Street greed. The state needs to pay Detroit the $730 million it owes the city in revenue-sharing. There should be a moratorium on all corporate tax abatements. The banks need to be sued. Even Public Act 436, under which Orr operates, says that he must comply with the state constitution by not impairing or diminishing pension benefits.”

McClellan and others also noted that the bankruptcy takes federal funds from workers whose wages, benefits and pensions are or were fully funded by federal grants, including those from the departments of Health, Human Services and Workforce Development.

In her written objection, Committee of Retirees member Gail Wilson, who is the widow of Leamon Wilson, long-time president of the bus mechanics’ AFSCME Local 312, says the POA fails to comply with the Federal Urban Mass Transit Act (UMTA) Sec. 13(c).

Her objection reads in part that the UMTA requires that “recipients of grant funds for the purpose of implementing projects, maintenance and/or operations involving mass transportation, must first voluntarily agree to enter into a Protective Agreement with the affected labor organization(s) to ensure that members of the labor organization are not harmed as a result of the project. . . .such protective assistance shall include, without being limited to, such provisions as may be necessary for (1) the preservation of rights, provisions and benefits (including pension rights and benefits) under existing collective bargaining agreements . . .”

Objections to elimination of retiree health care: “Most of us will be dead”

Numerous objectors told shocking stories of the added burden the elimination of health care has laid on their backs and those of their spouses.

Retired city bus driver Jesse Florence, said during the morning session that since the city cut health care benefits for retirees under 65, his premiums have jumped from $152 a month to $1026.

“I never thought I would be struggling to get health care,” he said. “This is devastating.”Marshall Meah said he worked 30 years in DWSD, sustained numerous injuries and diseases due to toxic exposure, and lost his wife and family because he was on 24-hour call, even having to take his child with him to work one time.“It was a very dangerous job working in the sewers,” he said. “There were no gas detectors in the beginning, the manhole looked like the size of a quarter from down below, and once our cable broke and I had to save a co-worker’s life.”He said he now needs constant medical care for physical injuries he sustained.

His brother Amru Meah, formerly Director of the Buildings and Safety Engineering Department, said he pays $858 a month for health care which he desperately needs because he is a cancer patient.

His brother Amru Meah, formerly Director of the Buildings and Safety Engineering Department, said he pays $858 a month for health care which he desperately needs because he is a cancer patient.

Roger Rice, a Department of Public Works retiree and long-time union officer, said his wife had a heart attack due to stress after the announcement of the bankruptcy, and now has had her entire city health insurance eliminated because she is under 65. He noted that retirees can’t wait 20 years for restoration of their benefits. He said he will be 86. Another retiree said, “Most of us will be dead by then.”

Cuts reduce one retiree’s annual income from $21,000 to $4,942

Constance Phillips, a supervisor for 17 years at the Human Services Department, helping Detroiters with their utility bills and other needs, she said she now estimates cuts in her health care, pension, and annuities will reduce her annual compensation from $21,000 to $4,942, putting her in her former clients’ positions and worse.

“Remove the retirees from these bankruptcy proceedings!” H. Jean Powell demanded.Rhonda Sims, a UAW member, said the cuts are targeted specifically at Black workers by Michigan Governor Rick Snyder and the Koch Brothers.“Any further cuts will have a devastating psychological effect on our already devastated African-American community,” she said.

“Retirees are the backbone of our communities. Many retirees are supporting grandchildren and parents, four generations in one household. How will the younger generation be motivated to get an honest job after they watch their parents and grandparents, who worked all their lives, homeless and on the streets? There are no summer jobs, no recreation centers, no Belle Isle, and now no water. Why should they not turn to crime? The banks can afford to take cuts, pensioners cannot.”

Retirees object to sell-out by retirement systems, balloting process

“The Detroit General Retirement System’s use of coercion and blackmail [in its mailing calling for a ‘yes’ vote] was totally offensive,” said Beverly Holman. “Not all elements are disclosed, including the total dollar amount of [alleged] excess interest paid to retirees. We are told that we can pay it back in one lump sum—that is like eating an elephant in one bite. This will create a new class of the elderly poor in Detroit and across the U.S., eligible for public assistance.” (Read full letter from DGRS at DGRS Yes letter.)

Many referred to the 3200 ballots that had to be remailed due to deficiencies, as well as the inclusion of letters from the Detroit Retired City Employees Association (DRCEA), the Detroit General Retirement System, Denton’s, and others recommending a “Yes” vote. The DGRS even told its members that they could request another ballot if they wanted to change their vote.Several said the ballots could easily be falsified since the “Yes” and “No” pages are separate from the signature pages. One retiree said his groups had filed an FOIA to get a copy of the mailing list of retirees so they could mail out fliers advocating “NO” votes and giving the complete picture.

Carl Williams outlined numerous violations of Chapter 9 Bankruptcy Procedures in the Plan of Adjustment. He and retiree Hassan Aleem sponsored a series of objections signed earlier at a meeting of the Detroit Concerned Citizens, Active Employees, and Retirees. Two of those objections are listed below.

“Orr is a representative of the state, not the city,” he said. “Only a municipality can file for bankruptcy. That state owes the city millions, but then it turns around and files bankruptcy, not in good faith, and not for the benefit of the city.”

Williams added that Rhodes’ court never had jurisdiction over the filing, alleging that Rhodes is a magistrate, not a judge, without the authority to make any judgments in the case. Rhodes did not deny Williams’ allegation.

Retirees at meeting of Concerned Detroiters, Active Employees and Retirees July 7, 2014. Meetings are held every Monday at N’namdi’s, 12150 Woodward at 11 a.m.

Many objectors, including Cindy Darrah, raised the issue of the billions in public taxes that are being paid to wealthy developers like Mike Illitch, Dan Gilbert, Roger Penske and others, while Detroit is allegedly bankrupt.

“The state has the obligation not to look the other way,” Darrah said. “They gave the ‘Grand Bargain’ $195 million while giving Illitch $240,000,000, illegally out of the school aid fund for his new hockey rink.”

“The state has the obligation not to look the other way,” Darrah said. “They gave the ‘Grand Bargain’ $195 million while giving Illitch $240,000,000, illegally out of the school aid fund for his new hockey rink.”

John Lauve, who protested outside the courtroom, handed out a flier detailing the public costs of the Red Wing area, the M-1 trolley, and $1 no bid sales to developers.

“Penske’s trolley system diverts money that should be used to fix the failed bus system to benefit the entire City,” Lauve noted “This added transit system will compete and disrupt the two current bus services.”

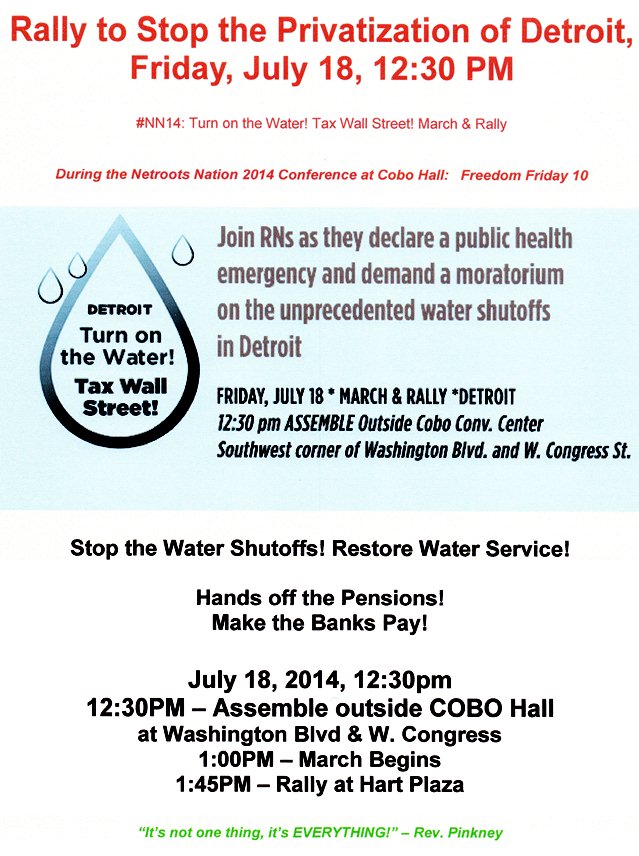

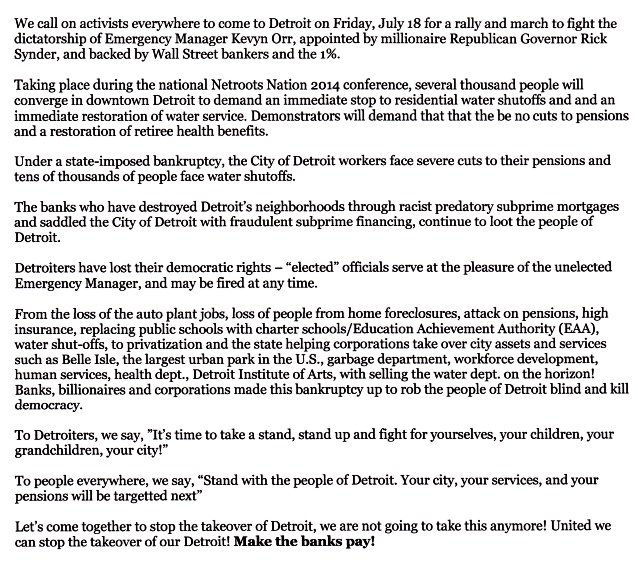

Endorsements of July 18 march and rally in Detroit

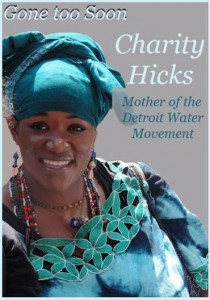

HOME GOING SERVICES FOR ACTIVIST CHARITY HICKS

SATURDAY, JULY 19, 2014 9:30 A.M.

CHURCH OF THE MESSIAH

231 E. GRAND BLVD. AT E. LAFAYETTE

Related documents and stories:

Full testimony of Kris Hamel on the water shut-offs. KH testimony.

Steven Wojtowicz official objection at DB Wojtowicz objection.

Group objection Carl Williams, Hassan Aleem DB objection Hassan Aleem et al 7 8 14.

Group objection Williams, Aleem DB objection Williams Aleem et al

Jean Vortkamp’s full testimony at Vortkamp testimony.

Cindy Darrah’s full testimony at Darrah testimony.

John Lauve’s written objection at Lauve testimony.

http://voiceofdetroit.net/2014/07/13/britain-strikes-for-a-day-against-low-pay-job-cuts/

http://voiceofdetroit.net/2014/06/07/why-im-voting-no-on-the-grand-bargain/

http://voiceofdetroit.net/2014/05/14/state-bills-target-detroit-assets-in-bankruptcy/

http://voiceofdetroit.net/2014/05/12/dccr-update-on-pensions-in-detroit-bankruptcy-plan-vote-no/

http://voiceofdetroit.net/2014/05/05/aarp-joins-other-groups-in-legal-support-for-detroit-retirees/

http://www.workers.org/articles/2014/01/22/teachers-strike-shuts-puerto-ricos-schools/

http://www.reuters.com/article/2014/01/15/us-usa-puertorico-teachers-idUSBREA0E13P20140115

http://www.reuters.com/article/2014/04/11/puertorico-pensions-idUSL2N0N325N20140411