U.S. Launches Raids In Somalia And Libya

By ABDI GULED and JASON STRAZIUSO and KIMBERLY DOZIER

OCTOBER 5, 2013

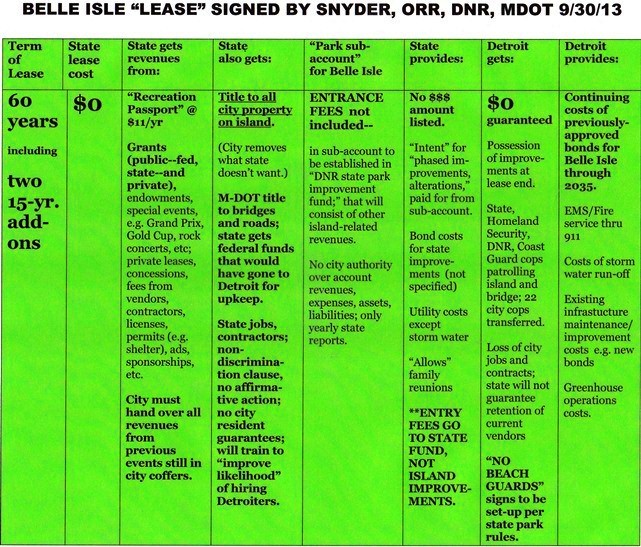

This image from the FBI website shows Anas al-Libi. Gunmen in a three-car convoy seized Nazih Abdul-Hamed al-Ruqai, known by his alias Anas al-Libi, an al-Qaeda leader connected to the 1998 embassy bombings in eastern Africa and wanted by the U.S. for more than a decade outside his house Saturday in the Libyan capital, his relatives said. (AP Photo/FBI)

MOGADISHU, Somalia (AP) — In a stealthy seaside assault in Somalia and in a raid in Libya’s capital, U.S. special forces on Saturday struck out against Islamic extremists who have carried out terrorist attacks in East Africa, snatching a Libyan al-Qaida leader allegedly involved in the bombings of U.S. embassies 15 years ago but aborting a mission to capture a terrorist suspect linked to last month’s Nairobi shopping mall attack after a fierce firefight.

A U.S. Navy SEAL team swam ashore near a town in southern Somalia before militants of the al-Qaida-linked terrorist group al-Shabab rose for dawn prayers, U.S. and Somali officials told The Associated Press. The raid on a house in the town of Barawe targeted a specific al-Qaida suspect related to the mall attack, but the operation did not get its target, one current and one former U.S. military official told AP.

Both officials spoke on condition of anonymity because they were not authorized to discuss the raid publicly.

In Washington, Pentagon spokesman George Little confirmed that U.S. military personnel had been involved in a counterterrorism operation against a known al-Shabab terrorist in Somalia, but did not provide details.

U.S. officials said there were no U.S. casualties in either the Somali or Libyan operation.

Navy Seals encountered “heavier resistance than expected” and aborted mission.

The Somali raid was carried out by members of SEAL Team Six, the same unit that killed al-Qaida leader Osama bin Laden in his Pakistan hideout in 2011, another senior U.S. military official said, speaking on condition of anonymity because the official was not authorized to speak publicly.

But this time, SEAL Team Six members encountered fiercer resistance than expected so after a 15-20 minute firefight, the unit leader decided to abort the mission and they swam away, the official said. SEAL Team Six has responsibility for counterterrorism activities in the Horn of Africa.

Delta Force team also assassinated Osama Bin Laden and dumped his body at sea.

Within hours of the Somalia attack, the U.S. Army’s Delta Force carried out a raid in Libya’s capital, Tripoli, to seize a Libyan al-Qaida leader wanted for the 1998 bombings of the U.S. Embassies in Kenya and Tanzania that killed more than 220 people, the military official said. Delta Force carries out counterterrorism operations in North Africa.

The Pentagon identified the captured al-Qaida leader as Nazih Abdul-Hamed al-Ruqai, known by his alias Anas al-Libi, who has been on the FBI’s most wanted terrorists list since it was introduced shortly after the Sept. 11, 2001 attacks.

Al-Libi “is currently lawfully detained by the U.S. military in a secure location outside of Libya,” Pentagon spokesman Little said.

Somalians downed U.S. Blackhawk helicopters during previous invasion of Libya in 1993 “Black Hawk Down” invasion. Eighteen U.S. soliders were killed, and the bodies of several were dragged through the streets of Mogadishu.

Saturday’s raid in Somalia occurred 20 years after the famous “Black Hawk Down” battle in Mogadishu in which a mission to capture Somali warlords in the capital went awry after militiamen shot down two U.S. helicopters. Eighteen 18 U.S. soldiers were killed in the battle, and it marked the beginning of the end of that U.S. military mission to bring stability to the Horn of Africa nation. Since then, U.S. military intervention has been limited to missile attacks and lightning operations by special forces.

A resident of Barawe — a seaside town 240 kilometers (150 miles) south of Mogadishu — said by telephone that heavy gunfire woke up residents before dawn prayers.

Al Shabaab fighter attends rally in Somalia.

The U.S. forces attacked a two-story beachside house in Barawe where foreign fighters lived, battling their way inside, said an al-Shabab fighter who gave his name as Abu Mohamed and who said he had visited the scene. Al-Shabab has a formal alliance with al-Qaida, and hundreds of men from the U.S., Britain and Middle Eastern countries fight alongside Somali members of al-Shabab.

A separate U.S. official described the action in Barawe as a capture operation against a high-value target. The official said U.S. forces engaged al-Shabab militants and sought to avoid civilian casualties. The U.S. forces disengaged after inflicting some casualties on fighters, said the official, who was not authorized to speak by name and insisted on anonymity.

Map of Somalia on the African continent.

The leader of al-Shabab, Mukhtar Abu Zubeyr, also known as Ahmed Godane, claimed responsibility for the attack on the upscale mall in Nairobi, Kenya, a four-day terrorist siege that began on Sept. 21 and killed at least 67 people. A Somali intelligence official said the al-Shabab leader was the target of Saturday’s raid.

An al-Shabab official, Sheikh Abdiaziz Abu Musab, said in an audio message that the raid failed to achieve its goals.

Al-Shabab and al-Qaida have flourished in Somalia for years. Some of the plotters of the 1998 bombings of U.S. embassies in Kenya and Tanzania hid out there.

Barawe has seen Navy SEALs before. In September 2009 a daylight commando raid in Barawe killed six people, including Saleh Ali Saleh Nabhan, one of the most-wanted al-Qaida operatives in the region and an alleged plotter in the 1998 embassy bombings.

The Libyan al-Qaida leader also wanted for the bombings, al-Libi, is believed to have returned to Libya during the 2011 civil war that led to the ouster and killing of Libyan dictator Moammar Gadhafi.

The Libyan al-Qaida leader also wanted for the bombings, al-Libi, is believed to have returned to Libya during the 2011 civil war that led to the ouster and killing of Libyan dictator Moammar Gadhafi.

His brother, Nabih, said al-Libi was parking outside his house early Saturday after dawn prayers when a convoy of three vehicles encircled his car. Armed gunmen smashed the car’s window and seized al-Libi’s gun before grabbing him and taking him away. The brother said al-Libi’s wife saw the kidnapping from her window and described the abductors as foreign-looking armed “commandos.”

Al-Libi, who was believed to be a computer specialist for al-Qaida, is on the FBI’s most-wanted list with a $5 million bounty on his head. He was indicted by a federal court in the Southern District of New York, for his alleged role in the bombings of the U.S. Embassies in Dar es Salaam, Tanzania, and Nairobi, Kenya, on August 7, 1998.

Libyan officials did not return calls seeking comment on al-Libi’s abduction.

U.S. equipment left behind after aborted Somalia raid.

In Somalia, a resident of Barawe who gave his name as Mohamed Bile said militants closed down the town in the hours after the assault, and that all traffic and movements have been restricted. Militants were carrying out house-to-house searches, likely to find evidence that a spy had given intelligence to a foreign power used to launch the attack, he said.

“We woke up to find al-Shabab fighters had sealed off the area and their hospital is also inaccessible,” Bile told The Associated Press by phone. “The town is in a tense mood.”

Al-Shabab later posted pictures on the Internet of what it said was U.S. military gear left behind in the raid. Two former U.S. military officers identified the gear as the kind U.S. troops carry. Pictures showed items including bullets, an ammunition magazine, a military GPS device and a smoke and flash-bang grenade used to clear rooms. The officials could not confirm if those items had come from the raid.

Kenya’s Westgate mall.

In Kenya, military spokesman Maj. Emmanuel Chirchir on Saturday gave the names of four fighters implicated in the Westgate Mall attack as Abu Baara al-Sudani, Omar Nabhan, Khattab al-Kene and Umayr, names that were first broadcast by a local Kenyan television station.

Matt Bryden, the former head of the U.N. Monitoring Group on Somalia and Eritrea, said via email that al-Kene and Umayr are known members of al-Hijra, the Kenyan arm of al-Shabab. He added that Nabhan may be a relative of Saleh Ali Saleh Nabhan, the target of the 2009 Navy SEALs raid in Barawe.

The identities of the four men from the mall attack came as a Nairobi station obtained and broadcast the closed circuit television footage from Westgate. The footage shows four attackers calmly walking through a storeroom inside the complex, holding machine guns. One of the men’s pant legs appears to be stained with blood, though he is not limping. It is unclear if the blood is his, or that of his victims’.

Government statements shortly after the four-day siege began on Sept. 21 indicated between 10 to 15 attackers were involved, but indications since then are that fewer attackers took part, though the footage may not show all of the assailants

Straziuso reported from Nairobi, Kenya, and Dozier from Charlotte, North Carolina. Associated Press writers Rukmini Callimachi in Nairobi and Matthew Lee in Bali, Indonesia, also contributed to this report.

CBS/AP/ October 6, 2013, 2:03 PM

Attack on Kenya’s mall related to U.S.-backed invasion of Somalia

Sept. 23 — Billows of smoke emanated from the Westgate shopping mall in Nairobi, Kenya, on the third day of a standoff among Kenyan, Israeli and U.S. FBI forces against members of the Al-Shabaab Islamic resistance movement based in Somalia, which had seized the mall. Reports indicated that at least 62 people have been killed since the incident began on Sept. 21, most of them civilian mall shoppers..

“Kenya Defense Forces” have occupied southern Somalia.

Many news sources reported that members of Al-Shabaab said their operation was in response to the ongoing occupation by approximately 2,500 Kenyan Defense Forces troops of southern Somalia.

The attack on the Westgate Mall is being portrayed by the corporate and pro-imperialist media in the U.S. and Europe as a new episode in the so-called “war on terrorism.” But there has been little news with background about the incident or of the significant role of U.S. imperialism in creating instability in the region.

U.S. Pres. Barack Obama with Kenyan President Mwai Kibaki

Kenya, which shares a border with Somalia, sent its army into the troubled Horn of Africa state in October 2011 with U.S. blessing. President Mwai Kibaki and Prime Minister Raila Odinga, close allies of the U.S. administration, led the Kenyan government then.

KDF forces bombed the strategic port city at Kismayo in the early phase of the operation. The city was a financial base for Al-Shabaab, which controlled lucrative charcoal exports from the country.

Since the intervention of Kenya into Somalia, resistance has continued in the country’s south and has been escalating outside Kismayo, where Al-Shabaab fighters battle KDF occupation troops daily.

U.S. role in the Somalia crisis

U.S. imperialism has attempted to influence politics in Somalia for decades. In the late 1970s, the Jimmy Carter administration armed Somalian leader Mohamed Siad Barre against revolutionary Ethiopia, then in alliance with the Soviet Union and Cuba.

As a result Somalia was plunged into a disastrous war with Ethiopia over the Ogaden region. Somalia’s defeat began a decade-long political crisis. By early 1991, the Barre regime had collapsed, leaving a vast security and political vacuum. U.S. troops went into Somalia in a phony “humanitarian” intervention until military casualties caused them to leave in 1994.

Mengistu Haile Mariam, President of People’s Democratic Republic of Ethiopia from 1987-91, driven out of power by U.S. and Somalia.

After Ethiopia’s socialist-oriented government was driven out in 1991, Washington used its new clients in that country to gain more influence in the region. The George W. Bush administration encouraged Ethiopia to invade Somalia in 2006 in order to displace the Islamic Courts Union government that had begun to consolidate its influence and stabilize the country.

With Somalia facing a grave famine, Ethiopian military forces withdrew in early 2009 and sections of the Islamic Courts were won over to a Washington-backed Transitional Federal Government. A youth wing of the Islamic Courts arose known as Al-Shabaab (Youth) and began to wage war against the TFG, demanding that all foreign forces be withdrawn from Somalia.

Beginning in 2007, the African Union Mission to Somalia (AMISOM) was formed. The bulk of its forces were from the U.S.-allied Ugandan government. U.S. and British bombing operations have been carried out against alleged Al-Shabaab and Al-Qaeda bases in Somalia. The country is also a base of operations for U.S. drone programs, and Mogadishu is home to a major CIA field station.

AMISON forces.

The combined AMISOM forces, now consisting of some 17,500 troops, receive training and funding from Washington.

The U.S.’s Somalia operation is part and parcel of the United States Africa Command (AFRICOM), which was formally started in 2008 under Bush but has been strengthened and enhanced by the Obama administration.

Kenya’s intervention in southern Somalia in October 2011 had been planned for at least two years. The release of WikiLeak’s cables in 2010 documented the plans and the role of the State Department.

In addition to U.S. involvement in Somalia and Kenya, the state of Israel has close ties with the government in Nairobi.

U.S. and British warships in Gulf of Aden, 2011.

Developments in Kenya and throughout the entire region of East Africa must be viewed in the context of U.S. economic and strategic interests in partnership with its NATO allies and the state of Israel. In recent years flotillas of U.S. and European Union warships have been occupying the Gulf of Aden off the coast of Somalia with the pretext of fighting piracy.

Both Kenyan President Uhuru Kenyatta and Vice President William Ruto are under indictment by the International Criminal Court in The Hague, accused of human rights violations following elections in 2007. Not only the Kenyan government but the entire 54-member nations in the African Union have rejected the ICC, which has almost exclusively focused its charges on Africa’s leaders.

While Washington did not favor the government of President Kenyatta during the March elections, it is likely the U.S. will try to take advantage of the mall attack to increase its already strong presence in Kenya.

Related WW articles:

“The exercise of arbitrary power allows the ‘Stephens’ of the Black Misleadership Class to feel more a part of the oligarchy they serve.”

“The exercise of arbitrary power allows the ‘Stephens’ of the Black Misleadership Class to feel more a part of the oligarchy they serve.”