HANDS OFF ASSATA–SHE IS NOT A TERRORIST!

May 4, 2013 by Jamahiriya News Agency

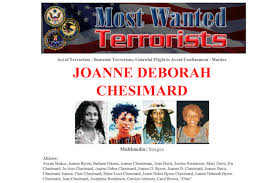

On May 2, the Federal Bureau of Investigation suddenly announced that they had placed Assata Shakur on its “Most Wanted Terrorists” list, making her the first woman to be so designated. The state of New Jersey also raised the bounty on her head to $2 million. These government actions came on the 40th anniversary of the shoot-out in which police allege that Shakur killed an officer.

It is clear that these are the vindictive attempts of the Empire still outraged that a rebel could escape, survive outside its reach, and continue to expose its long history of exploitation and oppression. The recent provocations are part of a long-term smear campaign by the U.S. government to erase her revolutionary legacy.

The FBI’s accusations target Shakur as an individual, but the labeling of her as a terrorist is an attack on all revolutionaries.

Shakur has been living in exile in Cuba for the last 29 years. So what changed in the recent days and weeks to now put her on the “Most Wanted Terrorists” list? The FBI presented no evidence against her and revealed no terrorist plots. Assata’s real crime, FBI spokesman Aaron Ford said, was that from Cuba she continues to “maintain and promote her … ideology” and “provides anti-U.S. government speeches espousing the Black Liberation Army message”—an ideology and message that the U.S. government has declared “terrorism.”

In other words, President Obama’s and Eric Holder’s FBI is charging Shakur with a political crime, the advocacy of revolutionary politics and Black liberation as “terroristic” and “criminal.” According to the outrageous “War on Terror” legal doctrines currently employed in Washington, she could be targeted for assassination. In addition, the designation of Shakur as a terrorist helps them justify the targeting of socialist Cuba as a “state sponsor of terrorism.”

The defense of Assata Shakur is therefore part and parcel of a general defense of the right to espouse revolutionary politics, of Black liberation and of free speech more generally.

‘I wanted a name that had something to do with struggle’

Assata Shakur was born JoAnne Chesimard, and her change in name was reflective of her desire to fully identify with the revolutionary struggles of her African heritage. Assata means “she who struggles,” her middle name Olugbala means “love for the people,“ and her last name Shakur was taken in honor of her comrade Zayd Shakur.

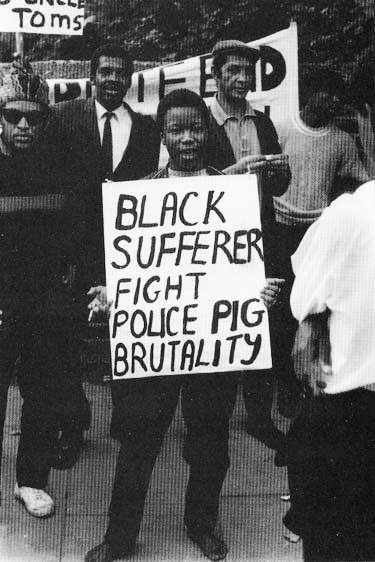

It is no surprise that the U.S. government now seeks to further criminalize Shakur. In fact, it is just the latest extension of the government’s counter-revolutionary COINTELPRO initiative waged against the Black liberation movement in the 1960s and 1970s. At that time, the U.S. government was so fearful of the growth of revolutionary movements that J. Edgar Hoover even declared the Black Panther Party, of which Shakur was a member, the “greatest internal threat” facing the ruling class. It used a wide range of tactics, all the way up to assassinations of leaders, to disrupt this radical movement.

It must be recalled that the government described much of the political activity of the era—in the anti-war movement, the Black freedom movement, the fight for independence of Puerto Rico, and solidarity with revolutionary Cuba, among other struggles—as explicitly criminal.

Of course, while they were locking up and killing activists and revolutionaries within the country, the U.S. government was engaged in a wide-ranging brutal and murderous campaign in Southeast Asia. They were dealing cosmetically with the terrible conditions of poverty and class oppression inside the United States, while deploying troops to suppress growing rebellions among oppressed Black, Latino and Native peoples. They were launching coups in multiple nations. They were attempting—and sometimes succeeding—in assassinating revolutionary leaders. They were backing apartheid and Portuguese colonialism in Africa.

When Martin Luther King Jr. famously said that the U.S. government was the “greatest purveyor of violence in the world today,” he laid bare the essence of the “American Century.”

It was in this world context, which in its core features is unchanged today, that Assata Shakur grew up. Millions took part in the growing movements against the injustices of the U.S. government and Shakur was one of those millions. As a college student, Shakur did not use her degree as an “escape valve” to distance herself from the mass of poor, oppressed and exploited people. Instead, she joined—body and soul—in the fight for their collective liberation.

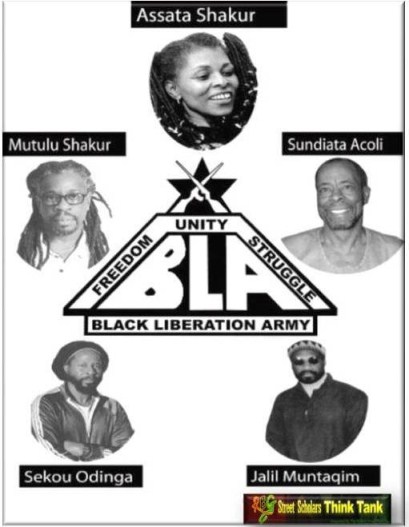

Out of the mass movement in the United States, a wing emerged that advocated for various forms of armed struggle as a way to expedite the revolutionary movement and give solidarity to peoples of the Third World. Assata was part of this trend—and she and her comrades were targeted for severe repression, often framed and incarcerated under false pretenses.

Assata Shakur is not guilty

Shakur was falsely convicted of having killed an officer on May 2, 1973. While driving on the New Jersey Turnpike, Assata, Zayd Shakur, and Sundiata Acoli were stopped by state troopers, allegedly for having a “faulty taillight.” A shootout ensued where one state trooper killed Zayd Shakur, and another trooper, Werner Foerster, ended up dead. Shakur was charged with both murders, despite the fact that the other trooper, James Harper, admitted he killed Zayd Shakur.

Assata had been, following police instructions, standing with her hands in the air, when she was shot by Trooper Harper more than once, including a bullet to the back. Trooper Harper lied and said he had seen Shakur reach for a gun, a claim he later recanted. He also claimed she had been in a firing position, something a surgeon who examined her said was “anatomically impossible.” The same surgeon said it was “anatomically necessary” for her arms to have been raised for her to receive the bullet wounds she did. Tests done by the police found that Shakur had not fired a gun, and no physical or medical evidence was presented by the prosecution to back up their claim that she had fired a gun at Trooper Harper.

Assata had been, following police instructions, standing with her hands in the air, when she was shot by Trooper Harper more than once, including a bullet to the back. Trooper Harper lied and said he had seen Shakur reach for a gun, a claim he later recanted. He also claimed she had been in a firing position, something a surgeon who examined her said was “anatomically impossible.” The same surgeon said it was “anatomically necessary” for her arms to have been raised for her to receive the bullet wounds she did. Tests done by the police found that Shakur had not fired a gun, and no physical or medical evidence was presented by the prosecution to back up their claim that she had fired a gun at Trooper Harper.

While she was in trial proceedings, the state attempted to pin six other serious crimes on her, alleging she had carried out bank robberies, kidnappings and attempted killings. She was acquitted three times, two were dismissed and one resulted in a hung jury.

Shukur was put on trial in a county where because of pre-trial publicity 70 percent of people thought she was guilty, and she was judged by an all-white jury. Without any physical evidence to present, the prosecution had to rely totally on false statements and innuendo aimed at playing on the prejudices of the jury pool against Black people, political radicals, and Black revolutionaries in particular. Finally, after years behind bars, the state secured her conviction for the Turnpike shooting.

Terrorism double-standard and potential of assassination

Being placed on this Most Wanted Terrorist list means that hypothetically Shakur could be targeted for assassination. The legal white paper released by the Obama administration around the confirmation of CIA Director John Brennan stated that the United States would pay no attention to another nation’s sovereignty in choosing targets who they deem to be “terrorists.” The massive expansion of the security powers and the methods used in the “War on Terror” are being fashioned to target revolutionary militants.

Placing Shakur on the Most Wanted Terrorists list is also a significant attack on Cuba. On May 1, 2013, the United States refused to remove Cuba from the “State Sponsors of Terrorism” list. The next day, Assata became a “Most Wanted Terrorist.” By claiming that Cuba supports “terrorism” and is harboring a “terrorist,” the government provides itself with a pretext to continue the illegal blockade of Cuba and starve the revolution of trade.

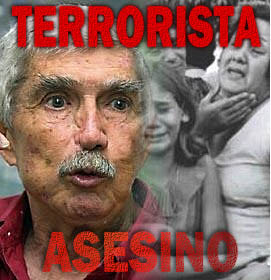

Further, the United States does absolutely nothing to apprehend, convict or punish in any way the violent anti-Cuba groups who routinely and openly boast from U.S. soil of planning terrorist attacks on Cuba. Despite having killed thousands of Cubans, none of these organizations or individuals have ever been placed on America’s list of “Most Wanted Terrorists.”

For instance, Luis Posada Carriles, a former CIA operative who currently walks free in Miami, publicly admitted to The New York Times that he had engaged in a campaign of fatal hotel bombings in Cuba. In 1976, Posada was a key figure in the bombing of a Cuban airliner where 73 people perished. In 2000, Posada was caught attempting to set up a plot to assassinate Fidel Castro as he spoke to university students in Panama. If successful, the attack would have killed hundreds.

Threat to political prisoner solidarity work

Ominously, by criminalizing Assata Shakur, the government has also taken a step towards criminalizing the broader movement in support of political prisoners. Many political prisoners in this country have also been alleged to be members of the Black Liberation Army. If Shakur is a terrorist simply for giving speeches in support of the BLA, what about those convicted of crimes alleged to have taken place while they were members? Will political prisoner support groups now be targeted as “supporters of terrorism” or “terrorists” themselves?

Political prisoner Imam Jamil Al-Amin (formerly known as H. Rap Brown of the Black Panthers) is in prison for life, framed up in the killing of a Georgia police officer.

The new attacks on Shakur aim to have a chilling effect on those who seek to express their support for political prisoners. This is especially true when one considers that drone strikes and indefinite detention at Guantanamo Bay are the typical U.S. responses to those accused of terrorism.

The placement of Assata Shakur on the Most Wanted Terrorist list is another example that the U.S. government, and the capitalist class it represents, will go to any length to intimidate, repress and defeat potential threats.

Because Shakur remains a symbol of resistance, and is unrepentant in her politics, the government will never stop their attempts to smear, kidnap or kill her. But millions of people know the truth. Her legacy cannot be whitewashed or dismissed; it cannot be distorted. So even though she is in Cuba, the government remains afraid of her example. They know that while decades have passed, the conditions still exist to give birth to a million Assata Shakurs.

Related:

NY Black is Back Coalition Calls for Demonstration to Support Assata Shakur!

Assata Shakur, Black Freedom Fighter, Is Now On FBI Most Wanted Terrorist List