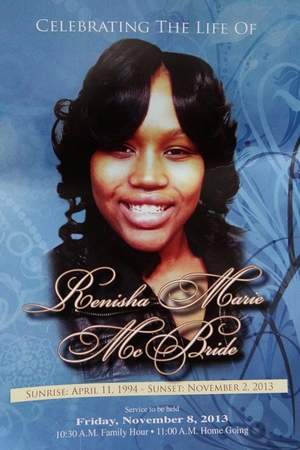

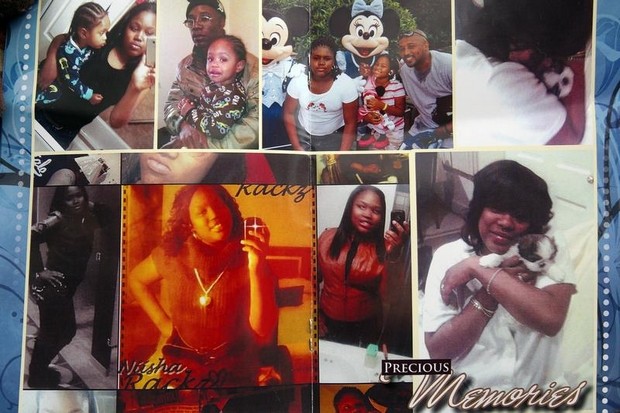

Celebrating The Life Of Renisha McBride! * * A No Struggle, No Development Production!

By Kenny Snodgrass

Published on Nov 8, 2013

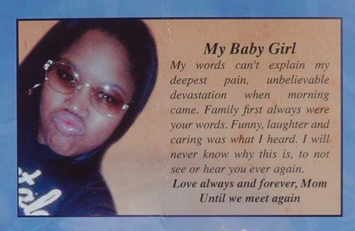

At Renisha McBride’s funeral, her family asked others to be patient as investigators determine whether to file criminal charges against the Dearborn Heights man who had shot 19-year-old Renisha on his porch a week ago.

McBride was shot in the face Nov. 2 as she stood on the porch of a home on Outer Drive around 3:40 a.m. Her family said she was seeking help after being involved in an auto accident that night.

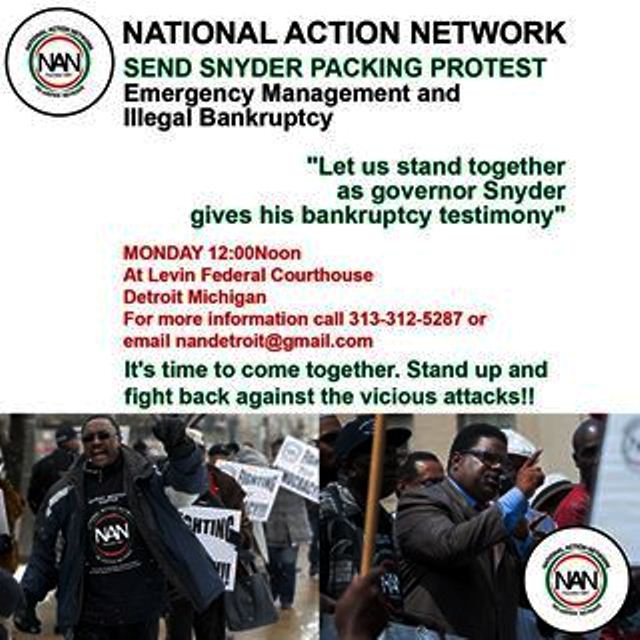

The family’s comments came as several civil rights leaders, including the Rev. Al Sharpton, and U.S. Rep. John Conyers, D-Detroit, today called for justice and a thorough investigation in the case.

A No Struggle, No Development Production! By Kenny Snodgrass, Activist, Photographer, Videographer, Author of

1} From Victimization To Empowerment… www.trafford.com/07-0913 eBook available at www.ebookstore.sony.com

2} The World As I’ve Seen It! My Greatest Experience!

{Photo Book}

YouTube: I have over 482 Video’s, 323 Subscribers, over 210,000 hits, now averaging 10,000 monthly on my YouTube channel @ www.YouTube.com/KennySnod

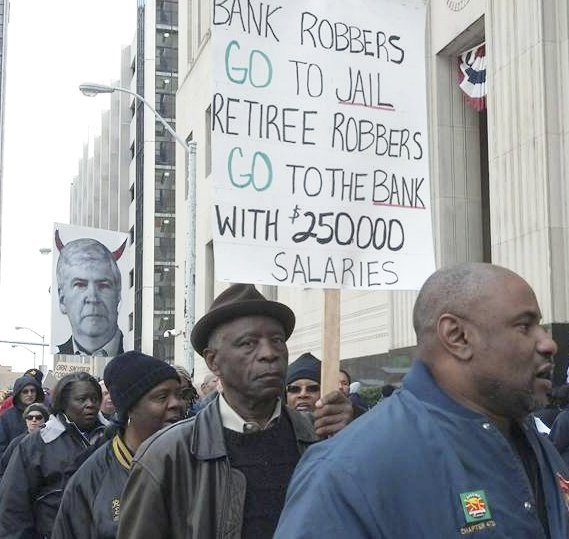

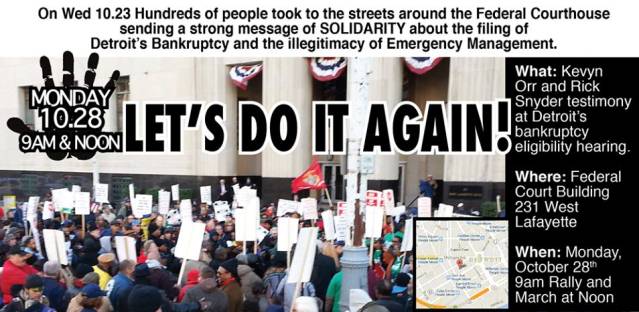

JUSTICE FOR RENISHA MCBRIDE—ARREST AND CHARGE HER KILLER

Sign Color of Change petition to Wayne County Prosecutor Kym Worthy at http://act.colorofchange.org/sign/renisha_mcbride/?akid=3184.202798.7ON75z&rd=1&t=3

Facebook page at https://www.facebook.com/justiceforrenishamcbride

By Diane Bukowski

November 9, 2013

Black teen shotgunned to death Nov. 2 on porch of Dearborn Heights home belonging to Theodore Paul Wafer

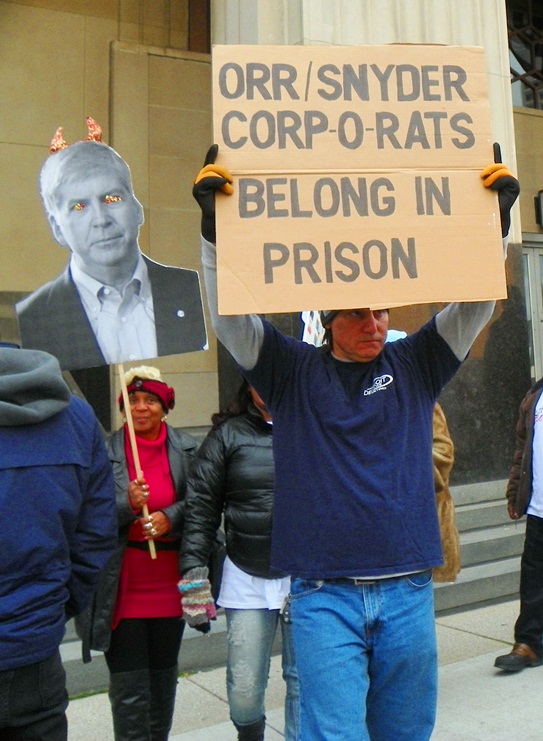

Youth at rally compare McBride case to that of Trayvon Martin, call for killer’s immediate arrest, charges to be brought

“If a white woman had come into a Black neighborhood seeking help, we would have helped her”—child at rally

DETROIT – The killing of Renisha McBride, 19, on Nov. 2 by a white Dearborn Heights man on the porch of a home owned by Theodore Paul Wafer, has sparked an outcry across Detroit and the nation. Many are comparing it to the vigilante-style killing of Trayvon Martin by George Zimmerman in Sanford, Fla. last year.

The story has received coverage from major newspapers across the U.S., as well as wire services.

Others, predictably, are trying to quell the storm by persuading people to wait for an investigation and expressing faith in a “justice” system which failed Trayvon and his family. One “activist” said, “We want to bring the tenor down a little bit and let them do their job,” referring to the police and prosecutor.

“Justice too long delayed is justice denied,” Dr. Martin Luther King, Jr. countered in his “Letter from a Birmingham Jail” in 1963. The homeowner, who blasted McBride in the face with a shotgun as she stood on his porch seeking help, has not even been arrested. Dearborn Heights police sent a warrant request to Wayne County Prosecutor Kym Worthy, whose spokesperson Maria Miller said, “We have requested further investigation by the police that must be submitted to our office before a decision will be made.”

McBride, an African-American Detroiter who graduated from Southfield High School and had just gotten a job with Ford Motor Company, had wandered into a largely white and Arab-American neighborhood looking for help after a car accident since her cell phone wasn’t working, her family and police have said.

“The press often just reports what the police say,” Dream Hampton said, during a rally outside Dearborn Heights police headquarters Nov. 7, which included many youth. “We’ll take up a collection for gas money if they need it to go to the scene of the crime. We need someone in handcuffs for shooting a 19-year-old with a shotgun. The killer was not a rape victim who had to have his identity protected. We know how we are criminalized. They even criminalized the corpse of Trayvon Martin.”

SCENE OF THE CRIME: Dearborn Heights death house owned by Theodore Paul Wafer at 16812 W. Outer Drive, Dearborn Heights, MI. Photo by Diane Bukowski

The rally was called by Hampton, activist Yusef Shakur, and rapper Invincible.

Shakur told VOD, “This killing shows the reality that Black life is not valued in this country. The majority of the more than two million people who are incarcerated in the U.S. are Black. The real narrative is about white supremacy.”

Another woman cried out, “Black women are being murdered, raped, beaten and shot all the time. I’m sick of the apathy in the community and in the media. Where is this man, who is he connected to? Why is he not in jail? Wherever he is, he needs to come to judgment.”

“If a white woman had come into a Black neighborhood seeking help,” a youngster named Isaiah said, “we would have helped her. All the stereotypes they put on Detroit are wrong. Detroit is not a bad place.”

Another woman said, “I have a twelve-year-old daughter. I don’t want to hear this kind of news about her. We have a Black President, but it is still open season on us. I’ve been working since the age of 14 and have three college degrees, but people still stereotype me, following me around as I’m shopping.”

Another speaker called to mind the racist history of Dearborn, which is currently 89.1 percent white, and Dearborn Heights, which is 86.1 percent white according to the U.S. Census. Dearborn was originally founded by Nazi sympathizer Henry Ford to house white Ford Motor Company workers.

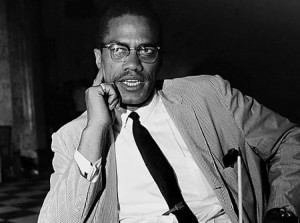

“Where we’re standing is in a city of restrictive covenants,” the speaker said. “It’s fertile ground for a new apartheid. Malcolm X said anything below Canada is the South. We must organize like we did in the days of Emmett Till. We don’t want anymore strange fruit.”

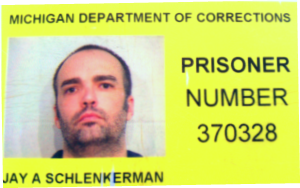

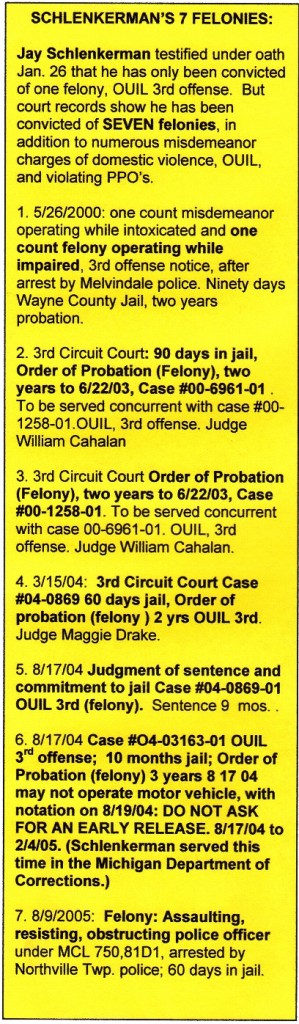

Daily media has refused to release the name of the killer, ostensibly because he has not yet been charged. But Dearborn Heights tax records and other online sources show that the owner of the home involved, located at 16821 W. Outer Drive, is Theodore Paul Wafer, 54, who has also lived in Livonia and Dearborn. Dearborn Heights police have reported the killer is a 54-year-old man living by himself.

Little else is known about Wafer at this point. His date of birth is Feb. 8, 1959. He was arrested by the Dearborn Heights Police in 1988 and 1994 for “traffic offenses,” according to State Police records. According to non-criminal Third Judicial Circuit Court records, he has an ongoing case related to a “stalking charge” he brought against a woman in 1995, which was just re-assigned Sept. 3, 2013. Dearborn Heights 20th District Court does not carry online criminal and non-criminal records.

The corporate media publishes the names of Black crime suspects before they are charged every day. In the case of Aiyana Stanley-Jones, 7, shot to death by Detroit police on May 16, 2010 during a horrific military-style raid on her home, reporters asked her family only a week afterwards whether her father, Charles Jones, gave a gun to Chauncey Owens to kill Detroit teen JeRean Blake two days earlier.

The media continued to publish Jones’ name in connection with that killing, claiming without written back-up that Owens named him in a plea deal. But Jones was not actually charged until 17 months after he rushed out of a bedroom with Aiyana’s mother Dominika Stanley and their infant sons to hear his mother Mertilla Jones, who had been sleeping on a front room couch with the child, tell him, “They just blasted your baby’s brains out.”

Neither Jones nor Owens have yet been tried, let alone convicted.

VOD has not been able to reach the killer or his attorney, who has claimed he shot McBride in self-defense, thinking she was breaking into his home.

Dearborn Heights Police Lieutenant James Serwatowski said in a published report that the killer said he did not even see the person he shot. However, the door to the home is solid, with no window, and a clear glass outer door. Both remain intact, meaning the killer would have had to at least open the inside door. Wafer also has a large plate glass window from which he may have viewed McBride before opening the door. There is also a large globe porch light next to the door.

Protesters at the rally noted he could have called 911 if he feared for his life, and did not have to open his door.

VOD obtained a statement from police headquarters after the rally, written by Serwatowski Nov. 4.

It says, “In the early morning hours of November 2, 2013 the Dearborn Heights police were called to a shooting in the 16000 block of Outer Drive. A Nineteen year old Detroit woman was fatally shot while standing on the front porch of the home. The case is currently under investigation. The Dearborn Heights Police have identified the person who fired the shot and killed the woman. This incident occurred on the front porch of the home. The decedent was not ‘dumped’ as some have reported. A final report will be forwarded to the Wayne County Prosecutor’s office for review in the near future.”

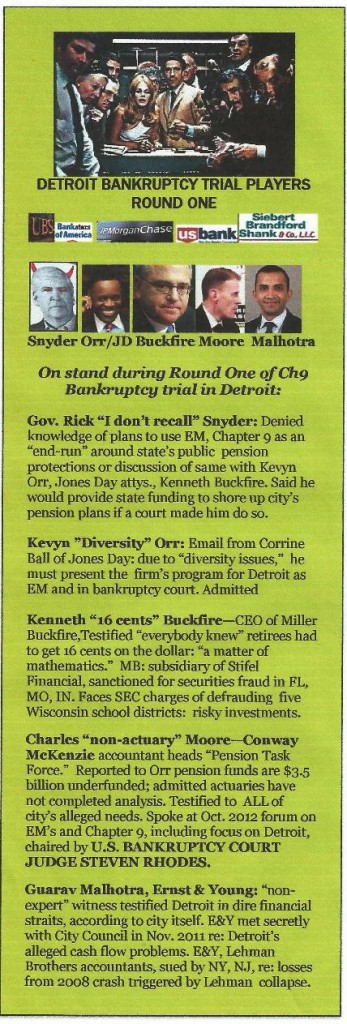

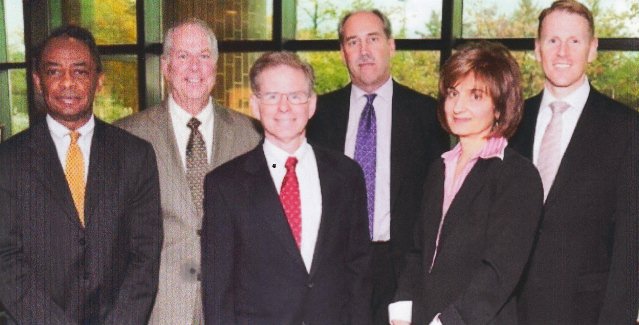

Wayne County Prosecutor Kym Worthy’s top asst. prosecutors are white males living in Oakland County.

Serwatowski said later that McBride was shot in the face as she stood on the porch around 3:40 a.m.

“She wasn’t shot leaving the porch in the back of the head,” he said in published reports. “She was shot in the front of the face, near the mouth.”

Other earlier comments from Serwatowski left the impression that McBride was a long way away from the house when she had the accident, although later reports said she was only four blocks away.

To date, Worthy has not even issued a press release regarding her intentions.