Protesters march outside Cobo Center where the 2014 North American International Auto Show is being held.

Photos and text by James Fassinger for MintPress News

Detroit–As automakers prepared to trumpet record profits and reveal new car models at the 25th annual North American International Auto Show at the Cobo Center in Detroit, dozens of union members, supporters and concerned citizens turned up to demonstrate for a ‘People’s Recovery’ outside the venue on Jan.12.

Union members and supporters protest outside the North American International Auto Show.

Organized by Autoworker Caravan and joined by other groups such as Moratorium Now, National Action Network and Jobs for Justice, they chose the day before Press Preview Week opens in hopes of capturing the attention of more than 5,000 journalists from around the world who are expected to cover the event.

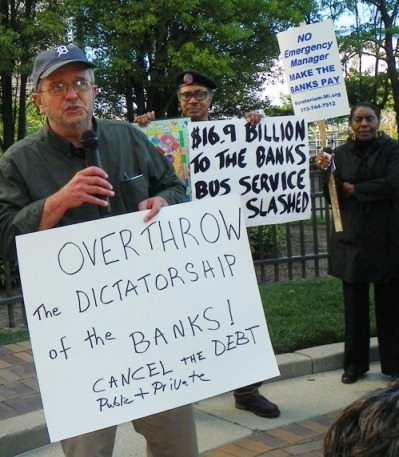

Members of Moratorium Now turned out in support of public and private workers and to demand the banks forgive Detroit’s loan debt.

“We see this as a golden opportunity to get past the Detroit corporate media censorship and tell our side of the story: that the 1 percent are making out like bandits while autoworkers are living with concessionary contracts and city workers are getting thrown under the bus,” organizers said.

Autoworker Caravan was founded in 2008 to give voice to rank and file auto workers after the financial crisis and bankruptcy of General Motors and Chrysler. Now in its fifth year protesting outside the NAIAS, organizers assert that Detroit, currently in bankruptcy, is at the forefront of a nationwide assault against workers and their unions in both the public and private sector. They demand an end to multi-tier workplaces and the “alternative work schedules” automakers have instituted, as well as the overturning of Michigan’s controversial Right to Work legislation and a moratorium on cuts to retiree pensions and benefits.

Renla Session, UAW local 600 assembly worker walks the picket line outside Cobo Center during the protest. “We are out here for all workers,” she says.

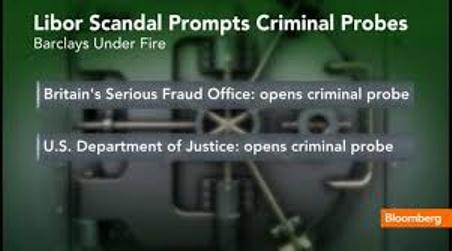

“Massive job losses and home foreclosures have left the city starved for revenues. Instead of creating an emergency jobs program and declaring a moratorium on home foreclosures, Governor Snyder and Wall Street are exploiting Detroit’s crisis for their own gains,” the group writes in an announcement for the action. “Using an Emergency Dictator, they forced Detroit into bankruptcy so they can – without interference – break union contracts, threaten city retirees’ negotiated pensions and benefits, reward the banks for fraudulent loans and sell off city assets to predatory corporations.”

Megan Minton (center) UAW local 12 member, started working at the Toledo, Ohio Chrysler Jeep assembly plant in August 2013. She came out to show her support for her fellow UAW workers and speak out against the two-tier system. Hired in at the lowest tier last August, she just started receiving her healthcare benefits this month.

Marching with her sign ‘Stop Outsourcing,’ Megan Minton, UAW local 12 member, said she came to support her union brothers and sisters. Minton works the line at the Toledo Chrysler Jeep Assembly Plant, about an hour south of Detroit. In August 2013, she was hired in at the lowest tier at the facility but only started receiving her health care benefits this month, with no dental or vision plan yet in place.

Don and Stacey Kemp of Flint, yell and chant during the rally. Don, a UAW local 598 member and autoworker at the Flint Truck and Bus facility has been with GM for 29 years. He and Stacey came out to protest against what they see as the social injustice happening with the implementation of the 2 and 3-tear wage system his company has introduced.

Minton says she doesn’t mind her fellow workers in the upper tier earning more money, because they have been working there longer, but with the new system, she will never be able to reach their hourly pay scale no matter how long she works at the plant.

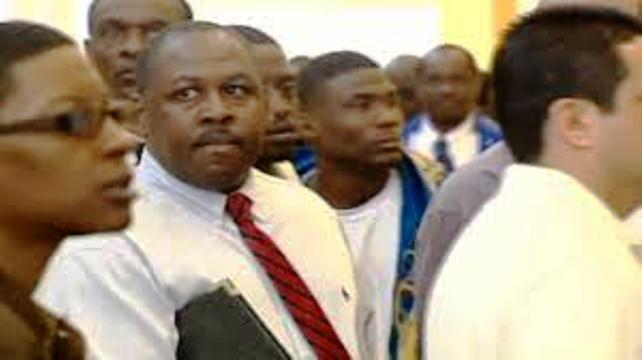

Melvin Thompson, former president of UAW local 140, and Warren Truck Assembly Plant worker of 19 years, rallies the crowd at the demonstration.

Melvin Thompson, former president of UAW local 140, has worked at the Warren Truck Assembly Plant for 19 years. Also an Autoworker Caravan member, he sees the two-tier system instituted in manufacturing today as a ‘divide and conquer’ strategy used by the automakers to create inequality in the workplace.

With the GM Renaissance Center the background, dozens demonstrate for an economic ‘People’s Recovery’, against the Trans-Pacific Partnership (TPP) trade agreement and against unfair labor practices like the multi-tier wage systems now in place within the manufacturing industry.

“How can we be union brothers if you are right next to me making two-thirds of what I’m making and we’re doing the same job? Then, when new contracts come up, you’ll have a section to vote on and I’ll have a section to vote on, and they’ll try to divide and conquer us by giving one something and taking something away from the others. So, we have to eliminate this two-tier system and get back to true solidarity.

Mark Farris worked for Ford for 30 years. He turned out to voice his opposition to what is happening in society and with workers. He says, “The rich keep getting richer and the poor keep getting poorer.”

“The recovery is clearly happening because we are selling vehicles, not because we are paying people less. You could pay all of us $40 an hour more than we’re making right now and they’d still make a killin’. [But] nobody’s going to do the math and print that in the paper,” Thompson said.

Dozens turned up to demonstrate for a ‘People’s Recovery’ outside Cobo Center in Detroit, ahead of Press Preview Week at the North American International Auto Show.

The organizers believe that the Big Three work in tandem with the fossil fuel industry and ignore climate change caused by the burning of fossil fuels, maintaining that Detroit could be a leader in public transit and renewable energy components.

Frank Hammer, retired UAW Local 909 president and Autoworker Caravan co-founder, says that automakers could help workers and the current economy by converting old, unused production facilities for green manufacturing to produce rail cars for public transportation, as well as products like solar panels and wind turbines. In doing so, automakers would not only provide thousands of manufacturing jobs, but help fight global climate change and cut carbon emissions.

Autoworker Caravan supporters pose and chant after the rally for a German camera crew in town to cover the NAIAS.

FOR MORE PHOTOS, CLICK http://on.fb.me/1b0MzCZ