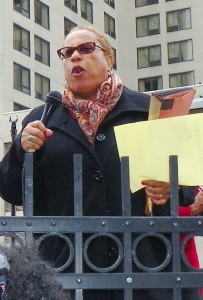

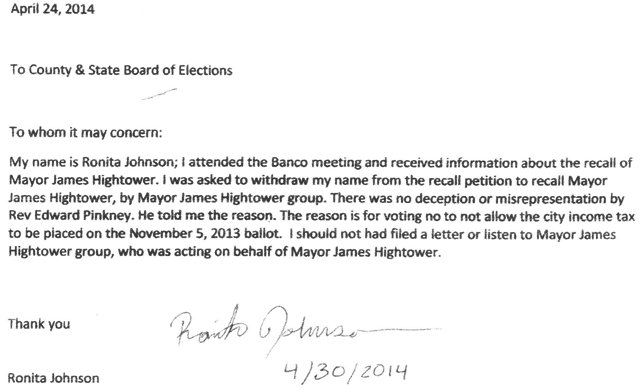

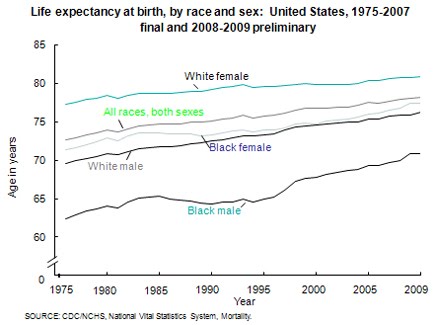

Marchers protest thousands of water shut-offs May 23 outside Water Board Building in downtown Detroit

Contractor Homrich shutting water off to thousands of Detroiters without notice or mercy

Charity Hicks, who protested assault by Homrich employee thrown into Mound Road prison to endure “conditions THAT are meant to shame you, demoralize you, criminalize you and break you down”

MS. HICKS WILL BE SPEAKING AT AN ACTIVISTS’ RE-UNION POT-LUCK PICNIC SATURDAY, MAY 31, 1-7 PM OUTSIDE THE HOME OF CALL ‘EM OUT FOUNDER AGNES HITCHCOCK, ON E. PHILADELPHIA BETWEEN JOHN R AND BRUSH; CALL 874-2792 FOR MORE INFO

MS. HICKS WILL BE SPEAKING AT AN ACTIVISTS’ RE-UNION POT-LUCK PICNIC SATURDAY, MAY 31, 1-7 PM OUTSIDE THE HOME OF CALL ‘EM OUT FOUNDER AGNES HITCHCOCK, ON E. PHILADELPHIA BETWEEN JOHN R AND BRUSH; CALL 874-2792 FOR MORE INFO

By Diane Bukowski

May 28, 2014

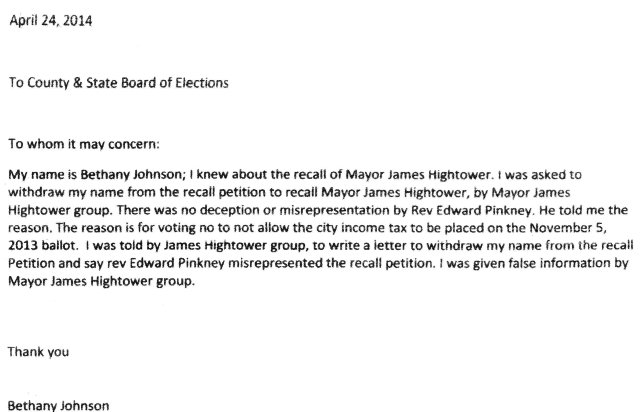

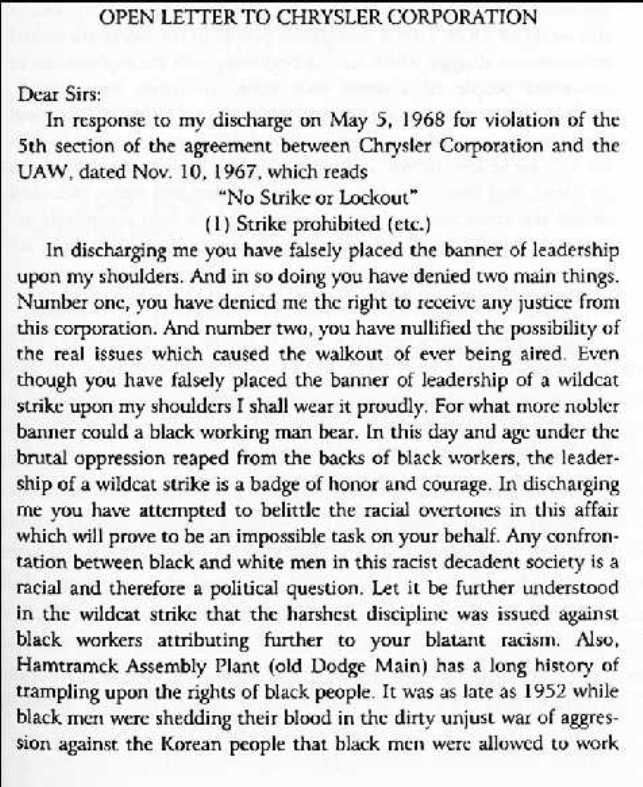

DETROIT — The State of Michigan’s fascist iron glove is pounding on Detroiters, using mass water shut-offs without notice, and mass concentration camp imprisonment at the Mound Road state facility. There, hundreds are locked into filthy holding rooms without sanitation, proper food, water and medical care, guarded by Michigan Department of Corrections personnel.

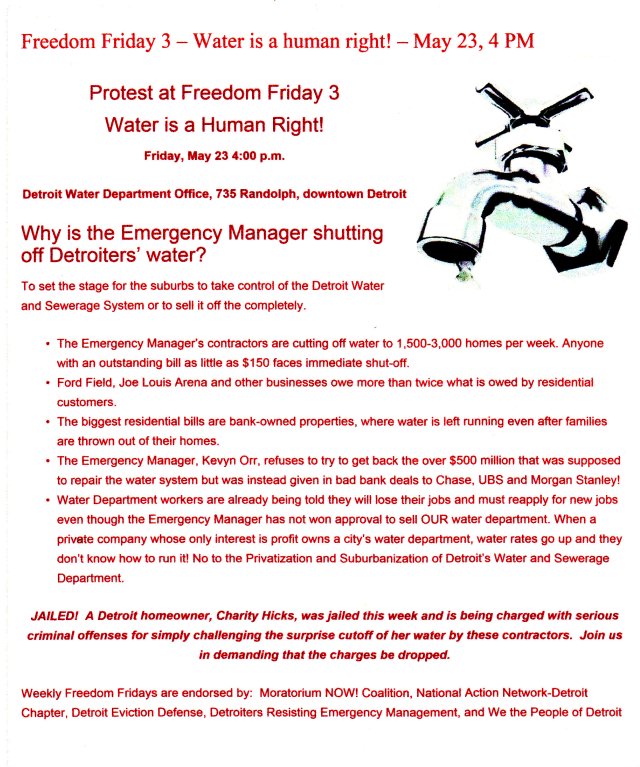

That is the horrendous story Charity Hicks told VOD, after her arrest during mass water shut-offs in her east-side neighborhood near Osborn High School. On May 23, members of the People’s Water Board, Moratorium NOW! and others protested the shut-offs outside the Detroit Water Board building as part of a series of weekly “Freedom Fridays.”

“There was a contractor on the block shutting off the whole block,” Hicks said. “They were no-knock, no-notice shut-offs of homes including those where pregnant women and children live. After they shut mine off, I went two houses over to ask the man if he could wait until the family could gather some water together for their immediate needs. They were coming early in the morning, between 6 a.m. and 8 a.m. and people had no time to brush their teeth or wash up. He told me he doesn’t have to give notice to the homes, and that he was just doing his job.”

Hicks said she told him that was the same explanation given by Nazis at the concentration camps, and by Detroit police when they are busting people’s heads.

Hicks said she told him that was the same explanation given by Nazis at the concentration camps, and by Detroit police when they are busting people’s heads.

Hicks said he wore some sort of water department decal without the name of Detroit, over his company badge. She said people she knows living in the Warrendale neighborhood had earlier complained about the shut-off workers not being official City of Detroit employees.

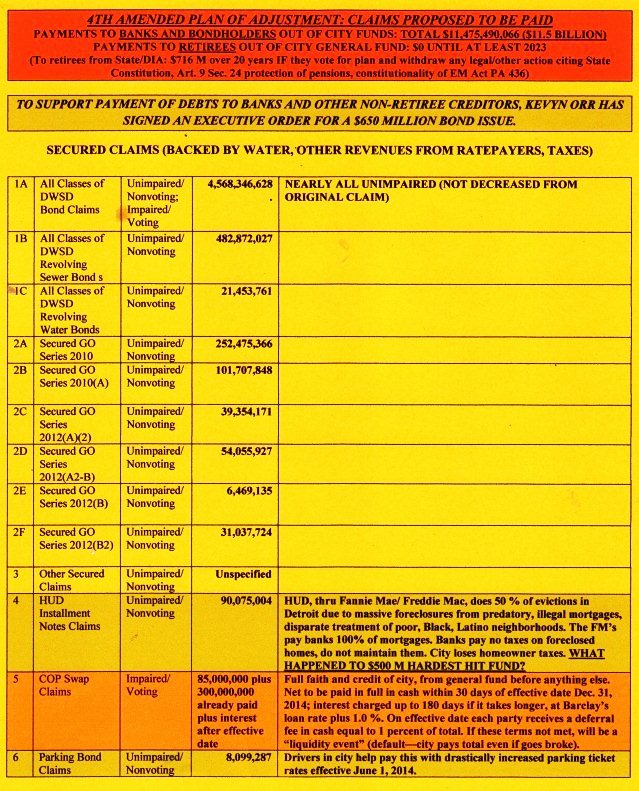

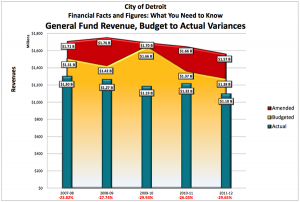

The Detroit Water Board approved a $5.6 million, 730 day contract with Homrich Wrecking April 24, Contract No. DWS-894, “Water Shut-Off/Turn-On Project,” according to the Board’s minutes.

“The Detroit Water and Sewerage Department (DWSD) is initiating this project to reduce DWSD’s delinquent water accounts,” DWSD Director Sue McCormick said in a letter to the Board. “As part of the overall plan to increase DWSD’s revenue collection, the Department will increase its efforts of water shut-offs for customers with a 60-day or more past-due balance. . . This project will target approximately 70,000 residential accounts throughout the City of Detroit over a period of two (2) years.” (Click on

Hicks said the contractor got mad when she asked to see the termination orders for herself and her neighbors.

“He told me they are on the computer and he couldn’t produce them,” Hicks said. “They are shutting people off with no procedures and no due process, despite the critical importance of the water infrastructure. The guy went to his car to look up the orders I thought, and I followed him so he could show me on the computer. I was leaning up slightly into the car to see, and all of a sudden he peeled off, hitting me and causing me to fall down and hurt my hip and gash my foot, which began bleeding. He didn’t say get back, and I just got discombobulated and fell down.”

Hicks said a one-gallon red plastic gas container fell off the back of his truck when he hit a bump in the road. She then called 911 to report that she had been assaulted.

“The police came, looked at my foot, and then told me they were going to charge me with felonious larceny for stealing city equipment. They said if they were going to believe anybody, it would be the city. All of a sudden, I became the perpetrator.”

Hicks said she had hurriedly dressed and was virtually naked, with no shoes, no socks, no underwear, no keys or other belongings. She said the two officers, who were white, arrested her in front of her home, did not read her her rights, then made racist remarks to her as they drove her to the Mound Road facility.

“They were completely racist, disrespectful and arrogant,” Hicks said. “They told me I seemed to be pretty articulate, asked how many degrees I had, and said it was clear that I wasn’t a typical Detroiter. They said they were ‘good ‘ol boys’ and kept playing country music on the radio.”

Hicks discovered when she got to Mound Road that everyone arrested in the city, whether for misdemeanors or felonies, is being taken there and booked by the Michigan Department of Corrections, which guards them and takes their fingerprints and photos, then keeps them in state custody. She said she was told she would be there for four days, although state law says arrested individuals must be arraigned within 72 hours.

She said she was disrobed and strip-searched.

“They threw me in a cell with hundreds of women,” Hicks recounted. “There was one urinal and no water to drink or wash with, and there was human waste including menstrual blood all over the floor. I asked for socks or shoes because of the wound in my foot, but got none. No water, no beds, no nothing. We had to use the urinal with no regard to our health and safety, where we could get HIV, hepatitis and other diseases. Even the Border Patrol brought a woman in because they are stopping people there who have warrants.”

She said women were separated into two holding areas, one for those brought in for alleged misdemeanors, and another for those with alleged felonies.

Hicks said City of Detroit police officers are in the back processing prisoners so they can be video-arraigned later in the 36th District Court, with arraignments for felonies going on seven days a week and for misdemeanors from Monday through Friday. She said staff from the Prosecutor’s office comes through there at all hours of the day and night to interview the prisoners.

She said the prosecutors frequently add six or seven more charges to the one the prisoner was brought in for, a tactic that office has long used to get people to plea bargain rather than face a jury composed primarily of non-Detroiters.

“The conditions are meant to shame you, demoralize you, criminalize you and break you down,” Hicks said. She said attorney Alice Jennings intervened to get her released after two days, and that no charges were even brought after her traumatic experience.

Jennings told VOD that she and Attorney John Royal went to the prison to get Hicks released due to her medical condition. She said she tried to visit with Hicks at one of the individual visting sections with glass walls, but the phones were not working in the sections. She asked the guards why she couldn’t meet with Hicks in a separate room, since they had brought her out in handcuffs anyway, but they refused.

“We basically had to communicate with each other through lip reading,” Jennings said. “This is an egregious violation of a prisoner’s right to consult with counsel.”

During the May 23 protest, Russ Bellant said Homrich had come through his east-side neighborhood as well, shut off at least nine people on his block alone without notice, then went to other blocks in the area of Seven Mile and Sherwood as well.

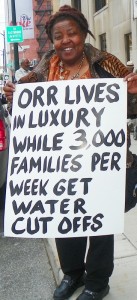

“We plan to launch a major international media campaign,” Lila Cabbil of the People’s Water Board told VOD during the protest. “Shutting water off affects children the worst. [Emergency Manager] Kevyn Orr is in violation of the Water Affordability Ordinance, which requires that late fees are supposed to be put into a fund to help those who can’t pay their bills.”

Protesters noted that the State’s Child Protective Services removes children from families where the water and other utilities are off. They said that numerous large entities including the VA hospital, the Palmer Park golf course, Ford Field, and others have not paid their water bills but do not face shut-offs.

“Illitch owes $80,000, Ford Field owes $55,000, and the golf course and hospital each owe at least $200,000. If they paid THEIR bills there would be no need to shut off poor folks,” Cabbell said.

Rev. Bill Wylie-Kellerman went into the customer service area of the Water Board building and began speaking to the numerous people there, telling them that thousands of people in the city are being shut off and are in danger of losing their children. He said guards threw him out despite his protests that it was a public building.

“They told me this is a place of business,” Wylie-Kellerman said.

Monica Patrick said, “These policies are totally inhumane and most egregious, aimed at literally killing off the people.”

She said she has been consulting with people from North Carolina who are visiting Detroit. They have been sponsoring the hugely successful Moral Mondays protests there against that state government’s policies, which closely resemble those passed by Michigan’s legislature and enacted by Gov. Rick Snyder.

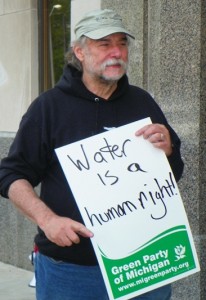

For more information, go to http://moratorium-mi.org/, http://peopleswaterboard.blogspot.com/ and https://www.facebook.com/peopleswaterboard.

Water cut-offs in Detroit a violation of human rights

|May 27, 2014

Maude Barlow is the National Chairperson of the Council of Canadians and chairs the board of Washington-based Food and Water Watch. More information on Maude Barlow can be found at: www.canadians.org/Maude

I recently visited Detroit, Michigan and am shocked and deeply disturbed at what I witnessed. I went as part of a Great Lakes project where a number of communities and organizations around the basin are calling for citizens to come together to protect the Great Lakes as a Lived Commons, a Public Trust and a Protected Bioregion. We are also deeply worried about the threat of extreme energy such as diluted bitumen from the tar sands of Alberta and fracked oil and fracking wastewater from North Dakota being transported by pipeline and rail near the lakes and on barges on the lakes and are calling for a ban of these dangerous toxins around and on the Great Lakes.

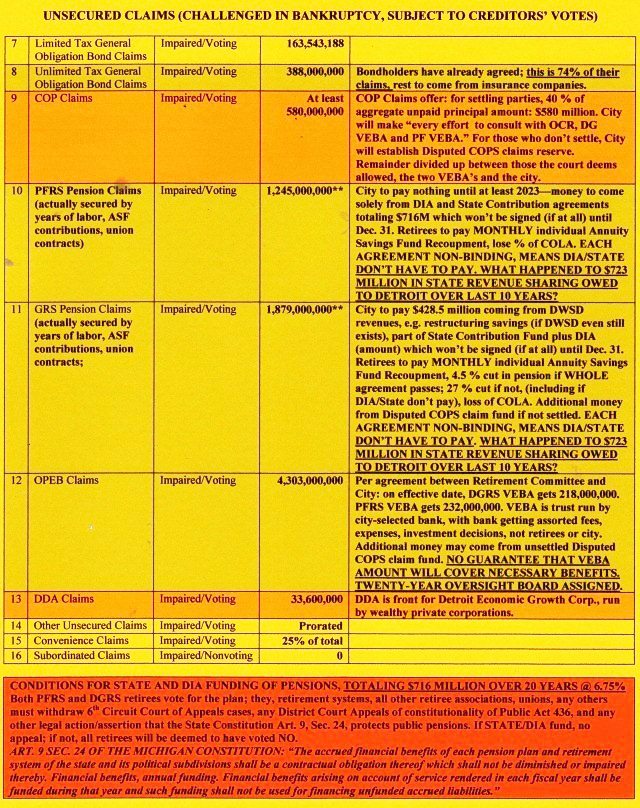

But the people of Detroit face another sinister enemy. Every day, thousands of them, in a city that is situated right by a body of water carrying one fifth of the world’s water supply, are having their water ruthlessly cut off by men working for the Detroit Water and Sewerage Department. Most of the residents are African American and two thirds of the cut offs involve children, which means that in some cases, child welfare authorities are moving in to remove children from their homes as it is a requirement that there be working utilities in all homes housing children.

People are given no warning and no time to fill buckets, sinks and tubs. Sick people are left without running water and running toilets. People recovering from surgery cannot wash and change bandages. Children cannot bathe and parents cannot cook. Is this a small number of victims? No. The water department has decreed that it will turn the water off to all 120,000 residences that owe it money by the end of the summer although it has made no such threat to the many corporations and institutions that are in arrears on their bills as well. How did it come to this? Continue reading