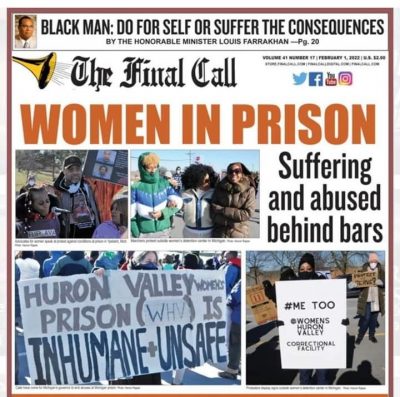

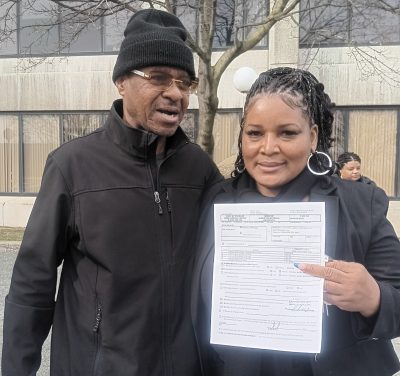

Supporters of women in the Women’s Huron Valley (WHV) correctional facility gather outside March 16, 2024. Photos:

This is a message from KRYSTAL CLARK # 435064 (one of plaintiffs in WHV class action lawsuit v. MDOC)

March 16, 2024

Shawanna Vaughn, of “Silent Cry” organized the March 16 WHV rally. Eric Walston of Prisoners Doing the Right Thing is at center (top).

Ypsilanti, Michigan — As you may be aware, in 2019 women prisoners at Women’s Huron Valley Correctional Facility (WHV) in Ypsilanti, Michigan filed a two-count civil rights action against the Michigan Department of Corrections (Case No. 19-13442).

This lawsuit alleged that Women’s Huron Valley, Michigan’s only women’s prison, is riddled with dangerous conditions which include haphazard retrofitting, leaky roofs, inoperable windows, inadequate ventilation, and outdated heating/cooling and ventilation systems which have created a breeding ground for harmful fungi and spore-producing molds such as Ochroconis, Cladosporium, and Chaetomium and that exposure to these molds constitute cruel and inhumane punishment in violation of the Eighth Amendment to the U.S. Constitution.

Make no mistake, the women in Women’s Huron Valley Correctional facility are suffering from mold exposure. In the lab reports of those women lucky enough to get an off-site medical diagnosis, ” MOLD” is clearly defined as the cause of their ailments.

Fire MDOC staff that has failed to address health concerns.

Mold related symptoms include: constant headaches, nosebleeds, constant fatigue, breathing disorders, nausea, diarrhea, vomiting, loss of appetite, weight loss, hair loss, skin rashes, open sores, short term memory loss, neurological disorders, swollen glands, chronic ear, sinus and bronchial infections, and pain in joints and muscles. Because of the substandard healthcare in this prison, women are not receiving the medical care nessesary to address mold-related ailments.

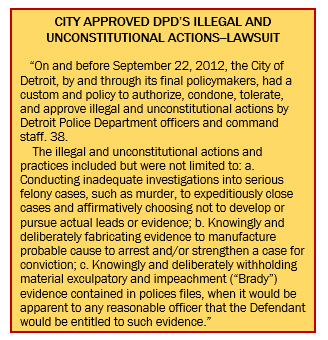

On August 25th, 2023, federal judge Victoria A. Roberts for the United States District Court for the Eastern District of Michigan dismissed the lawsuit brought by the women prisoners. What should shock the conscience of every citizen in the State of Michigan is what the attorneys representing the Michigan Department of Corrections stated when they stood before the Court.

Protesters at WHV March 16, 2024.

They said: ” There are no cases establishing a prisoner’s right to be free from these molds (Ochroconis, Cladosporium and Chaetomium), that it is not clearly established that any type of mold at WHV is sufficiently dangerous to incarcerated people, and EVEN IF IT WERE CLEARLY ESTABLISHED THAT CERTAIN MOLDS WERE DANGEROUS ENOUGH TO IMPLICATE THE EIGHTH AMENDMENT, IT IS NOT CLEARLY ESTABLISHED THAT PRISON OFFICIALS NEED TO TAKE ANY PARTICULAR ACTION TO REMEDIATE THE PRESENCE OF MOLD.”

The women imprisoned at Women’s Huron Valley are somebody’s loved ones. We have families and friends that worry about our health and safety.

The women imprisoned at Women’s Huron Valley are somebody’s loved ones. We have families and friends that worry about our health and safety.

The Michigan Department of Corrections DOES NOT share that concern. In their arguments before the Court they expressed NO responsibility or accountability for the mold- contaminated facility women are forced to live in. In other words, women prisoners should just shut up and die a slow, painful death in here from their mold- related illnesses.

By ANY standard of decency, this treatment is inhumane. If you wouldn’t allow a dog to live in such deplorable conditions and suffer the health consequences, how can you in good conscience allow Michigan’s imprisoned women to live this way.

Judge Victoria Roberts

COURT BATTLE NOT OVER, SAYS JUDGE ROBERTS: PLAINTIFFS CAN RE-FILE EMPHASIZING INADEQUATE VENTILATION

“The Court DISMISSES Plaintiffs’ claim without prejudice and allows them the opportunity to refile. Although the Court concludes there is no clearly established constitutional right in the Sixth Circuit to be free from exposure to mold that poses a serious risk to an incarcerated person’s health or safety, mold can be actionable in a different context.

The presence of mold—to the extent it contributes to inadequate and unhealthy ventilation systems in prisons—could support a claim of unsanitary prison conditions/inadequate ventilation which violates Eighth Amendment rights.“

GROUP PHOTO OF PROTESTERS OUTSIDE WOMEN’S HURON VALLEY PRISON March 16, 2024

Judge Roberts continued, “Defendants were on notice that Plaintiffs may have alleged an inadequate ventilation claim. In the amended complaint, Plaintiffs mention inadequate ventilation at least 22 separate times. . . .(“the prison and its bunkrooms lack proper ventilation, leading to a general moist environment and dampness in most of WHV’s units.

. . .In particular, the facility’s haphazard retrofitting, leaky roofs, inoperable windows, inadequate ventilation, and outdated HVAC systems all contribute to the mold problem at WHV.”) (“Defendants have failed . . . to replace the inadequate and failing HVAC system; instead allowing vents to fill up with mold and electing to use floor fans causing the mold to circulate in the air.”); id. at PageID.1107 (“Defendants have failed to replace the inadequate and failing air handlers, directly contributing to poor ventilation and condensation levels that encourage mold growth.”).

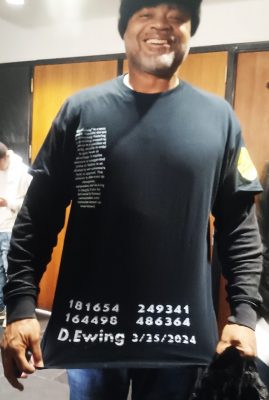

WHV PLAINTIFFS

Defendants even acknowledge the inadequate ventilation allegations in their briefing. See [ECF No. 152, PageID.2837] (articulating that Plaintiffs’ complaint alleges failure to remedy inadequate ventilation). Since the amended complaint already alleges inadequate ventilation, Defendants are on notice of this potential claim and will not be harmed if the Court dismisses this case as pled and allows Plaintiffs to amend the complaint.”

Court records show that a second amended Complaint was filed on behalf of plaintiffs PAULA BAILEY, KRYSTAL CLARK, AND HOPE ZENTZ, on behalf of themselves and others similarly situated, on September 15, 2023, by attorneys from multiple law firms including MARKO LAW, PLLC (Jonathan Marko), Detroit, MI; NICHOLS KASTER, PLLP (Matthew Morgan, Minneapolis, MN.; PITT MCGEHEE PALMER &RIVERS (Cary S. McGhee), Royal Oak, MI; LAW OFFICES OF DAVID S. STEINGOLD, PLLC, Detroit, MI;

STEINGOLD, PLLC; and EXCOLO LAW, PLLC Solomon M. Radner, Southfield, MI.

See amended complaint at

The complaint is now before USDC Judge Stephen Murphy III, with Elizabeth Stafford remaining as the Magistrate Judge. The Defendants again have filed for Summary Judgment, with the most recent filing on the case dated April 5, 2025.

Michigan Attorney General Dana Nessel’s office represents the Defendants, who are HEIDI WASHINGTON (MDOC Director), JEREMY HOWARD, iSHAWN BREWER, JEREMY BUSH, LIA GULICK,, ED VALLAD, DAVID JOHNSON, KARRI OSTERHOUT, JOSEPH TREPPA, DAN CARTER, JOEL DREFFS, i

Michigan Attorney General Dana Nessel’s office represents the Defendants, who are HEIDI WASHINGTON (MDOC Director), JEREMY HOWARD, iSHAWN BREWER, JEREMY BUSH, LIA GULICK,, ED VALLAD, DAVID JOHNSON, KARRI OSTERHOUT, JOSEPH TREPPA, DAN CARTER, JOEL DREFFS, i

RICHARD BULLARD, and TONI MOORE.

The Defendants are all being sued in their individual and official capacities.

RELATED:

**********************************************************************************

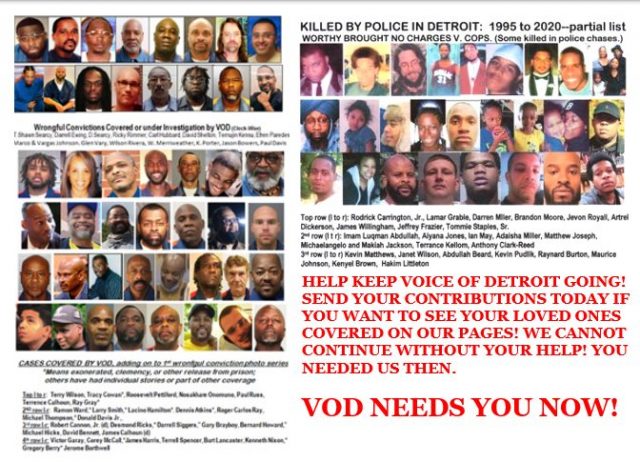

URGENT. Funds needed for quarterly web hosting charge of $465.00 by June 19, 2024 or VOD and 13 years of its stories will be taken off the web. VOD is a pro bono newspaper, now devoting itself entirely to stories related to our PRISON NATION and POLICE STATE.

URGENT. Funds needed for quarterly web hosting charge of $465.00 by June 19, 2024 or VOD and 13 years of its stories will be taken off the web. VOD is a pro bono newspaper, now devoting itself entirely to stories related to our PRISON NATION and POLICE STATE.

VOD’s editors and reporters, most of whom live on fixed incomes or are incarcerated, are not paid for their work. In addition to quarterly web hosting charge. other expenses include P.O. box fee of $226.00/yr., costs including utility and internet bills, costs for research including court records and internet fees, office supplies, gas, etc.

Please DONATE TO VOD at:

https://www.gofundme.com/donate-to-vod

CASH APP 313-825-6126 MDianeBukowski

***********************************************************************************

Vivian Kincaid was a close friend of VOD Editor Diane Bukowski. She was well-known in many circles, from those fighting for justice and freedom for imprisoned family members, to her fellow actors at Enter Stage Right in Port Huron. She was a brilliant, beautiful, courageous woman. She will be sorely missed.

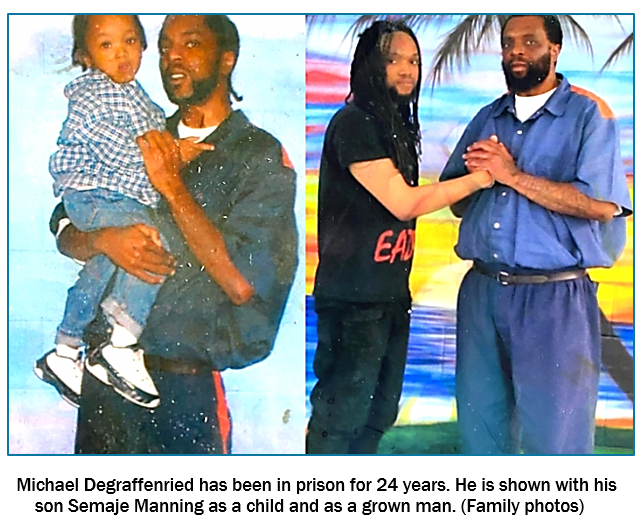

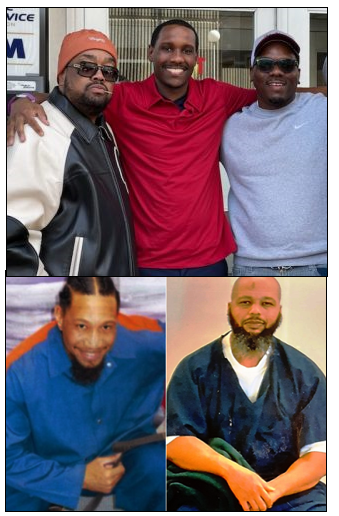

Vivian Kincaid was a close friend of VOD Editor Diane Bukowski. She was well-known in many circles, from those fighting for justice and freedom for imprisoned family members, to her fellow actors at Enter Stage Right in Port Huron. She was a brilliant, beautiful, courageous woman. She will be sorely missed.  Michael DeGraffenried, convicted of Inkster murder in 2000, is set for an evidentiary hearing Fri. April 12, WCCC Judge Tracy Green, FMHJ Rm. 604

Michael DeGraffenried, convicted of Inkster murder in 2000, is set for an evidentiary hearing Fri. April 12, WCCC Judge Tracy Green, FMHJ Rm. 604

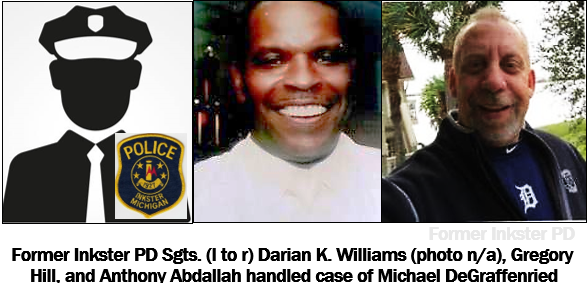

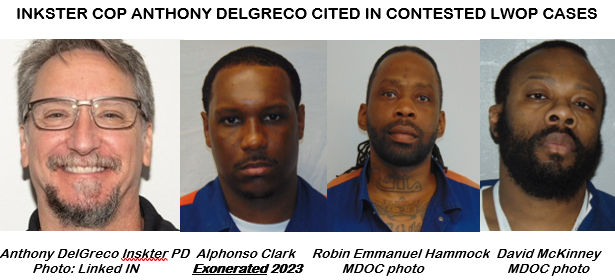

DETROIT — As Michael Degraffenried was being tried for murder and sentenced to 30 to 50 years on March 3o, 2000, the officer in charge (OIC) of his case, Inkster Police Sgt. Darian K. Williams, was robbing and extorting drug dealers using his official police car.

DETROIT — As Michael Degraffenried was being tried for murder and sentenced to 30 to 50 years on March 3o, 2000, the officer in charge (OIC) of his case, Inkster Police Sgt. Darian K. Williams, was robbing and extorting drug dealers using his official police car.

By Diane Bukowski

By Diane Bukowski

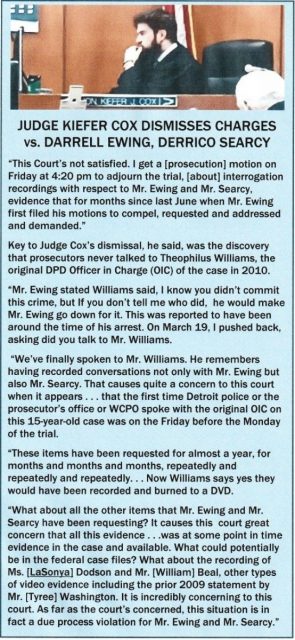

The Wayne Co. Prosecutor’s Office told WDIV Channel Four News that they will appeal Judge Cox’s ruling.

The Wayne Co. Prosecutor’s Office told WDIV Channel Four News that they will appeal Judge Cox’s ruling.

Voice of Detroit is a pro bono newspaper, now devoting itself entirely to stories related to our PRISON NATION and POLICE STATE. Funds are needed regularly to pay quarterly web hosting fee of $460.00 and other expenses. VOD will disappear from the web if fee not paid.

Voice of Detroit is a pro bono newspaper, now devoting itself entirely to stories related to our PRISON NATION and POLICE STATE. Funds are needed regularly to pay quarterly web hosting fee of $460.00 and other expenses. VOD will disappear from the web if fee not paid.

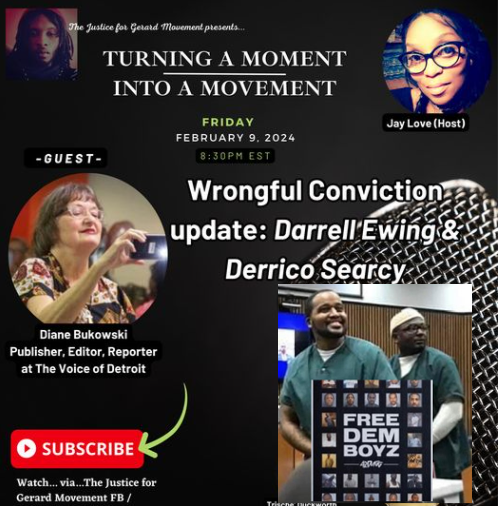

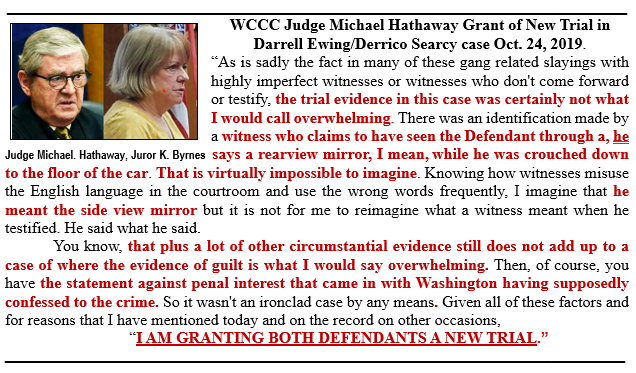

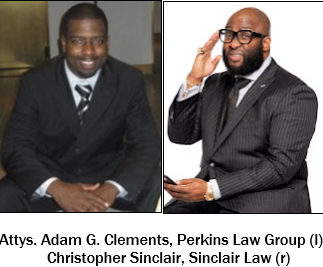

Attys. Christopher Sinclair and Adam G. Clements will now represent Ewing at trial March 25. They appeared in court March 19.

Attys. Christopher Sinclair and Adam G. Clements will now represent Ewing at trial March 25. They appeared in court March 19. On March 19, Cox said the restrictions applied to both sides, but appeared to focus primarily on Ewing.

On March 19, Cox said the restrictions applied to both sides, but appeared to focus primarily on Ewing.

During the hearing, Ewing clarified to the Court that there were two separate files on the case kept during and after the 2010 trial, one by the state, and one by the federal government, which was dealing with a separate case involving witnesses in the state case. Ewing said his defense had to go through a “Touhy” hearing with the U.S. to get various pieces of evidence in their possession.

During the hearing, Ewing clarified to the Court that there were two separate files on the case kept during and after the 2010 trial, one by the state, and one by the federal government, which was dealing with a separate case involving witnesses in the state case. Ewing said his defense had to go through a “Touhy” hearing with the U.S. to get various pieces of evidence in their possession.

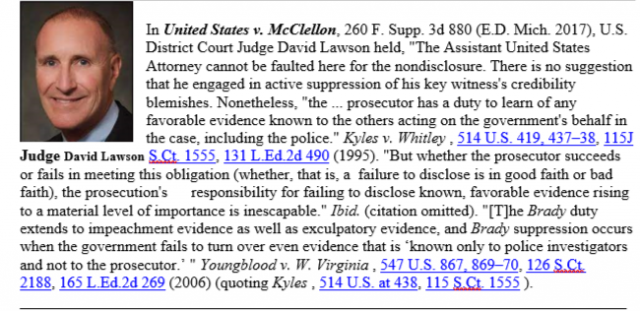

Previously in this case, Wayne Co. Criminal Court Chief Judge Pro Tem Donald Knapp denied Darrell Ewing’s motion to disqualify Judge Kiefer Cox due to his employment in the Wayne County Prosecutor’s Office for four years directly prior to his assuming the bench, and other matters.

Previously in this case, Wayne Co. Criminal Court Chief Judge Pro Tem Donald Knapp denied Darrell Ewing’s motion to disqualify Judge Kiefer Cox due to his employment in the Wayne County Prosecutor’s Office for four years directly prior to his assuming the bench, and other matters.

Voice of Detroit is a pro bono newspaper, now devoting itself entirely to stories related to the U.S. PRISON NATION/POLICE STATE, and the GENOCIDE taking place in Gaza, known as the world’s largest outdoor prison. Funds are needed regularly to pay our quarterly web hosting fee of $460.00 and other expenses. VOD will disappear from the web if fee not paid.

Voice of Detroit is a pro bono newspaper, now devoting itself entirely to stories related to the U.S. PRISON NATION/POLICE STATE, and the GENOCIDE taking place in Gaza, known as the world’s largest outdoor prison. Funds are needed regularly to pay our quarterly web hosting fee of $460.00 and other expenses. VOD will disappear from the web if fee not paid. DETROIT — Alexandre Ansari won a $10 million jury verdict Feb. 9 for damages from his wrongful conviction, the highest amount paid out to an individual involving the City of Detroit to date.

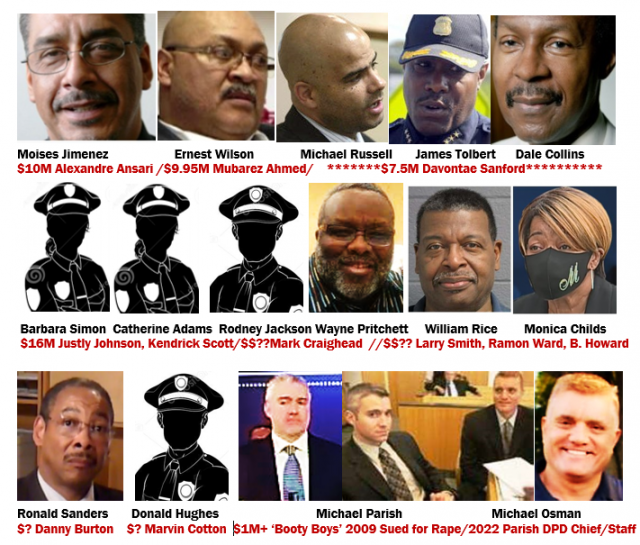

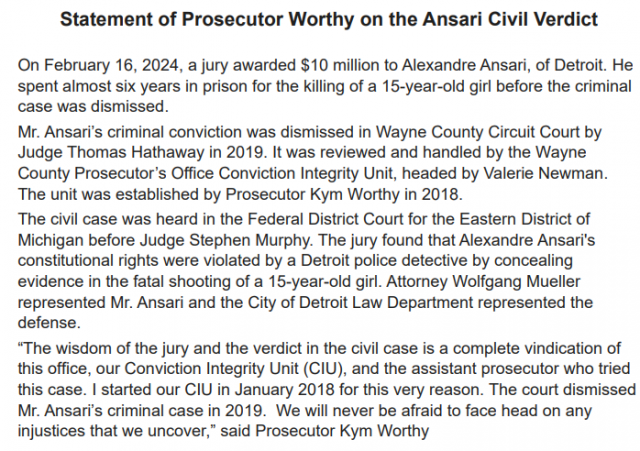

DETROIT — Alexandre Ansari won a $10 million jury verdict Feb. 9 for damages from his wrongful conviction, the highest amount paid out to an individual involving the City of Detroit to date.

The investigators found that Jimenez concealed evidence favorable to Ansari, including a witness statement describing a heavy-set 300-lb. man as the shooter, not Ansari, in keeping with testimony from other witnesses. Working closely with the U.S. Department of Justice, investigators obtained FBI reports that Jose Sandoval, an alleged drug dealer living in southwest Detroit, committed the shooting in retaliation for the theft of his drugs by Barley and Figueroa, along with Figueroa’s ex-girlfriend.

The investigators found that Jimenez concealed evidence favorable to Ansari, including a witness statement describing a heavy-set 300-lb. man as the shooter, not Ansari, in keeping with testimony from other witnesses. Working closely with the U.S. Department of Justice, investigators obtained FBI reports that Jose Sandoval, an alleged drug dealer living in southwest Detroit, committed the shooting in retaliation for the theft of his drugs by Barley and Figueroa, along with Figueroa’s ex-girlfriend.

The WCPO and the City of Detroit disagree on whether trial prosecutor Ericka Tusar knew about Moises Jimenez’ role in the Ansari convictions. Ansari was tried in two connected cases, the murder of Ileana Cuevas and that of Miguel Figueroa’s brother, which took place later in a separate incident. He was exonerated in 2019 in the Ileana Cuevas case, and previously was acquitted of the murder of Figueroa’s brother by a jury.

The WCPO and the City of Detroit disagree on whether trial prosecutor Ericka Tusar knew about Moises Jimenez’ role in the Ansari convictions. Ansari was tried in two connected cases, the murder of Ileana Cuevas and that of Miguel Figueroa’s brother, which took place later in a separate incident. He was exonerated in 2019 in the Ileana Cuevas case, and previously was acquitted of the murder of Figueroa’s brother by a jury.